“All Rules Of The Game, Institutional Architecture, And Physical Supply Chains Will Now Have To Change”

By Michael Every of Rabobank

EU wholesale electricity prices have collapsed a staggering 50% in a week – but that only takes them from “nobody can pay” to “very few can afford to pay” territory. Gazprom has turned off EU gas flow through Nord Stream 1, again. Europe claims it has stored 80% of the gas it needs for winter, cheering markets. Yet analysts point out Germany needs much more than it stores each year, and with no flow, huge problems – or very high LNG import prices. The colder this winter gets, the more so. German industry is already responding by closing down: and if it sees there is no power resolution possible for 2023, 2024, or 2025 (or longer), where might all that mighty production muscle be transplanted to?

Oil prices closed down another 2.3% yesterday with Brent at $96.50 – but there is a broadening public admittance from key players that financial markets are not reflecting physical reality and, as with many other commodities, are becoming less liquid and more volatile. Indeed, after US Energy Secretary Granholm recently implied the States may stop exporting diesel within months, and the ongoing decline in the US Strategic Petroleum Reserve, OPEC+ just tightened its outlook for the physical oil market for 2022 and 2023: the expected surplus for this year was cut in half to 400,000 barrels a day, and for 2023 it flipped from a projected surplus of 900,000 to a deficit of 300,000 barrels a day. Worse, OPEC+’s Joint Technical Committee has endorsed a Saudi recommendation to soon cut physical supply. Fortunately, the oil tanker that got stuck in the Suez Canal was quickly refloated: but it underlined again we are in truly Deep Ship given how easily such an ‘accident’ could happen, crippling global commodity and physical supply chains, should somebody want it to. (If rolling strike action doesn’t do the trick endogenously.)

Our agri-commodity team has tamed their longstanding bullish expectations on grains and oilseeds on the back of a stronger US dollar and specific supply and demand (destruction, as wheat consumption heads for its biggest annual decline in decades: and that’s a euphemism I despise given it means ‘hunger’.); yet they also acknowledge that any price rises from here will be about energy – which is likely to stay high/higher. Those life-time neck-deep in commodities trading also admit transparent, liquid, dollar-based markets are far less so, and parallel barter is all over – exactly as was warned alongside ‘Why Bretton Woods 3 Won’t Work’ several months ago. What you see on a screen is only part of what is happening.

The accusation of markets failing to reflect reality can also be leveled at financial assets. Equities’ critics point out the army of sell and buy analysts saying stocks only go up, as they keep going down. Yet even the global benchmark US Treasury market is not proving immune to whispers of lower liquidity and rising volatility as participants begin to realize that rates are going up and aren’t going down again fast, because supply-side inflation may be very sticky.

On which note, Eurozone inflation yesterday was 9.1% y-o-y and core inflation accelerated 0.3ppts to 4.3%. On the same day, a Financial Times interview with a UK construction CEO underlined while the initial shock from energy prices had already hit his firm, it is still filtering downstream through other inputs, and on into wage demands. He expects inflation to level off at 4-5% for 3-4 years after the peak (of maybe 20%?!) in early 2023. Which bond market is correctly pricing that coal-face (tin-foil hat?) view, even given eruptions like 20-year Gilt yields surging 20bps intra-day yesterday, before retracing to just 10bps?

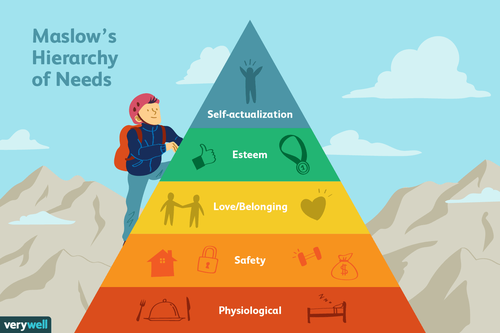

It seems we all need to go back to Maslow’s 1943 paper “A Theory of Human Motivation”. This argues all humans have a hierarchy of needs. The ‘Maslow pyramid’ has “physiological” at its base, then “safety”, “belonging and love”, “social needs”, “self-actualization”, and finally “transcendence”. “Physiological” means FOOD (which is now becoming too expensive for many) and SHELTER (which does not mean unaffordable property prices, and unaffordable energy bills for owners and renters alike). “Safety” ranges from the individual, and their community, to national security and not being, well, invaded or co-opted, or forced to kow-tow.

Modern economics –with its math wizardry and real-world stupidity– and modern Western leadership –who listened to it– have ignored the “physiological” and “safety” in favor of “transcendence”, defined as “the very highest and most inclusive or holistic levels of human consciousness, behaving and relating, as ends rather than means, to oneself, to significant others, to human beings in general, to other species, to nature, and to the cosmos.” (Maslow really was able to project 2022 Twitter, wasn’t he?)

Or, to put it another way, the global neoliberal model dug a basement level under the pyramid called “because markets”, which is now causing it all to fall down on us.

There is also irony in that the pyramid appears on the US dollar, which is still king through all this chaos, even if one day in a smaller kingdom, if only because the only alternative, sadly, *is* this chaos. Furthermore, the pyramid is one of the key ‘new world order’ memes, for those who like that kind of thing.

However you want to look at, or however you choose to ignore it, the painful facts of the matter are that all rules of the game, institutional architecture, and physical supply chains will now have to change: either be ahead of that curve, or be crushed by it.

We need to focus on the Maslow pyramid, not pyramid schemes.

We are not ‘lower for longer’. We are ‘Maslow-er for longer.’

Tyler Durden

Thu, 09/01/2022 – 10:15

via ZeroHedge News https://ift.tt/ISlUKW8 Tyler Durden