Insiders Are Dumping Stocks At The Fastest Pace In Months

Having aggressively bought the f**king dip off the March 2020 lows, supported a tsunami of free money spewing forth from every government orifice, it appears that ‘insiders’ have little interest in catching the falling knife now that The Fed has turned its back.

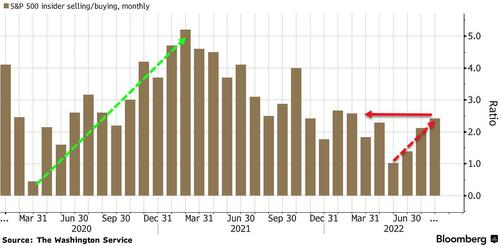

As Bloomberg reports, corporate insiders dumped their own shares aggressively in August, with some 2,150 executives hitting the sell button, the most since November 2021 on a net basis.

That’s pushed the ratio of insider selling to buying to the highest since February, data compiled by the Washington Service show.

“It’s yet another signpost, another signal that there is a high degree of uncertainty around the future,” Quincy Krosby, LPL Financial’s chief global strategist, said by phone.

“The view is that, with regards to both selling and buying, corporate insiders know what they’re doing. It adds to this general sense of uncertainty that’s already out there.”

The surge in insider-selling matches the slumping sentiment toward third-quarter operating margins, with expectations falling to 16.08% from 16.87% over the past eight weeks, data compiled by Bloomberg Intelligence show.

“A tremendous amount of weakness was clearly anticipated ahead of summer’s earnings, but even more is expected, given the pace of negative revisions picked up as the breadth of weakness spread beyond growth in recent weeks to include value stocks,” Gina Martin Adams, chief US equity strategist at Bloomberg Intelligence, said in a note.

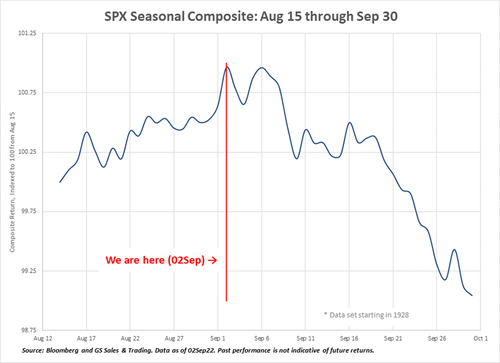

And don’t forget, it’s that time of the month again…

Finally, we note that it wasn’t just ‘insiders’, global equity funds had outflows of $9.4 billion in the week to Aug. 31, the fourth-largest redemptions this year, according to EPFR Global data cited by BofA. US equities had the biggest exodus in 10 weeks, while $4.2 billion left global bond funds.

Don’t fight The Fed works both ways…

Tyler Durden

Sat, 09/03/2022 – 16:00

via ZeroHedge News https://ift.tt/jtDNP5w Tyler Durden