Oil Surges After OPEC+ Said To Agree On 100Kb/d Production Cut

And there it is: the half life of the infamous fist bump proved to be less than two months, with a delegate telling Reuters that OPEC+ supports a 100kb/d reduction in oil output for October, meaning it’s a done deal.

- *OPEC+ JMMC SUPPORTS 100K B/D OIL-OUTPUT CUT FOR OCT: DELEGATE

… just as we predicted.

Will be funny when bin Salman cuts OPEC+ output after meeting Biden

— zerohedge (@zerohedge) June 22, 2022

* * *

The much-anticipated OPEC+ meeting later on Monday has all options on the table for oil, Bloomberg’s Nour Al Ali writes, adding that whatever the decision is on production in October, the alliance has the upper hand, which is bullish for the oil futures market.

A delegate has told Bloomberg that OPEC+ will discuss a range of oil-policy options at Monday’s meeting including a 100k b/d output cut – reversing last month’s just as symbolic output hike following Biden’s begging for more oil. Other options include maintaining production at current levels as well as an output cut before the next month’s meeting.

The options I hear OPEC+ is mulling for today’s meeting:

1) Roll-over current output quotas

2) ~100k b/d cut (reversing last month’s symbolic hike)

3) Roll-over quotas, but keep OPEC+ meeting “in session”, potentially cutting before next month if needed#OOTT #EnergyCrisis— Javier Blas (@JavierBlas) September 5, 2022

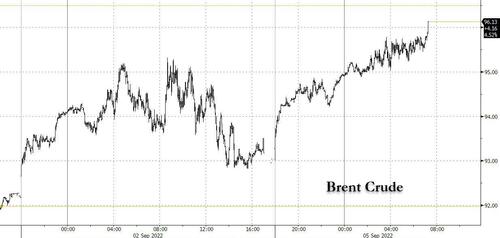

That much appears to be priced into futures markets, which remained about 2.7% higher at around the $95-level in Brent crude futures.

As Al Ali reminds us, we know from Saudi Arabia, that perhaps oil at current levels isn’t a fair reflection of the physical market’s tightness. Historically, the leader of the alliance is known to view prices at around $100 as fair.

Meanwhile, disruptions to global oil supply remain key. As the EU discusses a price cap on Russian oil, many members of the 23-nation alliance struggle to increase their output due to various reasons, and the outcome of a potential Iran nuclear deal remains uncertain. Technical experts at OPEC+ recently slashed forecasts for this year’s supply surplus in half, to 400,000 barrels a day, and expect a supply deficit in 2023.

Finally, as volatility picks up, the futures market (which is now “completely broken” according to oil trader Pierre Andruand) poses a conundrum for the alliance. Even as bearish factors such as a looming global economic slowdown and reduced demand out of China push prices lower, the European energy crisis puts the alliance back in the driver’s seat as an oil-for-gas substitution might be needed to keep the continent warm this winter.

Here’s what else to expect from today’s OPEC+ meeting which takes place as the US is out on vacation.

Courtesy of Newsquawk, here is a full preview of today’s JMMC and OPEC+ due at 12:00 BST

SCHEDULE: On September 5th, the Joint Ministerial Monitoring Committee (JMMC) will review the findings of the JTC and make a recommendation to the decision-making OPEC+ group. The JMMC is set to meet at 12:00BST/07:00EDT, with the OPEC+ ministerial meeting guided around 12:30BST/07:30EDT.

PRIOR MEETING: On August 3rd, OPEC+ agreed to hike total September quotas by 100k BPD. Split among most members, Saudi Arabia’s share was increased by 30k BPD, and the UAE’s by 7k BPD. The White House welcomed the decision, since it eases some pressure on Washington in the short term at least; the US Energy Department said at the time that it has seen a remarkable decline in oil prices, and wanted even lower prices.

LATEST SOURCES:

- Sources briefed on Saudi’s thinking says Saudi has not yet made a decision to tweak OPEC+ policy, but the energy minister is under pressure to keep prices near USD 100/bbl, FT reported: but the range of complicating factors could make the Kingdom opt for a pause.

- Russia doesn’t currently support an oil output cut and OPEC+ is likely to keep its output steady when it meets Monday, according to people familiar with the matter cited by WSJ. Russia is said to be concerned that production cut would signal crude supply is outgripping demand, thus reducing leverage will oil consuming nations.

- Reuters sources said OPEC+ is to weigh a rollover or small cut at its meeting on Monday Two out of five sources said the group could weigh a small cut of 100k BPD to bring quotas back to August levels. Five sources said existing policy could be rolled over.

RECENT SOURCES:

- OPEC+ is reportedly not currently discussing the possibility of reducing oil production, and one source says it is too early to talk about reduction, according to TASS; note: this quote has subsequently been withdrawn from the article, without an explanation yet provided.

- Reuters sources said OPEC+ might lean towards an oil output reduction when and if Iranian production returns, whilst warnings cuts may not be imminent. (23rd Aug)

- WSJ reported Saudi Arabia and its allies are open to oil-output cuts to keep prices high, and the comments from the Saudi Energy Minister have been backed by some OPEC members, such as Iraq, Kuwait, and Algeria for now. (23rd Aug)

- Five OPEC+ sources told Argus that a formal proposal to reduce production was not on the table, but another said cuts were possible “if needed”. (24th Aug)

- Saudi Arabia and UAE could pump significantly more oil in the case of a winter crisis, but would only do so if supply worsened, according to Reuters; sources said OPEC members possess around 2.0-2.7mln BPD of spare capacity. (4th Aug)

NOTABLE COMMENTARY:

- Saudi Energy Minister said OPEC+ may need to tighten output to stabilise the market and that the oil futures “disconnect” may force OPEC+ action. Furthermore, he stated OPEC+ will soon start work on a new accord for post-2022 and has the means to deal with market challenges including cutting production at any time and in different forms, while he also stated that the oil market is overlooking limited spare capacity and faces extreme volatility amid low liquidity, according to Bloomberg. (22nd Aug)

- Russian Deputy PM Novak said Russian oil producers support an extension of the OPEC+ deal after 2022. Russia and partners will discuss an extension in October.

- UAE is supportive of the latest statement from Saudi Arabia on crude markets, according to Reuters citing sources. (26th Aug)

- Iraq supports the statement from the Saudi oil minister on extreme volatility within oil markets and believes the OPEC alliance will take all necessary measures to achieve market balance, Bloombergsaid. Iraq said thin liquidity and extreme fluctuations in oil futures markets lead to prices being far from fundamentals, and OPEC has several tools to combat market fluctuations, due to discrepancies between futures and spot markets. (24th Aug)

- OPEC President (Congo) said he is open to an oil production cut, according to WSJ. (25th Aug).

- Algeria said it’s ready to balance oil market with OPEC+ partners; concerned about elevated oil price volatility which does not reflect a major change in fundamentals. (24th Aug)

- US State Department says conversations will continue with OPEC+ and other partners. (22nd Aug)

- Russia’s Gazprom CEO called for the OPEC+ deal to be extended, and geopolitics are behind high oil prices and OPEC+ is not to blame for it. (30th Aug)

- OPEC Secretary General said fears of a Chinese slowdown have been taken out of proportion, “relatively optimistic” on the 2023 oil outlook. OPEC Sec Gen says he sees a likelihood of an oil-supply squeeze this year, open to dialogue with the US. Still bullish on oil demand for 2022. Too soon to call the outcome of the September 5th gathering. (17th Aug)

JTC FINDINGS: The OPEC+ Joint Technical Committee (JTC), under a revised analysis due to underproduction by members, cut its 2022 surplus forecast by half to 400k BPD and flipped the forecast for 2023 to a deficit of 300k BPD. Assuming producers hit their quotas, the JTC sees the 2022 oil market surplus at 900k BPD, +100k BPD from the prior report; it also acknowledged the relevance of the Saudi Energy Minister’s comments on volatility and thin liquidity of crude markets, according to Reuters.

FACTORS IN PLAY

IRANIAN NUCLEAR DEAL:

The Iranian Nuclear Deal, formally known as the Joint Comprehensive Plan of Action (JCPOA), has been in a state of limbo following a string of unsuccessful negotiations between members, namely Tehran and Washington – who have resisted making concessions up until recently (a recent Newsquawk analysis can be found here). The Biden administration has attempted to revive the deal to bring energy prices down as the West shuns Russia’s oil and gas. In March 2022, the Iranian oil minister was cited saying Iranian oil production capacity can reach its maximum less than two months after a nuclear deal is reached. Iran pumped an average of 2.4mln BPD in 2021 and plans to increase output to 3.8mln BPD if sanctions are lifted, with the National Iranian Oil Company (NIOC) chief also suggesting the possibility of over 4mln BPD by year-end. More recently, on August 31st, the EU’s foreign policy chief said on he was hopeful the Iran nuclear deal could be revived “in the coming days” after receiving “reasonable” responses from Tehran and Washington to his proposed text.

SPARE CAPACITY:

OPEC+ is burdened with limited spare capacity, with Saudi Arabia and the UAE the members with the most output power left. As a reminder, the IEA estimates Saudi has a short-order capacity (reachable in less than 90 days) of around 1.2mln BPD, with the longer-term capacity predicted to be nearer to 2.1mln BPD. The argument OPEC watchers have been flagging is the state of confidence within the group (to stabilise the oil market) if they have no spare capacity, with oil traders warning of a potential upward spiral in oil prices if this “worst case” scenario was to occur.

GLOBAL GROWTH:

The COVID situation in China remains a headwind for global growth and overall demand. Several Chinese cities have tightened restrictions in recent days, with the latest major update being the Chinese metropolis of Chengdu, which will affect 21mln residents – this is China’s largest city-wide lockdown since Shanghai in June. Furthermore, Moody’s became the latest agency to downgrade its global economic growth forecast – “the risk of further energy shocks remains high. As for monetary policy, it will be tricky for central banks to navigate to an equilibrium where inflation falls but economic activity does not slip into a deep recession. China’s low tolerance for COVID-19 outbreaks and weakness in its property sector pose risks to its growth outlook,” Moody’s said.

EU ENERGY MEETING:

The holder of the EU’s rotating presidency, the Czech Republic, has called for an emergency energy meeting on September 9th in Brussels to discuss a broader solution to the rise in energy markets. “The main task… is to separate the price of electricity from the price of gas, and thus prevent Putin from dictating to Europe prices of electricity with his shenanigans with gas supplies,” the Czech Industry Minister said. Power prices have been on an exponential rise in recent weeks, with French and German contracts breaching both EUR 1,000/MWh (note: natural gas prices have seen some pull-back recently after EU officials pledged to take action). The Czech Industry Minister expects draft proposals next week. One-fifth of European electricity is generated by gas-fired power plants. A Commission official also said the EU is looking at energy price caps as well as options for lowering electricity demand, including looking at windfall taxes in the context of high energy prices.

OIL PRICES & MARKET SHARE:

Oil prices have been volatile since OPEC’s last meeting, and somewhat unstable with Brent in a USD 15/bbl range. The Saudi Energy Minister said OPEC+ seeks to calm a “yo-yo” oil market that he views as a threat to energy security and the global economy. Some have also suggested the Saudi commentary indicates an “OPEC put”, i.e., a price floor – however, his comments were seemingly more related to volatility. Meanwhile, IEA’s Birol said a further strategic petroleum reserve release is not off the table, and Russian oil production has not fallen as much as previously expected.

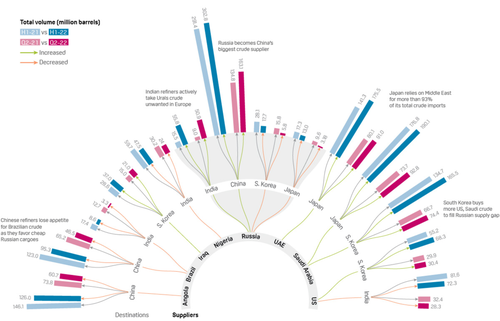

Amid the shunning of Russian energy from the West, market share has been rejigged, with some Asian nations upping imports of Russian crude (see figure below via S&P Global). There have also been reports that Russia is mulling oil discounts of up to 30% with Asian nations in response to the price-cap push, according to Bloomberg.

Meanwhile, Iraq’s SOMO said it can redirect more crude oil exports to Europe if needed, according to Reuters citing a SOMO source. SOMO began exports to Europe in June and said Iraq has adjusted export flows as a result of increased competition in Asian markets.

Tyler Durden

Mon, 09/05/2022 – 07:43

via ZeroHedge News https://ift.tt/u75fJVQ Tyler Durden