Brent Crude Plunges Below $90, Posing A Major Challenge For OPEC+

Oil is tumbling this morning with Brent slumping below $90 to the lowest since February and WTI dumping below $84 for the first time since January…

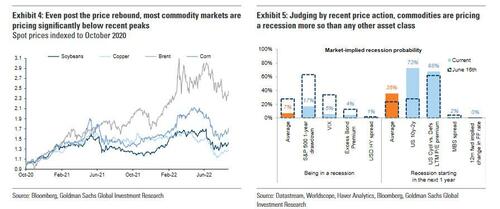

… as oil prices in the highest odds of any asset class as Goldman first pointed out last week.

The drop has obviously undone all the earlier gains after Russian President Vladimir Putin underlined that his country won’t supply oil and fuel if price caps on the country’s exports are introduced, which briefly pushed oil higher. Putin’s comments follow the G7 most industrialized countries agreeing to back an oil price cap for global purchases of Russian oil. It remains unclear how many countries have signed up to put limits on Russia.

The renewed weakness – which according to Bloomberg’s Jake Lloyd Smith – is driven by a nasty combination of demand concerns plus the dollar’s jump to a record – will test OPEC+’s appetite for further action.

When the cartel wrapped up its Monday meeting that endorsed a token 100,000 barrel a day cut in production, it also highlighted it would be willing to call another gathering “anytime to address market developments, if necessary.” Given the next scheduled talks are not until Oct. 5 – a full four weeks away – the latest selloff raises the possibility of an ad hoc session before then.

After the tiny reduction in supply, OPEC+ kingpin Saudi Arabia showcased that OPEC+ would be “attentive, preemptive and pro-active” in terms of managing the world’s most important commodity market. Those very public comments, plus the subsequent weakness in prices, may herald a test of Riyadh’s resolve.

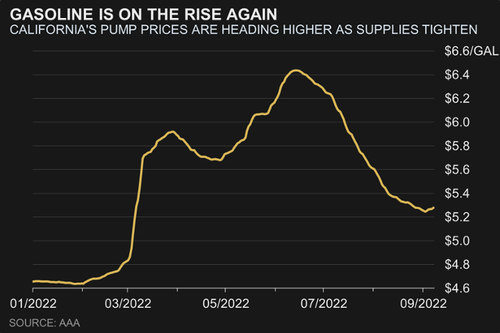

Meanwhile, even as oil slides, the price of regular gasoline is once again rising in California after steady declines since mid-June reversed course over the Labor Day weekend.

The end of the peak summer travel season typically brings lower fuel prices, but this year, a lack of imports and a refinery hiccup combined to drain stockpiles, sending wholesale and retail prices higher in the past week. Rising pump prices exacerbate the energy crisis Californians are already facing: a punishing heat wave and possible blackouts.

Tyler Durden

Wed, 09/07/2022 – 09:33

via ZeroHedge News https://ift.tt/P4Oofc2 Tyler Durden