Futures Flat, Dollars Steamrolls To New Record Highs Ahead Of Fed Speaker Barrage

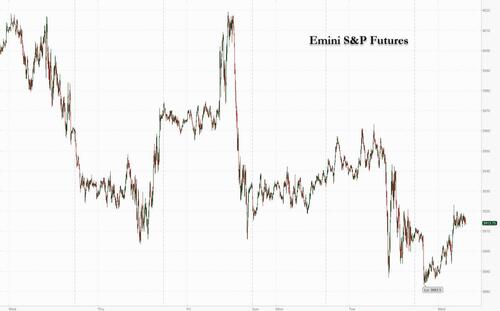

S&P futures swung in illiquid overnight trading, first sliding below the key 3,900 level after the Japan open, only to recover all losses after Europe opened, with the dollar storming to new record highs and steamrolling all FX competitors as traders braced for a slew of hawkish Fed speakers to assess the path of monetary policy and its impact on the economy. S&P 500 futures edged 0.1% higher at 7:15 a.m. in New York after the underlying benchmark fell six out of the last seven sessions, while Nasdaq 100 futures rose 0.3%, as both European and Asian market slumped. The Bloomberg Dollar index hit a new record high as the Yen plunge below 144 for the first time since 1998 and the Chinese yuan flirted with the key 7.00 level. Bitcoin recovered modestly after tumbling to new 2022 lows and oil erased a decline after Russian President Vladimir Putin underlined that his country won’t supply oil and fuel if price caps on the country’s exports are introduced..

In premarket trading, UiPath tumbled 21% after the application software company gave weaker-than-expected third-quarter revenue forecast. Meanwhile, Gitlab gained 3% in US premarket trading after second-quarter earnings. While analysts were broadly positive on the software development platform’s increased revenue guidance, especially given a tough backdrop, Piper Sandler flagged “noise” around a deceleration in billings. Here are the other notable premarket movers:

- Coupa Software (COUP US) rises about 12% in premarket trading on Wednesday after boosting its full-year earnings guidance and posting better-than-expected second-quarter results, helped by strong billings in North America. While analysts were positive about the results, they remained cautious about softness in Europe.

- Keep an eye on shares in US utilities and energy suppliers, incuding PG&E (PCG US), Edison International (EIX US) and Sempra Energy (SRE US) amid a deepening power crisis in California, where a heat wave is piling pressure on the US state’s power grid.

- Watch US digital health companies, as Truist initiates coverage on 16 firms, with a positive view on the industry overall. Progyny (PGNY US), Privia Health (PRVA US), Accolade (ACCD US), Agilon (AGL US) and R1 RCM (RCM US) all started with buy ratings.

- Watch Petco (WOOF US) stock as it was initiated with an outperform rating and $17 PT at RBC, with the broker saying near-term risks are reflected in the shares and the long-term picture is positive for the pet health company.

- Keep an eye on Guidewire (GWRE US) as RBC Capital Markets says that the software company has reported a “mixed” quarter amid macroeconomic headwinds with “muted” guidance.

- Alvotech (ALVO US) stock may be in focus as it was initiated with an equal-weight rating at Morgan Stanley, with broker flagging “many knowns” and a wide range of possible outcomes of the biotech’s US launch of its lead product, the biosimilar Humira.

- Newell Brands (NWL US) fell 4.6% in US postmarket trading on Tuesday after the consumer-products company cut its normalized earnings per share guidance for the full year. The firm has “limited” visibility and is buffeted by macroeconomic pressures, Morgan Stanley says.

On today’s calendar, no less than four Fed officials including Vice Chair Lael Brainard and Cleveland President Loretta Mester are set to speak before the release of the US Beige book later this afternoon. Richmond President Thomas Barkin already said rates must stay high until inflation eases. Investors will closely monitor their comments for clues about the pace of interest rate hikes in the face of slowing growth and still-elevated inflation. The consumer-price index reading due next week will also be paramount for the Fed’s September decision. Bets on another 75 basis points Fed interest-rate hike to tackle high inflation have spurred a selloff in Treasuries, while traders are bracing for a European Central Bank rates decision due on Thursday, with the potential for a similar-size move.

Aside from tightening monetary settings and an apparently unstoppable dollar, markets are also contending with a debilitating energy crisis in Europe and Covid lockdowns in China. Concerns are growing about the outlook for company earnings given the various global economic headwinds and a rebound seen in equity markets since mid-June is fading.

The S&P 500 rose too much in July and is overvalued by about 10% compared to macroeconomic fundamentals, according to Joachim Klement, head of strategy, accounting and sustainability at Liberum Capital. He expects the Federal Reserve to hike rates by 75 basis points even if inflation declined in August. “The current wait-and-see mode of the US market should be short-lived,” he said. “We expect another leg down in the S&P 500 into the fourth quarter before we find a bottom.”

“At this point, we see no positive triggers to keep the rally going, while there are rising risks moving into autumn amid a gloomier economic backdrop,” Amundi SA Chief Investment Officer Vincent Mortier and his deputy, Matteo Germano, wrote in a note. “To cope with this environment, we believe investors should adjust their asset allocation stances.”

Europe’s Stoxx 600 Index fell 0.4%, with tumbling miners leading the declines; IBEX outperforms, adding 0.4%, FTSE 100 lags, dropping 0.7%. Banks, miners and retailers are the worst-performing sectors.

Earlier in the session, Asiun stocks were pressured amid spillover selling from Wall St owing to the higher yield environment and as participants digested the latest Chinese trade data. ASX 200 weakened from the open with the index dragged lower by the energy and mining-related sectors and with somewhat mixed GDP data not doing much to spur risk appetite. Hang Seng and Shanghai Comp were subdued amid the ongoing COVID woes and following the softer than expected Chinese trade data in which all metrics missed forecasts.

Japanese stocks also fell as the yen slumped to a level that leaves it on track for its worst year on record, prompting government warnings and putting traders on edge as volatility rises. The Topix Index fell 0.6% to 1,915.65 as of market close Tokyo time, while the Nikkei declined 0.7% to 27,430.30. Sony Group Corp. contributed the most to the Topix Index decline, decreasing 2.3%. Out of 2,169 stocks in the index, 492 rose and 1,610 fell, while 67 were unchanged. While currency weakness is generally seen as favorable for exporters, rapid depreciation raises input costs and can complicate business decisions. “With the yen this weak, it’s difficult for the stock market to rally,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Limited.

In Australia, the S&P/ASX 200 index fell 1.4% to close at 6,729.30, dragged by declines in banks and mining shares. Energy-related shares fell after oil retreated to the lowest level since January on concern a global slowdown will cut demand in Europe and the US just as China’s Covid Zero strategy hurts consumption. In New Zealand, the S&P/NZX 50 index fell 0.4% to 11,548.30.

In India, key equity indexes dropped on Wednesday, tracking a selloff in Asia, with companies such as ICICI Bank and Reliance Industries putting pressure on the market. The S&P BSE Sensex closed 0.3% lower at 59,028.91 in Mumbai, while the NSE Nifty 50 Index fell 0.2%, extending its decline for a second day. Still, all but five of the 19 sector sub-gauges compiled by BSE Ltd. gained, led by an index of basic material companies. Automobile stocks were the worst performers. However, the broader market, including mid- and small-cap companies, gained as basic material stocks advanced on the back of recent decline in commodity prices. The S&P BSE MidCap Index fell as much as 0.5%, before closing higher by an equal measure and climbing to its highest level since Jan. 17.

In FX, the Bloomberg dollar index surged to a fresh record as strong US data and hawkish comments from a Federal Reserve official reinforced aggressive tightening bets. The Bloomberg Dollar Spot Index gained as much as 0.4% fuelling weakness among all of its Group-of-10 peers.

Fed’s Richmond President Thomas Barkin said in an interview with the Financial Times that the central bank must raise interest rates to a level that restrains economic activity and keep them there until policy makers are “convinced” that rampant inflation is subsiding.

- The yen fell to a fresh 24-year low, prompting Japan’s top spokesman Hirokazu Matsuno to say he’s concerned about recent rapid, one-sided moves in the yen and the country would need to take “necessary action” if these movements continue. But despite this verbal intervention, “markets appear quite happy with testing their tolerance” and 145.00 might be the line in the sand, Francesco Pesole, a strategist at ING Groep NV wrote in a note. USD/JPY rose as high as 144.99. The Bank of Japan said it would boost scheduled bond purchases as Japan’s benchmark 10- year yield hit 0.24% — approaching the 0.25% upper limit of the BOJ’s tolerated trading band

- GBP/USD fell 0.4% to 1.1471 erasing gains made after reports of Prime Minister Liz Truss’s energy support package. The pound has managed to “discount much of the bad news but that does not mean that it will bound higher anytime soon,” Steve Barrow, a strategist at Standard Bank wrote in a note.

- AUD/USD lost 0.2% to 0.6722; a drop below the July 14 low of 0.6682 would take it to the lowest since 2020

In rates,Treasuries hold gains, reversing some of Tuesday’s declines, amid a bull-steepening rally in gilts where 2-year yields are richer by around 25bp on the day as BOE speakers discuss inflation outlook amid proposed government action. US yields richer by 2bp to 4bp across the curve with gains led by front-end, steepening 2s10s spread by around 1bp; 10-year yields at 3.33%, richer by 2.5bp and underperforming bunds and gilts in the sector by 3.5bp and 6bp.Sharp bull-steepening in gilts follows dovish comments from BOE’s Tenreyro; UK 2s10s, 5s30s spreads widen 8bp and 7bp into the front-end led rally.Fed speaker slate includes Vice Chair Brainard on the economic outlook; Chair Powell has an appearance scheduled for Thursday; August CPI report to be released Sept. 13 falls during the blackout period.IG dollar issuance slate includes IFC $2b 3Y SOFR and IADB 7Y SOFR; more than $35b priced Tuesday with issuers paying just over 10bps in concessions on deals 2.8x covered, and at least three borrowers stood down.

WTI crude drifts 0.6% higher to trade near $87.38 after Putin said Russia won’t supply oil, fuel or gas if price caps are introduced; gold adds about ~$3 to $1,705. Bitcoin prices slipped overnight to under USD 19,000 whilst Ethereum tested 1,500 to the downside; and gold recovered to trade above $1,700 an ounce.

To the day ahead now, and there’s plenty on the central bank side, as the Bank of Canada announce their latest policy decision and the Fed release their Beige Book. We’ll also hear from Bank of England Governor Bailey, as well as the BoE’s Pill, Mann and Tenreyro as they testify before the Treasury Select Committee. In addition, there are scheduled remarks Fed officials, including Vice Chair Brainard, Vice Chair Barr, and Mester and Barkin. Otherwise, data releases include German industrial production and Italian retail sales for July.

Market Snapshot

- S&P 500 futures up 0.1% to 3,915.00

- STOXX Europe 600 down 0.5% to 412.19

- MXAP down 1.3% to 150.62

- MXAPJ down 1.2% to 496.50

- Nikkei down 0.7% to 27,430.30

- Topix down 0.6% to 1,915.65

- Hang Seng Index down 0.8% to 19,044.30

- Shanghai Composite little changed at 3,246.29

- Sensex down 0.2% to 59,092.96

- Australia S&P/ASX 200 down 1.4% to 6,729.34

- Kospi down 1.4% to 2,376.46

- Brent Futures down 0.3% to $92.56/bbl

- Gold spot up 0.1% to $1,703.64

- U.S. Dollar Index little changed at 110.31

- German 10Y yield little changed at 1.59%

- Euro up 0.1% to $0.9916

- Brent Futures down 0.3% to $92.57/bbl

Top Overnight News from Bloomberg

- The Federal Reserve must raise interest rates to a level that restrains economic activity and keep them there until policy makers are “convinced” that rampant inflation is subsiding, Fed Richmond President Thomas Barkin said in an interview with the Financial Times

- All 31 economists surveyed by Bloomberg expect Bank of Canada policy makers led by Governor Tiff Macklem to raise the benchmark overnight rate by at least 50 basis points, and most say it will be 75 basis points

- The ECB’s interest-rate hikes may fail to fully filter through into markets without a shift in its policies. Interest-rate rises are already struggling to be reflected across money markets because there’s too much cash chasing scarce high-quality securities, depressing their yields

- The euro-area economy expanded by more than initially estimated in the second quarter, with the revision revealing greater support from consumer and government spending. Output rose 0.8% from the previous three months — stronger than an earlier reading of 0.6%

- “Give us turbines and we’ll turn on Nord Stream tomorrow, but they won’t give us anything,” President Vladimir Putin said at the Eastern Economic Forum in Vladivostok

- The European Commission recommends member states cap the price of electricity from producers like wind farms, nuclear and coal plants at EU200 per MWh, the Financial Times reported, citing a draft of proposals it has seen

- The yen has slumped to a level that leaves it on track for its worst year on record, prompting the strongest warnings to date from senior Japanese government officials aimed at stemming the slide

- The world’s original and longest-running experiment in negative interest rates will finally end this week as Denmark raises borrowing costs in tandem with the euro zone. The move is likely as the ECB delivers a large hike on Thursday, because Danish monetary policy often shadows such moves to protect the krone’s peg to the single currency

- Developed economies are taking a hit from the dollar’s appreciation to multi-decade highs in ways that were once more familiar to their emerging-market peers

- China’s export growth slowed in August and imports stagnated, a sign of a darkening global economic picture and weak domestic growth hit by Covid lockdowns and a property slump. Exports in US dollar terms expanded 7.1% last month from a year earlier, far weaker than economists had predicted

- China sent its most powerful signal yet on its discomfort with the yuan’s weakness by setting its reference rate for the currency with the strongest bias on record

A more detailed look at global markets courtesy of Newsquawk

Asia stocks were pressured amid spillover selling from Wall St owing to the higher yield environment and as participants digested the latest Chinese trade data. ASX 200 weakened from the open with the index dragged lower by the energy and mining-related sectors and with somewhat mixed GDP data not doing much to spur risk appetite. Nikkei 225 declined despite a further weakening in the JPY as the recent rapid currency depreciation raised further questions surrounding the BoJ’s dovish resolve. Hang Seng and Shanghai Comp were subdued amid the ongoing COVID woes and following the softer than expected Chinese trade data in which all metrics missed forecasts.

Top Asian News

- Japanese Chief Cabinet Secretary Matsuno believes relaxation of border control measures could be an advantage with the weak JPY, while they are concerned by recent rapid, one-sided currency moves and are ready to take appropriate action on FX market moves if necessary, according to Reuters.

- Japanese Finance Minister Suzuki, when asked about the chance of currency intervention, says will take necessary steps, according to Reuters.

- Japan’s former MOF FX head Watanabe said there is no need for Japan to intervene in the currency market to stem the yen’s declines and that Japan intervening solo in the FX market would be meaningless as current FX moves are driven by broad dollar gains, while he noted that intervening solo would be a waste of money as markets would know Tokyo has limited to how much reserves it can tap to continue with such actions. Wakatabe also stated that USD/JPY is overshooting somewhat now and may briefly reach 145 later this month but such increases likely won’t last long, while he doesn’t think the BoJ will raise rates just to stem JPY’s declines.

- Xi, Putin to Meet for First Time Since Russia’s War in Ukraine

- China’s Xi Has Broad Support for Continued Rule, Envoy Says

- Korean Won Still Near 13-Year Low After Central Bank Warning

- Vietnam Wins Rating Upgrade From Moody’s on stronger Growth

- China State-Backed Expo Pulls Ukraine Trade Event at Last Minute

- Goldman Sachs, BNP Paribas at Odds Over Asia Earnings Outlook

European bourses have trimmed the losses seen at the open, but still trade mostly lower. European sectors are mostly lower after opening with a mild defensive bias – that bias has since eased somewhat, with some cyclicals making their way up the ranks. Stateside, US equity futures were softer in early trade, but to a lesser extent than peers across the pond, and have since mostly moved into the green as yields ease

Top European News

- UK PM Truss spoke with US President Biden with Truss said to be looking forward to working with Biden to tackle shared challenges, particularly extreme economic problems from Russian President Putin’s war, while they discussed domestic issues and agreed on the importance of protecting the Good Friday Agreement, according to Downing Street.

- UK PM Truss will not activate the emergency Article 16 override provision in the Northern Ireland protocol in the coming weeks and pulling away from an early confrontation with the EU over Brexit, according to FT citing the PM’s allies.

- BoE Governor Bailey noted that we have had volatile markets in the last six weeks, still seeing extreme volatility in energy markets. On the UK exchange rate, said there are dollar-specific factors in play; said the Fed is more focussed on bringing demand shock under control. Bailey added a review of the Bank’s mandate would not be a recognition that the BoE regime is failing.

- BoE Chief Economist Pill said he does not want to comment on fiscal stimulus without seeing the details. He expects headline inflation to decline in the short-term. Pill emphasised the importance of BoE inflation target as an anchor, not considering new regime.

- BoE’s Mann said trade, financial flows, and GBP may have heightened role in the next year. Mann added that more forceful bank rate moves open door for policy to be on hold or a reversal later. She added that short-term inflation spikes are getting increasingly embedded in domestic prices.

- BoE’s Tenreyro said demand is already weakening, and added when close to equilibrium rate, gradual hikes allow BoE to react before it tightens too far into contractionary territory. “Even without rate increases in August, rates were at a sufficient level to return inflation to target over the medium-term.”

FX

- DXY maintains bullish momentum but remained under 110.50 throughout most of the European session in a 110.17-69 range (at the time of writing).

- JPY underperforms with USD/JPY extending above 144.00 despite a slew of verbal intervention by Japanese officials, whilst the Yuan shrugged off another firm CNY fixing by the PBoC.

- EUR, and CHF are all trading mid-range vs the USD whilst the NZD, AUD, and CAD track risk sentiment.

Fixed Income

- Debt futures are hovering just below best levels having extended rebounds to fresh intraday highs in the run up to UK and German auctions that saw solid demand.

- Bunds sit under their 145.24 peak (+44 ticks vs -33 ticks at one stage), Gilts skirt 106.00 from 106.11 (+38 ticks vs -59 ticks at the Liffe low).

- 10yr T-note holds closer to 115-27 than 115-13+ following some hefty block purchases (two 10k clips in particular)

Commodities

- WTI and Brent futures have been bouncing off worst levels after printing multi-month lows.

- Spot gold fluctuates on either side of USD 1,700/oz, driven largely by bond yields.

- Base metals are mostly lower with upside hampered by disappointing Chinese trade data overnight.

- Indian PM Modi said keen to boost ties with Russia; said Russia and India can work closely on coking coal supply.

US Event Calendar

- 07:00: Sept. MBA Mortgage Applications, prior -3.7%

- 08:30: July Trade Balance, est. -$70.2b, prior -$79.6b

- 14:00: U.S. Federal Reserve Releases Beige Book

Fed Speakers

- 09:00: Fed’s Barkin Speaks at MIT

- 10:00: Fed’s Mester speaks at MNI virtual event

- 12:40: Fed’s Brainard Discusses the Economic Outlook

- 14:00: Fed’s Barr Speaks on Financial System Fairness and Safety

DB’s Jim Reid concludes the overnight wrap

The air of feral fog will lift from our house this morning as the kids go back to school. Only about 12-50 years, depending on the debts we collectively leave to our children, until they leave home. After the summer she’s had looking after them I’m slightly worried my wife will leave first. A big fingers crossed she doesn’t.

On this theme, today I’ve just launched a back-to-school survey as part of our regular monthly series. This month we ask whether you think Europe will make it through winter without gas rationing, whether you are thinking about using less energy, at recession probabilities, whether the next big move in bonds and equities will be up or down, your inflation expectations and which if any central banks are likely to make a policy error and in which direction. All help filling it in very much appreciated as usual. See here for the survey.

Yesterday I released my latest chartbook, which also has a back-to-school vibe as we review where we are on important issues facing global markets and the economy over the coming months. Among the charts, we look at how August was the worst month for European bonds in decades, why inflation isn’t going away over the medium-to-longer term, the latest on the European energy crisis, and also briefly examine the upcoming Italian election and the Chinese property sector’s troubles. As ever, it’s full of big easy-to-read figures and titles that explain our biases. Here’s the link. ***

With different asset classes swinging between gains and losses over the last 24 hours, it’s been difficult to point to a single factor behind the various moves. On the one hand, investors remain cautious about the growing array of risks on the horizon, ranging from the European energy situation to Chinese lockdowns to hawkish central banks. But on the other hand, the latest ISM services index for August added to the recent run of US data releases that’s pointed to an improving outlook, suggesting that the Fed can afford to be more aggressive in raising rates, which in turn led to a sharp selloff in Treasuries that leaves them on track for their 6th consecutive weekly decline.

In terms of the details of that ISM print, the headline measure unexpectedly rose in August to a 4-month high of 56.9 (vs. 55.3 expected), with improvements in the new orders and employment components as well. That follows in the footsteps of the ISM manufacturing reading last Thursday that was similarly better than expected, the weekly initial jobless claims that fell for a 3rd week running, and the Conference Board’s consumer confidence measure that hit a 3-month high in August. Now all this might be a last hurrah before our long expected 2023 recession, but there’s no doubt that recent data has been more positive than expected, and is coming alongside some other tailwinds of note like falling gasoline prices.

Given the stronger data, there were growing expectations (again) that the Fed might hike by 75bps in a couple of weeks’ time, with the hike priced in for September up by +2.9bps to 68.0bps. Treasury yields surged across the curve in response (with also a small catch-up after being closed on Monday), with some of the increase likely exacerbated by a banner day for corporate debt issuance ahead of the next Fed meeting (not to mention ahead of the next crucial CPI print), with the 10yr yield up +16.0bps on the day to 3.35%, and the 30yr yield (+15.6bps) even hitting a post-2014 high of 3.50%. That was driven by a rise in real yields, with the 10yr real yield (+15.0bps) rising to a post-2019 high of 0.87%. This morning in Asia, yields on the 10yr USTs are fairly stable. Bear in mind that it was less than -1% in early March after Russia invaded Ukraine, so we’ve seen an incredible shift in real borrowing costs over the last 6 months.

With US real yields reaching new heights, the dollar index advanced +0.62% to reach its strongest level in over two decades. However, it was bad news for equities and the S&P 500 (-0.41%) built on its run of 3 consecutive weekly declines to close at a 7-week low. The more interest-sensitive sectors were particularly affected, and the NASDAQ (-0.74%) and the FANG+ index (-1.50%) saw even larger declines, while there was a clear preference for defensive sectors with real estate (+1.02%) and utilities (+0.22%) outperforming the rest of the pack. Over in Europe there was a moderately better performance however, with the STOXX 600 up +0.24%, and the German Dax (+0.87%) recovering somewhat from the previous day’s heavy losses. Futures are weak this morning though with contracts on the S&P 500 (-0.52%), NASDAQ 100 (-0.53%) and DAX (-1.15%) lower.

When it comes to the energy situation, there wasn’t much respite yesterday as we look forward to Friday’s meeting of EU energy ministers. Natural gas futures in Europe fell by -2.47% to €240 per megawatt-hour, and German power prices for next year were also down -6.02% to €536 per megawatt-hour. But relative to their levels from last year they are still incredibly elevated. One piece of news we did get was from German Chancellor Scholz, who said that when it came to a cap on power prices, “If we have our way, it will take weeks rather than months”. In the meantime, European sovereign bonds lost further ground, with yields on 10yr bunds (+7.4bps), OATs (+3.5bps) and BTPs (+3.3bps) all moving higher.

Here in the UK, Liz Truss was appointed as the new Prime Minister yesterday, succeeding Boris Johnson after three years in the job. In her initial speech in front of Downing Street, she said that action would be taken on the energy crisis this week, so that’s one to keep an eye out for, with reports across the press (as we previewed yesterday) indicating that bills will be frozen around current levels rather than going up in October. That came as gilts strongly underperformed their continental counterparts yesterday, with 10yr yields up by +15.7bps to 3.09%, which is their highest closing level since 2011. Interestingly however, there was a major steepening in the yield curve, with 2yr yields down -2.0bps as investors reacted to the prospect of lower short-term inflation in light of the potential freeze on bills.

Asian equity markets are weak this morning with the Hang Seng (-1.65%) leading losses followed by the Kospi (-1.50%) and the Nikkei (-0.95%). Over in Mainland China, the Shanghai Composite (-0.05%) and the CSI (-0.08%) are wavering between gains and losses in early trade.

The latest trade data coming out of China this morning showed exports growing at a slower pace in August (+7.1% y/y) against market forecast of a +13.0% increase and compared to July’s +18.0% rise as global demand continued to soften. At the same time, imports rose only +0.3%, falling short of expectations for a +1.1% gain. Elsewhere, Australia’s GDP expanded +0.9% in the second quarter, in-line with market expectations as consumers kept spending while energy exports boomed. The growth figure for the previous quarter (+0.7%) was downwardly revised though.

In FX news, the Japanese yen (-0.90%) this morning slid to a fresh 24-year low of 144.09 against the US dollar. Widening rate differential is the main reason for yen’s depreciation while yesterday’s better than expected US data probably also pushed the yen weaker. Separately, the People’s Bank of China (PBOC) fixed the yuan at 6.9160 to the dollar, its strongest bias on record and the 11th successive increase as the authorities continue to fight the global trend of a strong dollar against virtually every currency.

In energy markets, oil prices are trading lower in Asian trade with Brent futures down -1.45% at $91.48/bbl as the demand could remain under pressure amid China’s Covid-19 lockdowns.

There wasn’t a great deal of other data yesterday, though in Europe we did get the German and UK construction PMIs for August, which were both in contractionary territory at 42.6 and 49.2 respectively. German factory orders in July also contracted by a faster-than-expected -1.1% (vs. -0.7% expected). Otherwise in the US, the final composite and services PMI for August painted quite a different picture to the ISM numbers, with the final services PMI revised down to 43.7 (vs. flash 44.1) and the final composite PMI revised down to 44.6 (vs. flash 45).

To the day ahead now, and there’s plenty on the central bank side, as the Bank of Canada announce their latest policy decision and the Fed release their Beige Book. We’ll also hear from Bank of England Governor Bailey, as well as the BoE’s Pill, Mann and Tenreyro as they testify before the Treasury Select Committee. In addition, there are scheduled remarks Fed officials, including Vice Chair Brainard, Vice Chair Barr, and Mester and Barkin. Otherwise, data releases include German industrial production and Italian retail sales for July.

Tyler Durden

Wed, 09/07/2022 – 07:52

via ZeroHedge News https://ift.tt/eOb7QzT Tyler Durden