Stocks & Bonds Dip As WSJ Fed Whisperer Hints At 75bps Hike In Sept

US equities and US Treasury bond prices tumbled this morning following a report by the new Fed whisperer himself – WSJ’s Nick Timiraos – suggesting The Fed’s inflation-fighting stance means 75bps is very much on the table for September’s FOMC meeting. While careful not to leak any inside scoop, the mere fact that Timiraos is reporting this story – after his CPI/75bps move earlier in the year is enough to spook traders.

Federal Reserve Chairman Jerome Powell’s public pledge to reduce inflation even if it increases unemployment appears to have put the central bank on a path to raise interest rates by 0.75 percentage point rather than 0.50 point this month.

Fed officials have done little to push back against market expectations of a third consecutive 0.75-point rate rise in recent public statements and interviews ahead of their Sept. 20-21 policy meeting.

“We will keep at it until we are confident the job is done,” Powell said in Jackson Hole.

Mr. Powell’s speech showed he “very much did not want to leave the impression that the Fed would fall short on fighting inflation,” said Tim Duy, chief U.S. economist at research firm SGH Macro Advisors.

Specifically, Timiraos notes that Fed officials have been uncomfortable by how markets rallied – easing financial conditions – following their July 26-27 meeting, when Mr. Powell at a news conference signaled the central bank would at some point slow its rate rises. The rally risked undoing some of the Fed’s work to slow the economy.

And so today’s story by a well-known Fed whisperer seems well-timed to front-run any attempted short-squeeze higher in stocks ahead of the Fed meeting.

The market’s odds of a 75bps hike surged to 90%…

Which sent stocks lower…

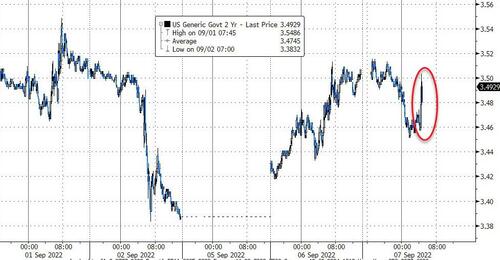

And short-dated yields higher…

Notably, Mr. Powell is set to speak Thursday in a moderated discussion at the Cato Institute, his last scheduled public remarks before the coming Fed meeting, and few if any expect any reduction in his hawkish J-Hole tone.

Tyler Durden

Wed, 09/07/2022 – 07:59

via ZeroHedge News https://ift.tt/wkqmcZb Tyler Durden