ECB Hikes 75bps, Expects To “Raise Rates Further To Dampen Demand”

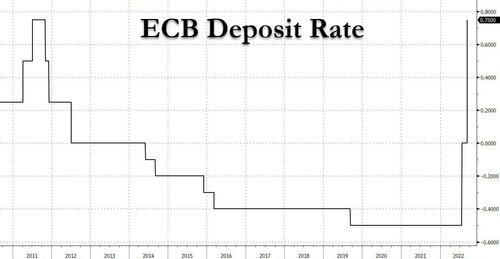

And we have the answer: after lots of heming and hawing, moments ago the ECB hiked its deposit rate by 75bps from 0% to 0.75bps, the first time European rates are positive in over a decade (since July 2012) noting that “the Governing Council’s future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach.” The ECB itself described today’s move as a “major step” that’s frontloading the transition toward a more neutral policy stance, and said that following the raising of the deposit facility rate to above zero, “the two-tier system for the remuneration of excess reserves is no longer necessary” and “the Governing Council therefore decided today to suspend the two-tier system by setting the multiplier to zero.”

And since today’s hike is paltry when compared to Europe’s runaway inflation which is almost in the double digits, the central bank said – not once but twice – that it expects over the next several meetings to raise interest rates further “because inflation remains far too high and is likely to stay above target for an extended period” and “to dampen demand and guard against the risk of a persistent upward shift in inflation expectations.”

As to how big the next rate hike will be, there was nothing there. All is data-dependent and meeting-by-meeting. Looking forward to seeing if Lagarde will offer at least a hint of what’s coming next.

The language on what the ECB will do in future meetings is changed. Previously, it said ” normalization of interest rates will be appropriate.” Now there’s more detail on the reasoning for why more hikes are on the cards: “The Governing Council expects to raise interest rates further to dampen demand and guard against the risk of a persistent upward shift in inflation expectations”

Also of note, there was nothing new on the Transmission Protection Instrument. It’s still there to “counter unwarranted, disorderly market dynamics.” With Italy about to undergo a political hurricane in the upcoming elections later this month, this will be a major mistake.

There was also no mention of QT in the official statement, although as Bloomberg notes, it wasn’t really expected but we may learn in the next hour or so if it was at least mentioned during the debate.

Remarkably, the ECB is hiking even as it writes the following in its statement:

After a rebound in the first half of 2022, recent data point to a substantial slowdown in euro area economic growth, with the economy expected to stagnate later in the year and in the first quarter of 2023. Very high energy prices are reducing the purchasing power of people’s incomes and, although supply bottlenecks are easing, they are still constraining economic activity. In addition, the adverse geopolitical situation, especially Russia’s unjustified aggression towards Ukraine, is weighing on the confidence of businesses and consumers. This outlook is reflected in the latest staff projections for economic growth, which have been revised down markedly for the remainder of the current year and throughout 2023. Staff now expect the economy to grow by 3.1% in 2022, 0.9% in 2023 and 1.9% in 2024.

In short, the ECB is hiking not into a recession but a full-blown depression, and it knows it, even if some disagree…

The size of today’s rate hike will not determine whether the eurozone economy slides into recession and will also not make the recession more or less severe, writes @carstenbrzeskihttps://t.co/4B64ss8vb1

— ING Economics (@ING_Economics) September 8, 2022

here are the other highlights from the statement:

RATES:

- Says today’s decision frontloads the transition from the prevailing highly accommodative level of policy rates towards levels that will ensure the timely return of inflation to the ECB’s 2% medium-term target

- Following the raising of the deposit facility rate to above zero, the two-tier system for the remuneration of excess reserves is no longer necessary.

- The Governing Council therefore decided today to suspend the two-tier system by setting the multiplier to zero.

GUIDANCE:

- Governing Council expects to raise interest rates further to dampen demand and guard against the risk of a persistent upward shift in inflation expectations.

- Governing Council will regularly re-evaluate its policy path in light of incoming information and the evolving inflation outlook

ASSET PURCHASES:

- Governing Council will therefore continue applying flexibility in reinvesting redemptions coming due in the pandemic emergency purchase programme portfolio, with a view to countering risks to the transmission mechanism related to the pandemic.

ECB Euro Area Real GDP Forecasts (Sep 2022):

- 2022: 3.1% (prev. 2.8%)

- 2023: 0.9% (prev. 2.1%)

- 2024: 1.3% (prev. 2.1%)

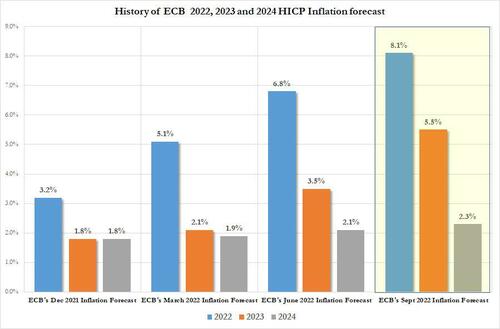

ECB Euro Area HICP Forecasts (Sep 2022):

- 2022: 8.1% (prev. 6.8%)

- 2023: 5.5% (prev. 3.5%)

- 2024: 2.3% (prev. 2.1%)

Good job with those forecasts, guys.

Here is a statement redline.

Tyler Durden

Thu, 09/08/2022 – 08:26

via ZeroHedge News https://ift.tt/krKut5q Tyler Durden