Goldman Changes Fed Hike View, Now Expects 75bps In Sept After Fed Mouthpiece Report

One upon a time Goldman Sachs – that consummate incubator of central bankers – did not need to be told by the Fed (or its mouthpieces) what the US central bank will do: instead, the flow of information (and decision-making) ran from Goldman to the Fed. Those days are long gone, however, with Goldman now targeting subprime households for its credit cards trinkets as most of its legendary traders and bankers have “moved on”, and yesterday was a glaring example that when it comes to the Fed, Goldman is now just another ordinary bank.

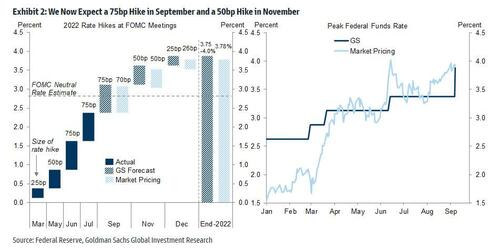

To wit, just a few hours after the WSJ’s new (poor-man’s) Fed whisperer, Nick Timiraos (now that Jon Hilsenrath is locked behind the WSJ Pro paywall) reported that a 75bps is coming, Goldman’s chief economist Jan Hatzius – who until now had adamantly pushed for a 50bps hike in Sept and two 25bps follow ups – changed his mind, and late on Wednesday writes that he is raising his Fed forecast to include a 75bp rate hike in September (vs. 50bp previously) and a 50bp hike in November (vs. 25bp previously), while continuing to expect a 25bp hike in December, which would take the funds rate to 3.75-4% by the end of 2022.

Some more details from the note available to pro subs:

At the July FOMC meeting, Chair Powell laid out a case for slowing the pace of tightening. Since then, the data have on net come in roughly as expected or even a bit more supportive than expected of the case for slowing down. But Fed officials have sounded hawkish recently and have seemed to imply that progress toward taming inflation has not been as uniform or as rapid as they would like. And today, the Wall Street Journal reported that the FOMC “appears to be on a path to raise interest rates by another 0.75 percentage point this month,” a likely hint from the Fed leadership that a 75bp hike is coming at the September meeting. We therefore now think the FOMC will delay its plan to slow down.

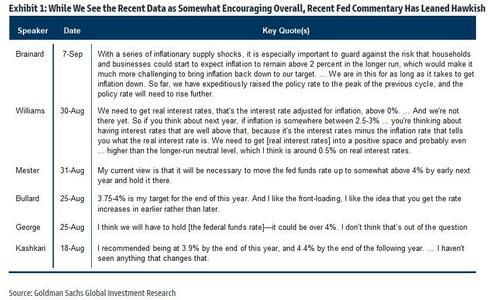

The chart below highlights some of the more hawkish remarks in recent Fed commentary, including Vice-Chair Brainard’s speech today, justifying Goldman’s overall takeaway “that the FOMC will most likely delay its plan to slow the pace of tightening until after September.”

Goldman also notes that its latest forecast matches the market, which is now pricing roughly a 75-50-25 path for the next three meetings…

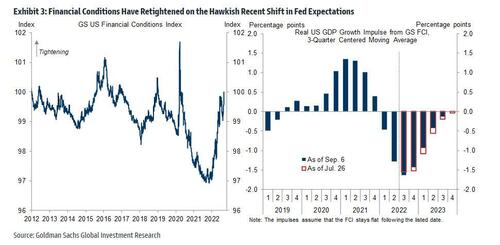

… as the bank’s financial conditions index has “tightened meaningfully” on the hawkish shift in expectations, more than fully reversing the easing in August.

As a result, Hatzius says “the implied drag on growth from tighter financial conditions is peaking now and should be enough to keep growth on a solidly below-potential path in the second half of 2022. How the drag from tighter financial conditions will net out with other key growth impulses in 2023 is more uncertain, and we could imagine the hiking cycle extending beyond this year.”

That said, how the drag from tighter financial conditions will net out with other key growth impulses in 2023 is more uncertain, and Goldman “could imagine the hiking cycle extending beyond this year if additional tightening proves necessary to keep growth on a below-potential path.” Of course, that goes both ways, and once the economy slumps into a recession and millions of jobs are lost – after the midterms of course – it will also force the Fed to cut much faster than anyone had expected.

Tyler Durden

Thu, 09/08/2022 – 10:22

via ZeroHedge News https://ift.tt/v3zZAfm Tyler Durden