Stocks & Bonds Dive After Powell Comments, Rate-Hike Odds Surge

Fed Chair Powell offered nothing new for ‘Fed Pivot’ bulls to cling desperately to during his Q&A with The Cato Institute this morning.

“History cautions strongly against prematurely loosening policy.”

Powell basically reiterated his strongly hawkish perspective from Jackson Hole

“We need to act now, forthrightly, strongly as we have been doing and we have to keep at it until the job is done.”

From Ira Jersey, chief US interest-rate strategist at Bloomberg Intelligence:

“Following the July Fed minutes, we noted that the Fed is worried about causing a recession, but it fears not hiking enough and not getting inflation expectations down. Powell just reiterated this sentiment at the Cato Institute.

This sentiment solidifies our flattening view, and tactically, we may have seen the steepest (least inverted) 2-year/10-year curve for now. The current flattening move may continue and re-test the recent lows.”

All of which prompted an unwind of yesterday’s short-squeeze-driven spike in stocks and bond yields which the narrative-creators pinned on Lael Brainard’s hope to not over-tighten.

Futures have tumbled…

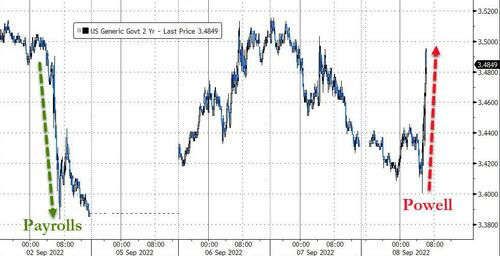

And bond yields spiked…

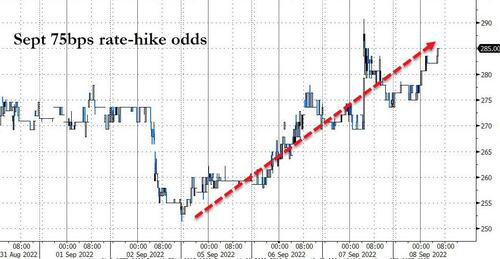

As rate-hike expectations push higher…

With the odds of 75bps in two weeks now back at 85%…

The pain is not going to stop yet.

Tyler Durden

Thu, 09/08/2022 – 09:23

via ZeroHedge News https://ift.tt/nioQjhr Tyler Durden