WTI Slides After Biggest Crude Build In 5 Months, Record SPR Draw

Oil prices are up this morning, a brief respite after yesterday’s tumble (and ‘death cross’) and follows API reporting an unexpected crude build.

“Recession woes, weak Chinese export/import data and COVID-related lockdowns are the primary price drivers at the moment,” said Tamas Varga, an analyst at PVM Oil Associates Ltd.

Oil’s deep loss on Wednesday came despite several supportive market factors.

Russian President Putin said the country would not supply energy to any nations that backed a planned US-led price cap on the nation’s crude, and the EIA raised its outlook for global oil demand, while also cutting the forecast for US supply.

API

-

Crude +3.645mm (+300k exp)

-

Cushing -772k

-

Gasoline -836k

-

Distillates +1.833mm

DOE

-

Crude +8.845mm (+300k exp) – biggest build since April

-

Cushing -501k

-

Gasoline +333k (-1.4mm exp)

-

Distillates +95k (+200k exp)

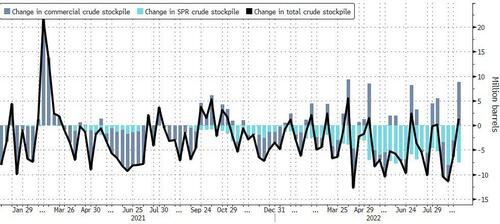

After API reported an unexpected crude build, the official data confirmed it was even bigger with a 8.85mm barrel build. Additionally, gasoline and distillates also saw builds…

Source: Bloomberg

The 8.8 million barrel build in commercial crude stockpiles was mostly offset by the withdrawal of 7.5 million barrels from the Strategic Petroleum Reserve. The net result was a nationwide crude build of just 1.3 million barrels in the week to Sept. 2. That’s the first build in total nationwide crude stockpiles in four weeks and the biggest build in two months.

Source: Bloomberg

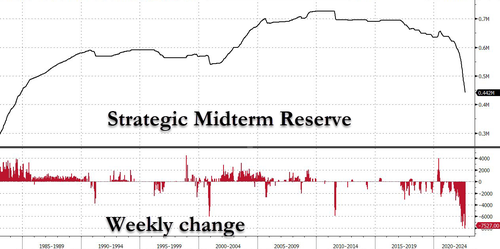

The last week saw a 7.5mm barrel draw from the SPR and a record 18.75mm barrels drawn down in the last 3 weeks…to its lowest since (ironically) 1984!

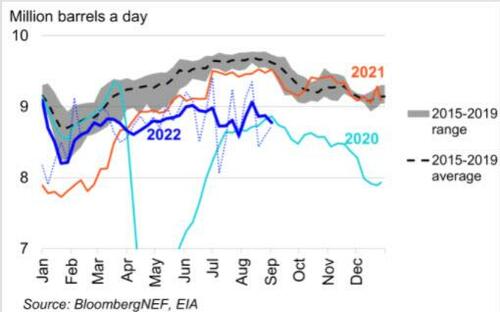

As Bloomberg reports, gasoline demand sunk below 2020 seasonal levels, again, based on the four-week moving average of product supplied. The figure has flatlined all summer, holding below 9 million barrels a day in all but one week since June.

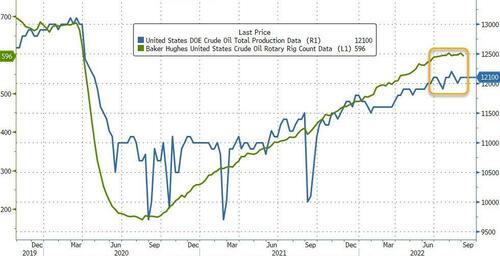

As rig counts begin to drop, US Crude production remains flat…

Source: Bloomberg

WTI hovered around $83 ahead of the official data and slid on the big crude build…

WTI also remains well below the ‘death cross’ level…

Finally, we note that WTI’s prompt spread slumped to its weakest level since early January on Wednesday amid a sharp retreat in front month crude prices.

This is traditionally a bearish sign of urgent demand (higher prompt spread suggests physical tightness) – which may be yet another reason why OPEC+ is willing to cut production (and continues to argue that physical and paper markets remain decoupled).

Tyler Durden

Thu, 09/08/2022 – 11:06

via ZeroHedge News https://ift.tt/w4mbPHA Tyler Durden