Ugly, Tailing 10Y Auction Prices At Highest Yield In More Than A Decade

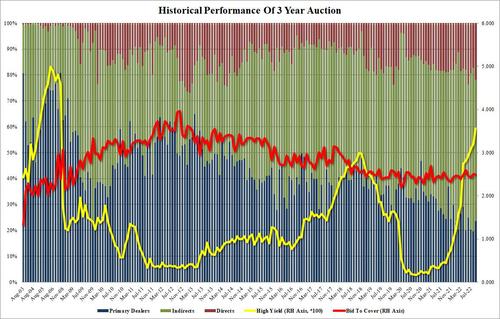

After an ugly 3Y auction this morning, the sale of $32 billion in 10Y paper which concluded moments ago was even uglier.

Stopping at a high yield of 3.330%, the auction was not only the highest of the current tightening cycle, but also surpassed the 3.209% hit in October 2018 during the previous tightening cycle, making today’s high yield the highest since April 2011 when the yield was 3.494%. More notably, the auction stopped a whopping 57.5bps above the August yield of 2.755%, and tailed the When Issued 3.303 by 2.7bps, the biggest tail since April and one of the biggest tails on history.

The bid to cover of 2.37 was in line with recent subpar showings, and while below the 2.42 six-auction average, it was above the August and July bids to cover of 2.34.

The internals were uglier, with Indirects slumping from 74.5% in August to just 62.3%, and with Directs awarded 17.9%, Dealers were left holding 19.8%, or the 2nd highest since April 2021 with just the July 2022 20.7% the exception to the upside.

Overall, this was an ugly, tailing auction and it has predictably sent 10Y yields to 3.33% from an intraday low of 3.26%, and just shy of session highs just above 3.34%.

Tyler Durden

Mon, 09/12/2022 – 13:17

via ZeroHedge News https://ift.tt/t6dRyO5 Tyler Durden