Bitcoin & Big-Tech Dump’n’Pump As Yield Curve Inversion Accelerates Ahead Of Fed

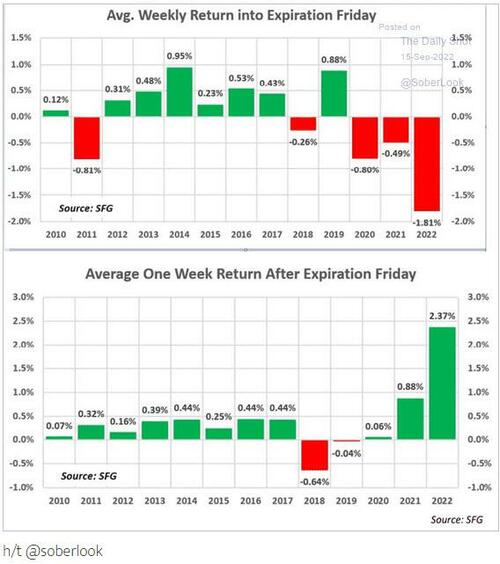

The usual post-OpEx bid tried its best but the event risk around this week’s FOMC meeting likely removed some vol-selling pressure as traders derisked to some extent.

Not much macro but homebuilder sentiment in the US tumbled for the 9th straight month – its longest losing streak since 1985.

Rate-hike expectations continue to rise into this week’s Fed meeting… and so do the implied-recession odds as 2023 rate-cut expectations rise…

Source: Bloomberg

The odds of a 100bps hike this week slipped to 20% but the odds of a subsequent 75bps hike in Nov (after this week’s implicit 75bps hike) rose to 80%.

Stocks were weaker overnight (dumped at the Asia open and at the European open), then panic-bid at the US cash open, gave all that back into the European close then caught a miraculous bid shortly after 1430ET (margin call time) lifting everything green…

Something odd happened at around the time the equity market went into melt-up mode – a spurious spike hit the VIX…

The S&P 500 closed at 3899.90 as the 3900 gamma trap was laser-beamed…

Vaccine makers were spanked today after President Biden unilaterally declared the pandemic is over…

Source: Bloomberg

Seems like The Fed is not a worry at all… or will this happen?

The tornado didn’t give a shit about the lake and just crossed it pic.twitter.com/RuXtMdbQzC

— Tim Urban (@waitbutwhy) September 19, 2022

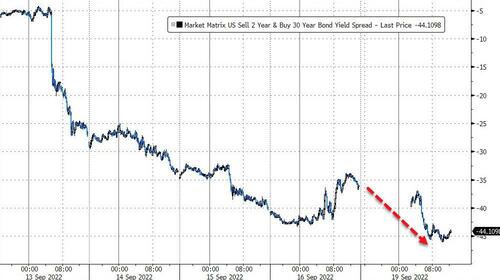

Treasuries were mixed today with the long-end bid (30Y -1bps) while the short-end was dumped more (2Y +8bps). Note many markets closed overnight (UK for Queen’s funeral)…

Source: Bloomberg

10Y yield jumped back above 3.50% for the first time since April 2011, before fading back…

Source: Bloomberg

All of which saw the yield curve (2s30s in this case) invert even deeper…

Source: Bloomberg

Real rates continued to scream higher, with 5Y back at its highest level since August 2009…

Source: Bloomberg

Which implies considerably more pain ahead for equity valuations…

Source: Bloomberg

The dollar trod water again today, unable to extend after last week’s CPI surge…

Source: Bloomberg

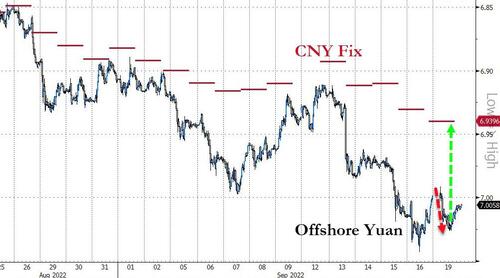

Offshore Yuan tumbled early in the Asia session (despite yet another strong yuan fix)

Source: Bloomberg

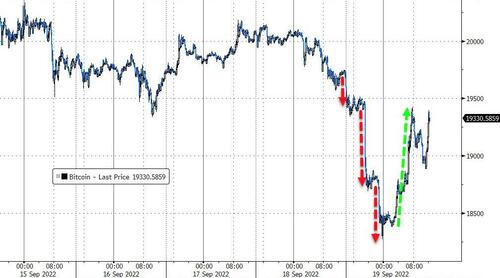

Crypto was clubbed like a baby seal overnight as Asia opened (with 3 big down-legs). But, beginning around 6amET, buyers returned and pushed Bitcoin back above $19,000…

Source: Bloomberg

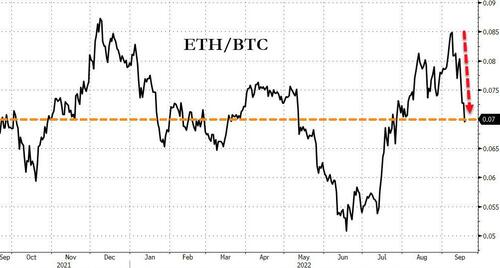

Notably Ethereum’s freefall relative to Bitcoin stalled today at what could be support…

Source: Bloomberg

Crazy day in crude trading today with WTI tumbling from $86 to an $81 handle beforee ripping back above $85…

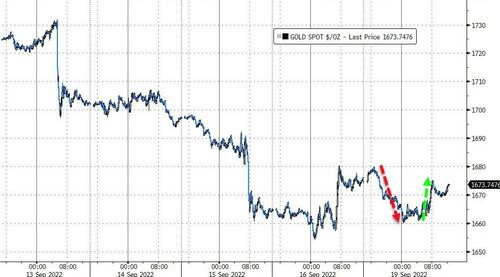

Gold tested Friday’s lows but bounced again to end unchanged…

Finally, the S&P has now traded below its key 200DMA for 110 straight days – the longest streak since the bear markets of 2008-2009 and 2000-2002. Bespoke strategists wrote in a note Friday. “It’s going to be hard to get too excited until the S&P moves back above its 200-day moving average.”

Source: Bloomberg

“There’s an awful lot of really challenging things being thrown at the market,” John Porter, CIO and head of equities at Newton Investment Management, said in an interview. “I’ve been in this industry for more than 25 years and I think the investment environment we’re in right now is one of the most complicated or complex environments I’ve seen in my entire career.”

Tyler Durden

Mon, 09/19/2022 – 16:01

via ZeroHedge News https://ift.tt/JYOC1yf Tyler Durden