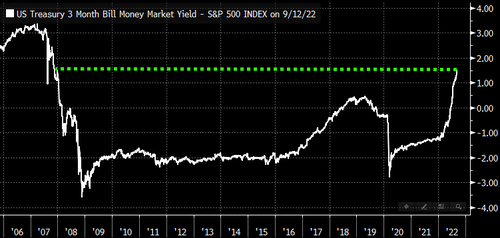

“Who Wants To Hold Volatile Risk Assets When You Can Hold Cash?”

Reinforcing our thoughts in the last week that ‘TINA has left the building’, Morgan Stanley’s Andrew Sheets wrote over the weekend that for much of the last 12 years, it was common to hear some variation of ‘TINA’ (There Is No Alternative), the idea that one needed to be long stocks and bonds because cash offered so little. Low yields were not the primary reason why stocks rallied over that time; global equities and global equity earnings simply rose by the same amount (~100%). But was TINA a helpful mental crutch for markets, especially in times of stress? Absolutely.

These tighter policy rates are now scrambling that mindset. Six-month US T-bills yield about ~3.75% and, as we discussed last month, cash and short-term fixed income increasingly offer lower volatility and high yield within a cross-asset portfolio. US 1- to 5-year credit yields ~4.9% against an S&P 500 earnings yield of ~5.9%. But over the last 30 days, the S&P 500 has been 5.7 times more volatile.

In short, investors now have a number of higher-yielding, lower-volatility alternatives if they want to step back from the market.

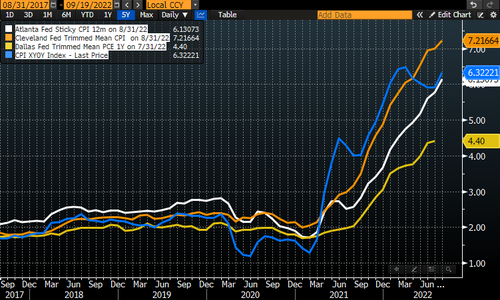

The fear among investors is further fomented by the realization, as Nomura’s Charlie McElligott writes, that the “broadening-out” inflation (both Core Services and a surprise reacceleration in Core Goods) and increasing evidence of “Wage-Price Spiral” >>> unanchoring of Inflation Expectations – but versus still “too hot” Labor- and Wage Growth- data…

…continue the fuel market repricing of higher Fed “Terminal Rate” in this week’s Fed meeting and beyond, with Mar23 FFOIS now comfortably parked ~ 4.50 (4.482 last)…

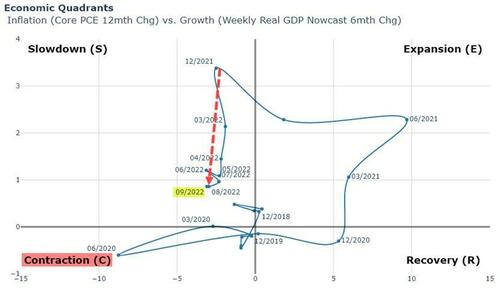

…which is part of the “FCI tightening impulse” driving US Dollar and Real Yields to multi-year highs which is causing so much strain for Risk-Assets, as “hard landing” is viewed as the only realistic US Economic outcome in ’23 with the Fed “slamming the breaks.”

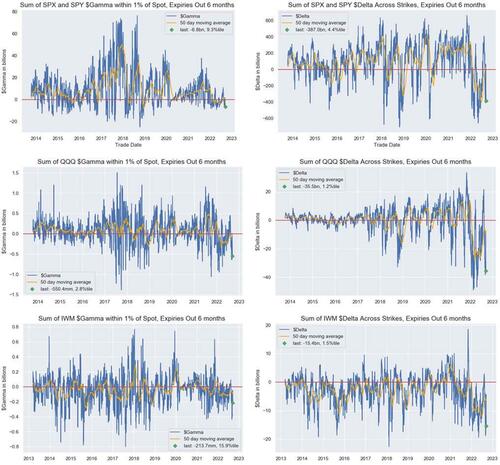

Shifting from the fundamental to the technical, McElligott notes that Options Dealer Positioning is in “Negative Gamma vs Spot” regime (where again we currently find ourselves, and have been for majority of the year 2022), making markets prone to outsized moves due to intraday hedging flows which counterproductively “press” underlying market moves, acting as an “momentum accelerant” which mechanically “has to” sell into lows and / or buy into highs, acting as a net “liquidity TAKER” which further exacerbates the magnitude of ranges and iVol.

So within both this particular:

1) Equities Vol “market structure” context, in addition to

2) the larger Macro theme of Equities currently being punished under the global Central Bank regime of “Tight FCIs until demand-side Inflation is killed”

…a topic that is part of almost every conversation we are currently having with clients is “Who wants to hold volatile Risk-Assets when you can hold CASH?”, as global Central Banks are telling you that we have months left of the “financial conditions tightening shocks” left until we see Terminal Rates at a level where the “demand-side” of Inflation is broken…versus say owning and rolling 3m US T-Bills yielding 3.10% in “risk-free heaven,” now a net 1.5% over SPX 12m Div Yield

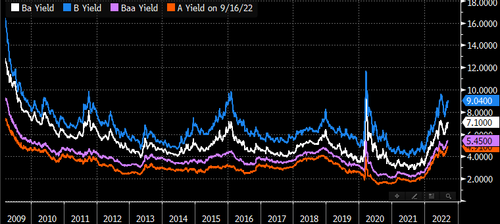

The Nomura strategist also notes that further to this “End of TINA” -era of “Equities over everything,” Asset Allocation –type Clients are voicing “cautiously constructive” long-term views on US Credit > Equities as well, where we currently see decade-high type pick-up with A’s yielding a very “real” 4.91%, Baa @ 5.45%, Ba @ 7.10% and B @9.04%, but particularly where 1m rVol on US Investment Grade is 5.9, and for High Yield is 7.9…versus US Equities benchmark S&P 500 as a 26 Vol asset!

This idea that there now IS actual competition again for Equities as the de facto “bulk weighting” for US Investors is going to be critical as we move forward, particularly when thinking about “Who is the Incremental Seller of Equities From Here?”, especially IF there there is to be another “leg down,” as the Fed is forced to “crash-land the plane”

The punchline to all this is that McElligott believe a “next leg” shock-down in Equities in coming-months would probably require the “401k Investor Class” to sees years-worth of positive Equities performance wiped-out first (back to pre-COVID levels), which then in conjunction with the “Return of Cash” as a viable Asset Class, would drive a larger “Asset Allocation” regime shift out of Equities and back towards Fixed-Income now yielding at levels which allow it to act as AAA – “An Actual Alternative” to Equities, but at a much lower Vol -in a future-state where the Inflation monster has been slayed, but likely via a hard “Recessionary” outcome.

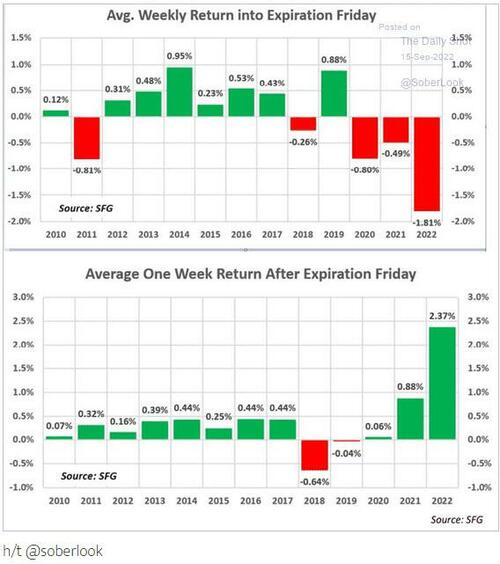

Finally, as we discussed over the weekend, the chart below shows the SPX returns for the weeks into OPEX (top chart) and after OPEX (bottom), illustrating the stark contrast of negative returns into OPEX, and positive returns out of OPEX.

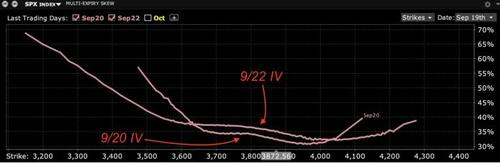

BUT, for those hoping to BTFD and play this swing again; as SpotGamma explains, it’s different this time because the huge event risk surrounding this week’s FOMC meeting is holding implied volatility up. You can see this reflected in the term structure between 9/20 (pre-FOMC) & 9/22 (post-FOMC).

SpotGamma’s view remains that FOMC is going to trigger a large directional move which should last into month end. Ultimately a move back above the 4000 Vol Trigger signals a full risk-on for markets with a move up into 4200 by 9/30. If Powell triggers bearish sentiment, we target recent lows of 3650 by 9/30.

Tyler Durden

Mon, 09/19/2022 – 12:25

via ZeroHedge News https://ift.tt/za35c6T Tyler Durden