Fed Put Getting Closer, Equity Market Says

By Simon White, Bloomberg Markets Live reporter and macro strategist

The price of deeper out-of-the-money insurance in equities is falling, implying lower demand for crash insurance. This suggests the market believes the Fed put is getting closer.

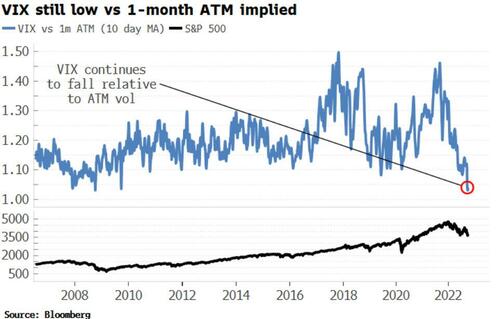

A conundrum all year has the been the relatively low level of the VIX despite equity markets being in a bear market. The VIX has been low relative to implied volatility, relative to longer-term volatility, and remains low compared to cross-asset volatility. Most notably, though, the VIX has been low — and continues to fall — versus at-the-money (ATM) volatility.

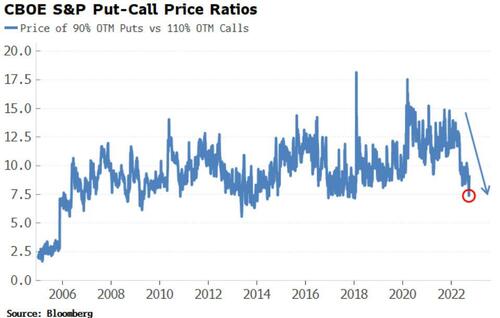

This is due to the price of further out-of-the-money (OTM) put options falling by more than options that are less out of the money. We can see this by looking the difference in volatility between 80% and 90% out-of-the-money put options and see it has been falling.

As the VIX is a weighted average of all S&P options with approximately 1-month to expiry and that have a non-zero bid, the lower price of these deeper out-of-the-money options is keeping the VIX lower relative to at-the-money volatility than it otherwise would be.

Puts have still been in demand though. The put/call volume ratio has been rising, showing that investors are buying more puts relative to calls. But the put/call price ratio has been falling, showing that investors have been paying relatively less for those puts.

Investors have therefore not been paying up as much for crash insurance, and buying puts that are less out of the money.

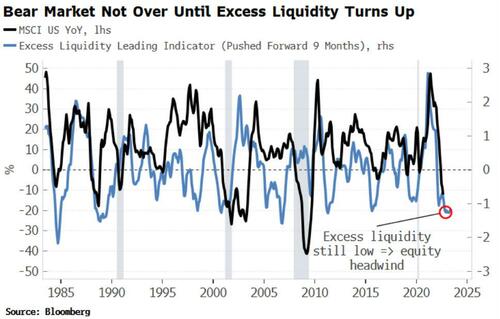

The Fed is now well into its hiking cycle, and the market is inferring it believes the Fed put is getting nearer. Certainly, current oversold conditions suggest a short-term bounce is at hand.

But while excess liquidity remains depressed, it will be hard for the market to make new highs. The Fed put may be closer, but that does not mean the bear market is over.

Tyler Durden

Fri, 09/30/2022 – 10:18

via ZeroHedge News https://ift.tt/J54UoVO Tyler Durden