To date, I have not written about President Biden’s student loan forgiveness initiative. Why? Because the rule doesn’t actually exist! There has been no notice in the Federal Register. Rather, we are left with a series of press releases, fact sheets, and the like. Government by blog post, as I’ve called it, is not new. The Obama Administration would often modify regulatory regimes, such as the Affordable Care Act, through FAQs and other subregulatory guidance documents. But as best as I can recall, the Obama Administration did not deliberately avoid publishing a new rule to frustrate legal challenges. Yet it seems that the Biden Administration is doing exactly that. Indeed, the Administration appears to be making changes to the policy on the fly for the express purpose of blocking law suits.

Consider the case brought by the Pacific Legal Foundation on September 27. What was the theory of standing? Frank Garrison (a lawyer for PLF) claimed he would face an increased tax burden if his debt was automatically cancelled. When the suit was filed, Garrison did not have to take any steps–the debt would be cancelled automatically. PLF obviously recognized that this policy could be changed. Steve Simpson of PLF told the New York Times:

If borrowers can opt out, Mr. Garrison’s claim “will be a harder case for us,” said Steve Simpson, a senior attorney at Pacific Legal, which is representing Mr. Garrison. “It would be harder to argue that he’s harmed any more.”

Lo and behold, the Biden Administration would make just that change. On September 28, the Department of Education filed a notice with the court:

In his motions for temporary restraining order and preliminary injunction, Plaintiff challenges a federal student loan cancellation policy announced by the U.S. Department of Education (“Department”), and claims that he will be harmed if the Department automatically cancels $20,000 of his federal student loan debt. Defendants submit this notice in advance of tomorrow’s scheduled conference to inform the Court that the Department updated its website today to confirm that any borrower who qualifies for automatic debt relief—i.e., relief without filing an application—will be given an opportunity to opt out. See U.S. Dep’t of Educ., Federal Student Aid, One-Time Student Debt Relief, https://ift.tt/LtJTix2 (last visited Sept. 28, 2022) (“If you would like to opt out of debt relief for any reason, including because you are concerned about a state tax liability, you will be given an opportunity to opt out.”). Upon receiving this lawsuit and reviewing Plaintiff’s filings, the Department has already taken steps to effectuate Plaintiff’s clearly stated desire to opt out of the program and not receive $20,000 in automatic cancellation of his federal student loan debt, and so notified Plaintiff’s counsel today.

Within 24 hours, the Department updated its website, and opted Garrison out of cancellation, thus mooting the suit. This filing almost sounds giddy. You can’t stop us! We’re the government! And, by the way, you’re stuck paying the $20,000 debt. Sorry, Frank. Emily Bremer flagged the change:

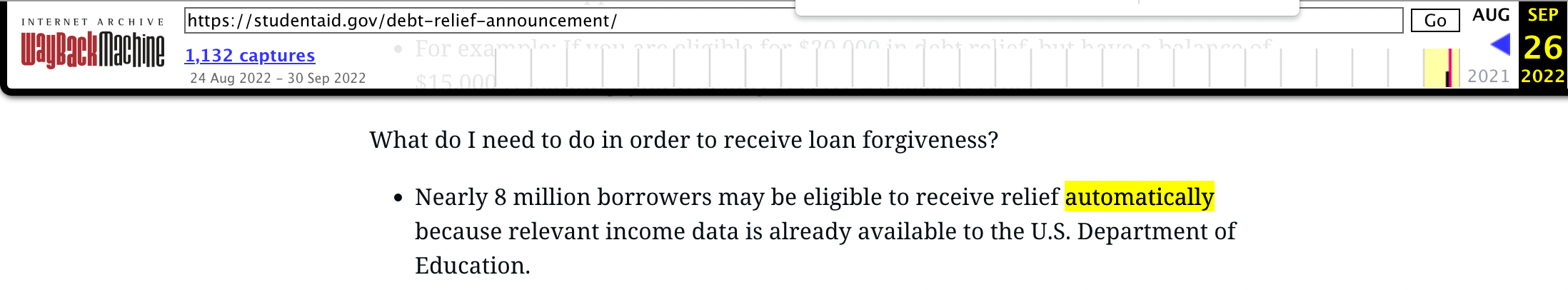

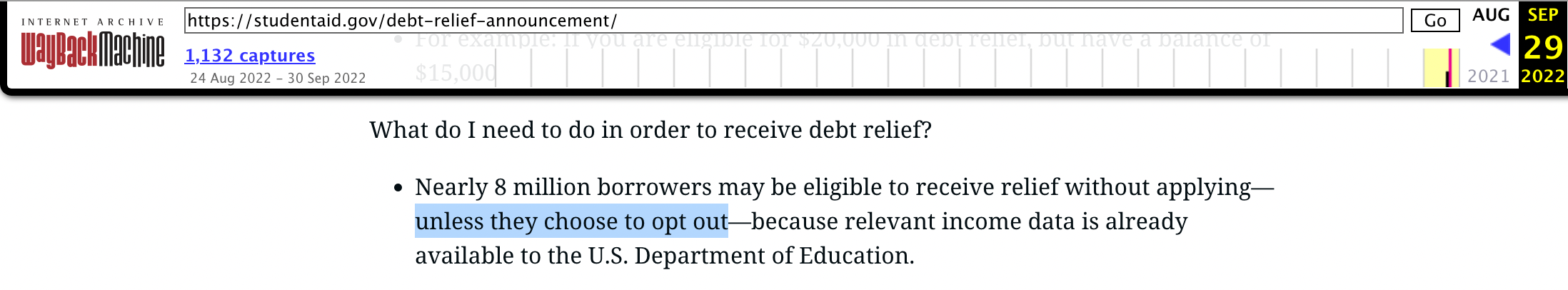

Because the Department has not yet published a notice of or rule governing the program (the final agency action everyone seems to be waiting for), the program remains malleable even as its implementation is already underway. Indeed, the Department’s guidance to borrowers changed just this week (compare this snapshot from Monday, September 26 to this snapshot from today). “Nearly 8 million borrowers may be eligible to receive relief automatically,” changed to “[n]early 8 million borrowers may be eligible to receive relief without applying–unless they choose to opt out.”

The word “automatically” was simply airbrushed away, like a photo of Stalin.

And on September 29, the district court denied relief because of the change:

Following a change in the student loan debt relief plan at issue (Filing No. 13), the court, in view of the fact the Department of Education exempted Plaintiff from receiving debt relief, finds Plaintiff cannot be irreparably harmed as is required for preliminary relief. Pursuant to the parties’ agreement, the motions for a temporary restraining order (Filing No. 4) and preliminary injunction (Filing No. 5) are DENIED without prejudice.

Notice that the court refers to a “student loan debt relief plan.” Not a rule or regulation or anything of the sort. A “plan,” whatever that is.

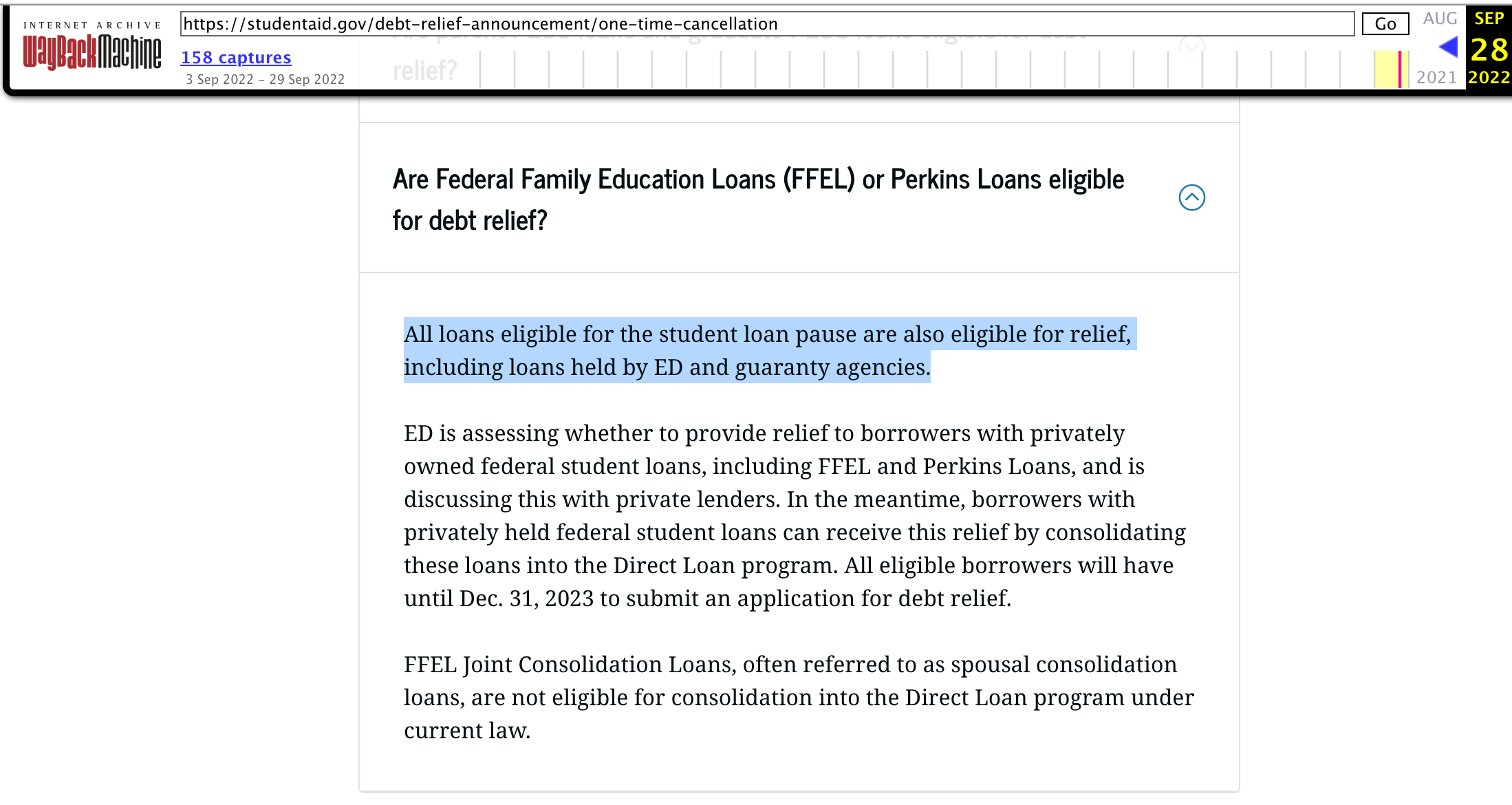

On September 29, we saw yet another attempt to block litigation. Missouri and several other states challenged the not-yet-released policy. Missouri’s Higher Education Authority asserted standing based on servicing Federal Family Education Loans (FFELP):

104. The Mass Debt Cancellation has created an enormous incentive to consolidate FFELP loans not held by ED (which are not currently eligible for cancellation) into DLP loans (which are eligible for cancellation). The inevitable result is that FFELP loan borrowers will likely consolidate into DLP loans en masse.

105. The consolidation of MOHELA’s FFELP loans harms the entity by depriving it of an asset (the FFELP loans themselves) that it currently owns.

106. The consolidation of MOHELA’s FFELP loans harms the entity by depriving it of the ongoing interest payments that those loans generate.

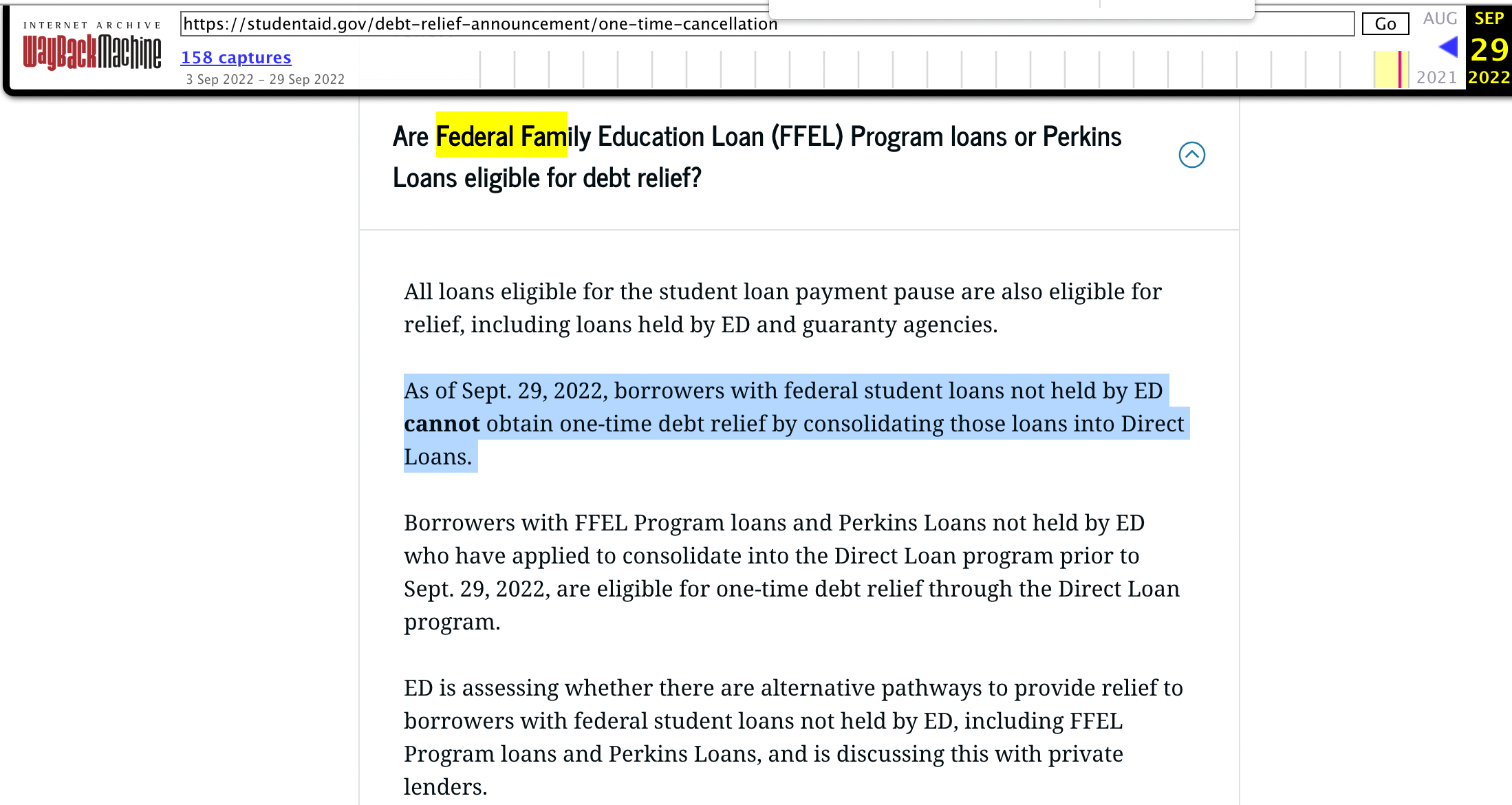

This argument may have been valid when the complaint was filed. But sometime on September 29, the Education Department excluded the FFEL loans from the loan forgiveness policy. Poof! NPR described the reversal as “remarkable.”

Today, according to federal data, more than 4 million borrowers still have commercially-held FFEL loans. Until Thursday, the department’s own website advised these borrowers that they could consolidate these loans into federal Direct Loans and thereby qualify for relief under Biden’s debt cancellation program.

On Thursday, though, the department iss. The guidance now says, “As of Sept. 29, 2022, borrowers with federal student loans not held by ED cannot obtain one-time debt relief by consolidating those loans into Direct Loans.”

If only the Internet Archive was around to index the missing eighteen minutes from the Watergate Tapes!

The Department of Education excluded nearly 800,000 borrowers with FFEL loans. Why? It seems that the government is trying to block Missouri’s suit. To be sure, Missouri has several other theories of standing. (I was impressed with how thorough the injury section was.) But the government’s behavior here is clear as day: modify the policy on the fly to knock out any viable theories of standing, even if doing so excludes people from loan forgiveness.

Emily Bremer offers a more charitable take:

This change presumably was made in response to the lawsuit filed earlier this week challenging the program’s legality, to defeat the plaintiff’s standing (and prevent others from having such standing).

This raises a troubling possibility: that the Department of Education has not published a notice or rule establishing the loan forgiveness program (as § 1098bb requires) precisely because the absence of a final agency action makes a legal challenge more difficult. Maybe a notice or rule will be forthcoming–perhaps when the first borrowers receive the promised loan forgiveness. If so, millions of borrowers might be granted relief before a court could consider a challenge to the program’s lawsuits. And perhaps that, too, is the goal.

How do you challenge a rule that doesn’t exist, and that constantly changes with every new blog post? The Biden Administration keeps moving the goal posts to block legal challenges.

I have no doubt lawyers in DOJ planned each and every step here: they would wait till a suit was filed, then update the website with a “revision” to try to moot the litigation. (Congressional Republicans should exercise their oversight power here to investigate.) And, for all we know, the Department will finally publish the rule when it looks like things are getting risky in court–maybe hope for a remand without vacatur. (Recall the various iterations of the travel ban that were issued.) But by that point, millions of Americans will already benefit from the rule, and the Administration will have prevailed.

We should all think back to the census litigation. The Chief Justice, in particular, was incensed with how the Trump Administration played fast and loose with the rules, and modified explanations on the fly during the course of litigation. Here, we have an inchoate policy that is about to spend hundreds of billions of dollars, without an actual rule in print. And, the plan is being altered for the blatant purpose of blocking litigation. I suspect this gamesmanship will not be received well. If one or more circuits enjoin the policy, do not expect the Supreme Court to stay the injunction on the emergency docket.

The post How Do You Challenge A Student Loan Forgiveness Rule That Does Not Exist? appeared first on Reason.com.

from Latest https://ift.tt/3YKmSqA

via IFTTT