Brit Stearns? UK Property Funds Gate Redemptions To Avoid Asset “Firesales”

The dominoes keep falling in Britain…

The last week – since The Bank of England bailed out its pension fund system – long-gilts and cable have rallied notably erasing much of the immediate pain felt in the margin-call/liquidity-fest chaos that forced the ‘old lady’ to step in.

However, as we noted over the weekend, the scars remain and funds are continuing to sell down assets, reducing exposures as the sudden collateral shortage has spooked many.

That selling has prompted spillover effects, specifically, as The FT reports, three of the UK’s largest property fund-managers have admitted they are unable to handle heavy demand from investors seeking to withdraw money.

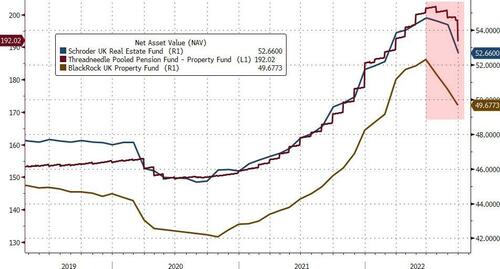

Specifically, The FT notes that Schroders said it will make some redemptions originally due on Monday as late as July next year (the £2.7bn UK Real Estate fund), while Columbia Threadneedle said volatile market conditions had forced it to switch from daily to monthly payouts (the £2.3bn Pooled Property fund). At the same time, BlackRock also imposed new restrictions on withdrawals (the £3.5bn UK Property fund).

So that’s £8.5bn of assets now tied up.

The NAVs of these funds has yet to really implode (that’s the point) but that suggests the true ‘price’ is well below current levels (as liquidity risk premia strike).

As The FT notes, UK pension funds have been cutting real estate holdings for several months as rising interest rates and slowing activity have weighed on the property market. Tumbling prices of UK government debt have also increased the proportion of funds’ portfolios in real estate, prompting some to reduce their exposure.

“It’s a fairly feeble market and you’ve thrown in some volatility. Shifting to monthly redemptions [from daily] reduces your need to firesale assets,” said one adviser to property funds.

Calum Mackenzie, investment partner with Aon, the pension consultants, added, “I think this is part of a longer-term trend by pension funds to [cut risk] by selling off the less liquid assets…This trend is now being exacerbated by last week’s short-term liquidity rush by pension funds.”

The last time we saw UK Property funds gating redemptions was immediately after the Brexit vote in July 2016 and during the early months of the COVID response.

Bear in mind that during the post-Brexit gates, the idea quickly struck a chord with the rest of the country’s “liquidity-challenged” asset managers, sparking vastly more capital restrictions.

Tyler Durden

Tue, 10/04/2022 – 05:45

via ZeroHedge News https://ift.tt/7LVK4Cf Tyler Durden