The Worst September, Q3 And YTD Of Your Career?

As DB’s Jim Reid writes in the preamble to his first Chart of the Day for October, he was thinking over the weekend that “there is so much negativity around at the moment that it will be good to do a “positive news” week very soon and only focus on things that are looking favorable for markets or economies” and as such he welcomes all reader feedback as, he admits, “it may take some digging to get a week’s worth.”

Actually, he adds, “one positive is that EVERYTHING is getting cheaper.” Indeed, as he observes in the bank’s latest performance report, we are coming off the back of one of the worst Septembers, worst Q3s and worst YTD of our careers in terms of the the number of assets tracked by Deustsche Bank declining.

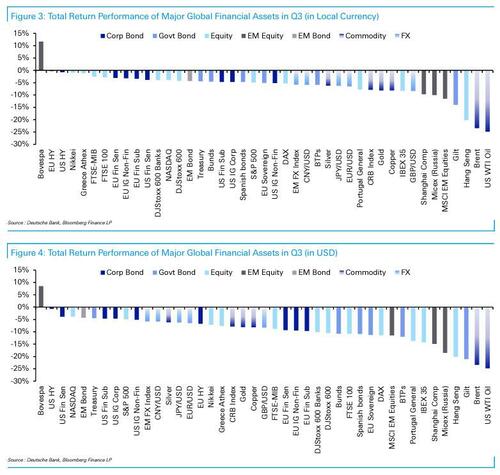

Which brings us to today’s CoTD, which is an abridged version of DB’s latest performance review (attached below), and which looks at a larger selection of global assets across charts and a big table in terms of YTD, Q3 and September returns (in local currency and USD).

It shows that in September just 2 non-currency assets out of the 38 Reid normally tracks, managed to post a positive return on the month. Worse, in Q3 it was just one which is the worst performance since DB started tracking all these assets in our monthly review back in 2007. Even if one went back a few decades, Reid writes that “it’s probably going to be hard to find a worse period for such a variety of assets.”

As Reid concludes, “this remains an “everything down” market which given that (pretty much) everything went up for 40 years together to extreme valuations shouldn’t be a huge surprise now that the drivers have changed.”

Next let’s take a closer look at what specifically the Sept / Q3 / YTD asset performance return shows.

As Deutsche Bank’s Henry Allen writes, echoing the above, “Q3 was a very volatile quarter for financial markets, with an astonishingly wide set of declines across all the major asset classes.”

The (mostly downward) moves came as investors grew increasingly concerned about a looming recession thanks to a combination of hawkish central banks (yes, central banks are doing everything in their power to crush demand by unleashing a recession), major disruptions to Europe’s energy supply, and some serious market turmoil in late-September that was centerd on the UK government’s fiscal announcement. As a result, major global equity indices dropped for a third consecutive quarter, which is the first time that’s happened since the financial crisis. Furthermore, as Reid noted above, over the quarter as a whole just 1 non-currency asset out of the 38 DB normally tracks managed to post a positive return.

In chronological terms, the quarter actually started off quite well in many respects, with risk assets posting a decent rally. Indeed, the S&P 500 was up by nearly +14% in total return terms over July and early-August as a result of a bear market rally… until the rally fizzled just shy of the 200DMA. That was supported by a belief in a “peak inflation” narrative, suggesting that we had seen the worst of rapid price gains, and thus the Fed would be able to pivot towards rate cuts as we moved into 2023. This narrative was aided by a dovish interpretation of the July FOMC meeting, with investors latching onto comments from Fed Chair Powell that as “monetary policy tightens further, it likely will become appropriate to slow the pace of increases”. And then there was a further boost after the US CPI reading for July came in much lower than expected, showing a monthly decline in prices for the first time since May 2020.

But, as everyone still so vividly remembers, by mid-August that view had begun to shift: a number of Fed speakers were pushing back on the more dovish interpretation from markets, which culminated in a very hawkish speech from Chair Powell at the Jackson Hole symposium. In no uncertain terms, he said that getting back to price stability would “likely require maintaining a restrictive policy stance for some time”, and a worse-than-expected inflation reading for August dampened any remaining hopes that the Fed might be about to slow down their pace of rate hikes. The Fed then followed through on this hawkish rhetoric, delivering a third consecutive 75bps rate hike at their September meeting. Furthermore, the median dot indicated that officials favored a further 125bps of hikes this year at the two remaining meetings, with the Fed Funds rate still at 4.6% by end-2023. Over at the ECB it was a similar story, albeit from a different starting point. When Q3 began, it was expected that the ECB would commence their tightening cycle in July with a 25bps hike, in line with their forward guidance from the June meeting. However, with inflation continuing to rise to fresh records, they went against that guidance to hike by 50bps in July, and followed up with an even larger 75bps move in September. In the meantime, inflation has shown no sign of abating yet, with the flash estimate for September rising to +10.0%.

In many respects, Allen explains, what alarmed markets most over the quarter (and September in particular) was how central banks became more explicit about how they would be willing to keep policy in restrictive territory, even if growth was to slow. For instance, the FOMC’s latest projections at the September meeting showed that policymakers were willing to keep rates in restrictive territory even if that meant a noticeable rise in unemployment, with the median participant expecting unemployment to rise from 3.8% by end-2022 to 4.4% by end-2023. With growing expectations about a US recession, that led risk assets to slump, and the S&P 500 fell by more than -12% between September 12 (the day before the higher-than-expected August CPI report came out) and the end of the month. In the meantime, yields on 10yr Treasuries moved above 4% in trading for the first time since 2010.

The DB strategist continues, by taking a look at Europe, where a key reason behind high inflation has been the massive energy shock that’s taken place. That gathered further pace over Q3, with natural gas futures up by +30.6% over the quarter to close at €189 per megawatt-hour, driven in part by the suspension of the Nord Stream gas pipeline to Europe. Governments have moved to step in across the continent to deal with the issue, with Germany announcing it would be borrowing €200bn to cap gas prices, whilst the UK government has unveiled an Energy Price Guarantee that will mean average energy costs over the coming year are roughly around the levels prevailing in September.

Overall then, the theme of Q3 was similar in many respects to what happened in Q1 and Q2: investors grew more concerned about high inflation (after growing less concerned resulting in a sharp rally), further rate hikes and low growth, leading to a broad-based sell-off across equities, credit and sovereign bonds, alongside fresh gains for the US Dollar.

With that in mind, here is the breakdown of which assets – or really, which asset – saw the biggest gains in Q3?

-

US Dollar: One of the few places it was worth being in Q3 was the US Dollar, which strengthened against every other G10 currency as the Fed reiterated its hawkishness. Over the quarter as a whole, the dollar index strengthened by +7.1%, marking its strongest quarterly performance since Q1 2015. It also marked the first time since the late-1990s that the dollar has strengthened for 5 consecutive quarters.

Next, we look at which assets saw the biggest losses in Q3: here there was plenty.

-

Equities: In spite of a strong performance at the outset, the major equity indices all lost ground in Q3 that accelerated towards the end of the quarter. Indeed, for both the S&P 500 (-4.9%) and Europe’s STOXX 600 (-4.2%), this is the first time since the GFC that they’ve lost ground for 3 consecutive quarters, with their YTD losses standing at -23.9% and -18.0%, respectively.

-

Sovereign Bonds: Persistent inflation and more hawkish central banks than expected meant that sovereign bonds had another poor quarterly performance. Gilts (-14.0%) were the worst affected given the market turmoil in the UK, although both US Treasuries (-4.4%) and European sovereigns (-5.1%) still lost significant ground. Combined with the losses over Q1 and Q2, that brings the YTD decline for US Treasuries to -13.4%, and for European sovereigns to -16.7%.

-

Credit: For the third quarter in a row, every single credit index we follow lost ground, across each of USD, EUR and GBP. Unsurprisingly though, it was GBP credit that was by far the worst performer, with IG non-fin down -12.7% over the quarter, compared with -3.2% for EUR and -5.1% for USD.

-

Commodities: There were broad-based declines across different commodity groups in Q3. Both Brent crude (-23.4%) and WTI (-24.8%) saw their worst quarterly performances since Q1 2020 as much of the world went into lockdown. And on a monthly basis, Brent Crude has now declined for 4 consecutive months for the first time since 2017. Both precious and industrial metals also struggled over Q3, with copper (-8.1%) and gold (-8.1%) losing ground as well

One final point: while the DB database focuses on traditional assets, observing the performance of crypto in Q3 reveals that not all was doom and gloom. In fact, as Kaiko Research notes, most crypto sectors outperformed other traditional assets in Q3, recovering from double-digits losses in Q2. Despite a sharp post-Merge pullback, ETH managed to close the quarter up more than 20%, outperforming our Layer 1 and Layer 2 baskets. After rallying in August, BTC lost most of its gains in September and ended the quarter slightly down following a drop in global risk sentiment.

Finally, here is the visual breakdown of the best performing assets of September…

… the third quarter…

… and 2022 YTD.

Tyler Durden

Mon, 10/03/2022 – 16:40

via ZeroHedge News https://ift.tt/EeDi0aP Tyler Durden