Diesel Back Above $5, Gas Prices Continue To Rise As “Ugly Inflation” Returns

Authored by Katabella Roberts via The Epoch Times,

Gas prices again are on the rise in the United States after months of volatility, and are expected to increase further over the next few weeks as “ugly” inflation returns, industry experts have said.

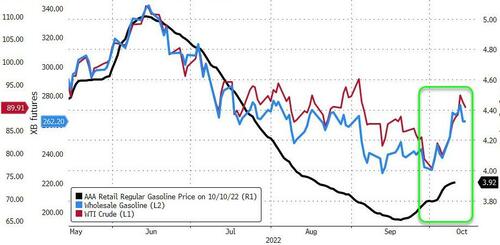

Patrick De Haan, senior energy analyst at Gas Buddy, noted in a statement on Twitter late Sunday that gas prices are up $0.133 a gallon from a week ago, to $3.92. Diesel prices have also surged over $5, De Haan said, up $0.18 a gallon, to $5.05.

“Relief coming to West Coast and Great Lakes while gas prices will rise in most other areas 10-20c/gal over the next week or two,” he added.

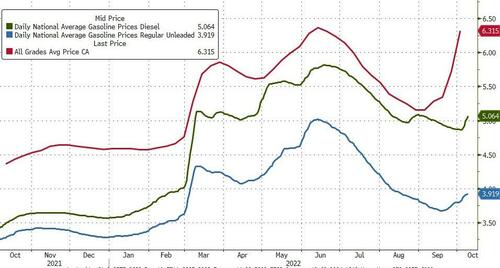

The national average gas price was at $3.919 a gallon on Oct. 10, up from $3.799 a week prior and $3.269 this time last year, according to the American Automobile Association (AAA).

Meanwhile, diesel prices are at $5.064 a gallon as of Oct. 10, up from $4.870 a week ago and $3.460 a year ago, AAA data show.

Gas prices had declined in recent weeks as the Biden administration released record amounts of crude oil from the Strategic Petroleum Reserve, and fears were rife that a recession was on the horizon, dampening demand.

However, the volatile prices have once again shot up at a time when Americans are bracing for a winter full of duress amid surging electricity and heating costs, with the average household set to pay roughly 17 percent more this winter compared to last winter to heat their home, according to a forecast from the nonprofit National Energy Assistance Directors Association.

‘Return of Some Ugly Inflation’

Elsewhere over the weekend, Tom Kloza, energy analysis global head at Oil Price Information Service (OPIS), wrote on Twitter that there has been an “incredible spike this week for heating oil, diesel, and jet fuel markets.”

He noted that OPIS has confirmed “wholesale price increases of 75 cents per gallon to over $1 per gallon in the week,” adding that Americans can expect a “return of some ugly inflation to freight, home comfort, and airfares.”

Kloza also pointed to “very tight inventories,” particularly for diesel, heating oil, and jet fuel, noting that gasoline issues are regional and will likely not prompt a spike in prices until the spring of 2023.

According to data from the Energy Information Administration (EIA) published on Oct. 6, demand for gas increased nationally, from 8.83 million barrels a day to 9.47 million barrels a day last week, while total domestic gasoline stocks tightened significantly by 4.7 million barrels, to 207.5 million barrels.

“High gasoline demand, amid tight supply, has led to higher pump prices nationwide,” the EIA said.

American drivers on the West Coast have faced higher prices amid ongoing planned and unplanned maintenance at around six refineries, which has resulted in limited supply in the region.

Drivers May See Some Relief, Says AAA

Despite the less-than-rosy outlook, AAA noted that refinery restarts and California’s move to allow retailers to start using less-expensive winter-blend gasoline early this year should bring some relief to drivers at the pump in those areas in the coming days.

The state had required retailers to sell an emissions-reducing summer-blend fuel, which increases the cost of gasoline per gallon by as much as $0.25.

In addition, the association noted that the United States is heading into the fall- and winter-driving season, which typically sees a decline in gasoline demand, meaning prices at the pump could also decline in the week ahead.

However, some experts have warned that U.S gas prices are set to rise further after OPEC+, which includes Saudi Arabia and Russia, said it would reduce oil production by 2 million barrels per day, the equivalent of about 2 percent of global oil demand.

That decision, which comes following Biden’s failed attempts to lobby the Saudi kingdom to produce more oil, was made “in light of the uncertainty that surrounds the global economic and oil market outlooks,” the group said.

Tyler Durden

Tue, 10/11/2022 – 13:45

via ZeroHedge News https://ift.tt/E4BqFuj Tyler Durden