NY Fed 1-Year Inflation Expectations Slide To 12 Month Low As Household Spending Expectations Crater Most On Record

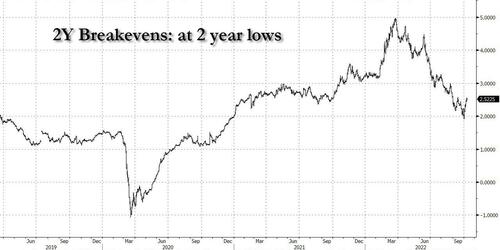

With inflation expectations recently tumbling across the board, the best example of which is the collapse in 2Y Breakevens which are trading near 2 year low thanks to the sharp drop in commodity prices (recent post-OPEC+ spike in oil notwithstanding), and recently even dropping below the Fed’s own inflation target of 2%…

… moments ago the latest NY Fed consumer expectations survey confirmed what we already know, namely that one year-ahead inflation expectations, those which are driven most directly by the price of gas, extended their recent steep declines in September, from 5.7% to 5.4%, the lowest print since September 2021 – even as the longer-term, 3Y inflation expectations rose modestly from 2.8% to 2.9%, or roughly where they were 2 years ago and where they have trended on average over the past decade (median five-year-ahead inflation expectations, which have been included in the monthly SCE core survey on an ad-hoc basis since the beginning of this year, increased to 2.2 percent from 2.0 percent).

With the latest NY Fed survey data we can update our matrix of various inflation expectations data points which now looks like this:

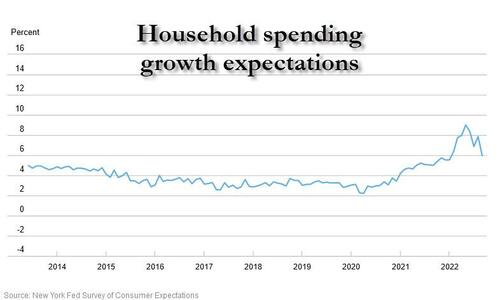

But while the continued decline in near-term inflation expectations will be welcomed by the Fed as longer-term expectations remain anchored not too far from their long-term average, a more ominous reading was seen in the expectations about household spending growth which cratered to 6.0% from 7.8% in August, the largest one month decline since the series’ inception in June 2013.

Perceptions about households’ current financial situations compared to a year ago were roughly unchanged, but the share of households reporting a worse situation compared to a year ago remains close to its series high. Year-ahead expectations about households’ financial situations were also roughly unchanged in September.

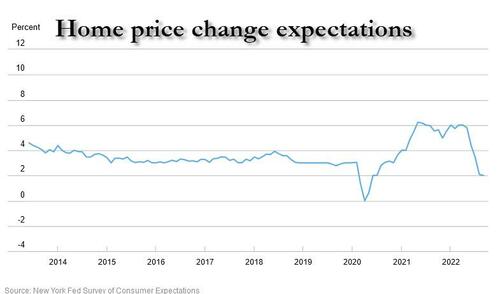

And another sign that the slowdown in the economy is trickling down to the consumer level was that median home price growth expectations fell to 2.0% from 2.09%, the lowest since June 2020; a which according to the NY Fed was “most pronounced among respondents with a college education and annual household income over $100k, but was broad based across geographic regions.”

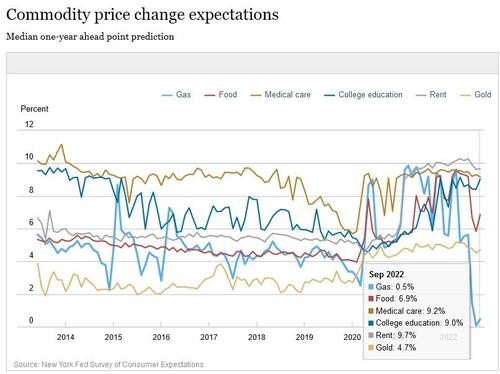

Elsewhere, expectations about year-ahead price changes rose by 0.4% for gas (to 0.5%), 1.0% for food (to 6.9%), 0.6% for college education (to 9.0%), medical costs dropped by 0.1% (to 9.2%) and rent rose 0.1% (to 9.7%). The median expected change in the cost of medical care, on the other hand, fell by 0.1% (to 9.2%).

Over the next year consumers expect gasoline prices to rise 0.46%; food prices to rise 6.85%; medical costs to rise 9.17%; the price of a college education to rise 9.03%; rent prices to rise 9.67%

Some other observations, first on the state of the labor market:

- Median one-year-ahead expected earnings growth fell by 0.1 percentage point to 2.9% in September. The decline was most pronounced for respondents over the age of 60 and those with a high-school education or less.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—decreased by 0.9 percentage point to 39.1%.

- The mean perceived probability of losing one’s job in the next 12 months increased by 0.5 percentage point to 11.6%. Similarly, the mean probability of leaving one’s job voluntarily in the next 12 months increased by 0.9 percentage point to 19.4%. Both increases were most pronounced for those over the age of 60.

- The mean perceived probability of finding a job (if one’s current job was lost) increased by 0.1 percentage point to 57.3%.

And then on broader Household Finances

- The median expected growth in household income was unchanged in September at its series high of 3.5%.

- Median household spending growth expectations fell sharply to 6.0% from 7.8% in August, its steepest one month decline since the series’ inception in June 2013, and its lowest reading since January of this year. The decline was broad based across demographic groups.

- Perceptions of credit access compared to a year ago were roughly unchanged, but the share of households reporting it is harder to obtain credit than one year ago remains at a series high. In contrast, expectations for future credit availability improved, with the share of respondents expecting it will be harder to obtain credit in the year ahead falling sharply.

- The average perceived probability of missing a minimum debt payment over the next three months was unchanged at 12.2%.

- The median expectation regarding a year-ahead change in taxes (at current income level) was also unchanged at 4.5%.

- Median year-ahead expected growth in government debt decreased by 0.1 percentage point to 10.3%, its lowest reading since March 2020.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.6 percentage point to 34.7%. The increase was most pronounced for those with annual household income over $100k.

- Perceptions about households’ current financial situations compared to a year ago were roughly unchanged, but the share of households reporting a worse situation compared to a year ago remains close to its series high. Year-ahead expectations about households’ financial situations were also roughly unchanged in September.

Perhaps the most notable other data point is that some 35.3% of consumers still expect US stock prices to be higher in 12 months (a drop of 1.1% from August). Whether they are right will depend on how fast the Fed crashes the economy.

Tyler Durden

Tue, 10/11/2022 – 11:31

via ZeroHedge News https://ift.tt/relK8pW Tyler Durden