Rent Inflation Hits Outer-Ring Suburbs The Most, Core-Cities The Least

Authored by Mike Shedlock via MishTalk.com,

The impact of work-from-home arrangements is clearly visible in rental preferences. City crime is likely another “get me out of here” factor…

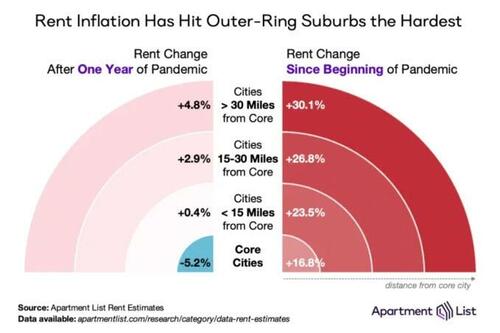

Image courtesy of Apartment List.

Please consider the Suburban Rent Boom Has Been a Constant Throughout the Pandemic

In the earliest phases of the pandemic, many of the nation’s large cities saw sharp rent declines as a subset of renters with newly remote working arrangements moved away from expensive downtown areas that had temporarily lost their vibrancy, in search of more space in the surrounding suburbs. At the same time, widespread job losses also forced many workers to give up leases they could no longer afford. In the time since, big city rent prices have bounced back as employment has rebounded and return to work plans have begun to materialize. But it’s still the suburbs that have continued to see the fastest rent growth.

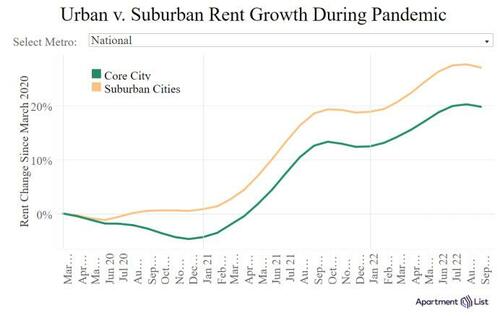

Analyzing our rent estimates across 39 large and medium-sized metropolitan areas, we find that since March 2020, rents in the suburbs of these metros have grown by 27.2 percent, on average, substantially outpacing the 19.8 percent average rent growth in the core cities that they surround.

Urban vs Suburban Rent Growth

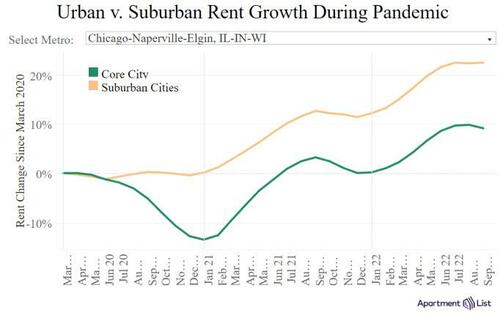

ApartmentList covers 39 major metro here is the Chicago metro area.

Urban vs Suburban Rent Growth Chicago

Many workers who lost jobs or who no longer needed to be close to an office decided that it was no longer wise to pay a premium for downtown rentals. As existing renters gave up their leases without new renters to take their places, rents in core cities were discounted. This was especially true in the nation’s priciest cities, such as San Francisco, Seattle, Boston, and New York City, all of which saw their median rents plummet by at least 20 percent by the end of 2020. On average, rents in the core cities that we analyzed fell by 4.6 percent from March through December of 2020. Meanwhile, rents in the suburbs of these metros ticked up slightly, rising by an average of 0.7 percent.

The fastest rent growth since March 2020 has been occurring in the suburbs that sit furthest from the urban core.

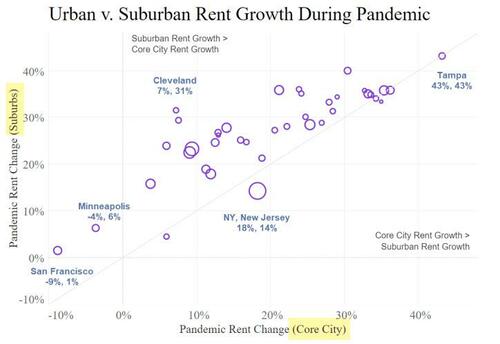

Urban vs Suburban Rent Growth Interactive

The widest gap is Cleveland. New York bucks the trend with an 18% rise in the city and 14.2 percent in the suburbs.

Even as large core cities have rebounded strongly from early-pandemic declines, rent growth has continued to be fastest in the suburbs. Even before the pandemic, increasingly unaffordable housing costs close to the urban core had been pushing more and more renters to the far peripheries of the nation’s large metro areas, resulting in a proliferation of “super commuters”.

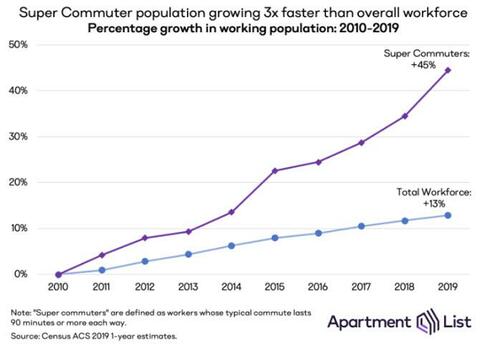

The above trend is part of the Explosion of Super Commuters

Explosion of Super Commuters

-

There are 4.6 million workers in the U.S. who commute 90+ minutes each way, comprising 3.1 percent of the American workforce. From 2010 to 2019, the number of super commuters nationally increased by 45 percent, more than tripling the growth rate of the overall workforce.

-

Super commuting is concentrated in the nation’s most expensive markets — the New York City, Los Angeles, and San Francisco regions collectively contain nearly one-in-three super commuters nationally.

Work from home and hybrid arrangements have enhanced this trend.

Housing Units Under Construction

Of the purported 461,000 homes for sale, only 49,000 are complete. However, there are 306,000 units under construction. That number exceeds every total but the final stages of the housing bubble years.

For discussion, please see New Home Sales Jump an Astonishing 28 Percent in August

Are those homes in the right places, enough to match the ongoing flight from big cities?

If not, don’t expect much rent relief. And shelter is about 32 percent of the CPI.

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.

Tyler Durden

Wed, 10/12/2022 – 11:27

via ZeroHedge News https://ift.tt/ie4XhST Tyler Durden