Chinese Job Prospects ‘Worst On Record’ As Economy Slows

Chinese workers are experiencing the worst job market prospects on record amid an economic slowdown that will give CCP policymakers much to talk about during a key political meeting next week, Bloomberg reports.

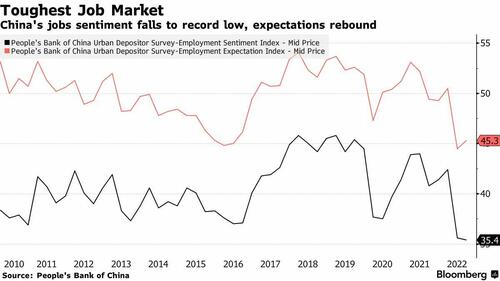

The Chinese central bank’s Employment Sentiment Index – a survey of 20,000 households’ employment outlook – plummeted to 35.4 in the third quarter – its lowest level since the index was launched in 2010, according to a Sunday report published by the People’s Bank of China.

Around 42% of households reported that finding a job had been “tough” or “hard to judge,” while just 9.7% of those asked said it was ‘easy’ to find work.

According to economist Tommy Xie of Singapore-based Oversea-Chinese Banking Corp, the deteriorating confidence will likely delay an economic recovery, as weak sentiment is the result of several factors which include regulatory crackdowns, Covid restrictions and a softened real estate market.

“The continually weakening household sector is the biggest challenge in the economy,” said Xie, adding “A comprehensive policy package that takes both Covid and industry regulation into considerations will be needed to boost people’s confidence.”

The survey underlines dwindling confidence as growth is dragged down by repeated Covid flare-ups and a property market slump that has lasted for more than a year. Job prospects for young people are especially bleak, with the unemployment rate for those aged 16-24 at nearly 19%, almost four times the official urban jobless rate of 5.3%. Separate data from the purchasing managers surveys last week showed ongoing job losses in the services sector, a major employer.

Top officials have highlighted the importance of employment as a key focus for the government as they downplay growth targets. Economists surveyed by Bloomberg predict gross domestic product will grow just 3.3% this year, well below the official goal of around 5.5%. -Bloomberg

Meanwhile, private investment in fixed assets only expanded 2.3% in the first 8 months of 2022, the slowest pace since the end of 2020, while retail sales posted month-on-month declines for two straight months – only the second time since 2011 this has happened. Holiday spending over last week’s National Day break was also lower than a year ago.

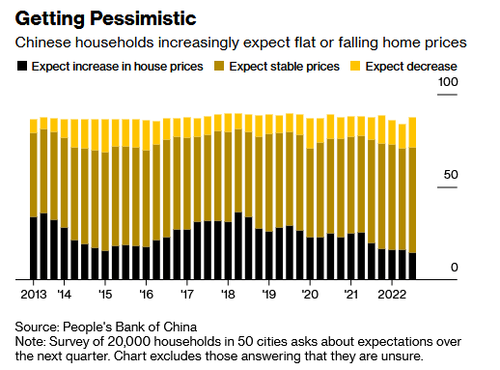

Adding to the sour outlook, the PBOC survey revealed that just 14.8% of respondents think home prices will rise in the next quarter – the lowest since 2010, while 16.3% said they expect home prices to fall – the highest percentage since the first quarter of 2015. 56.6% of those surveyed forecast no change.

“The property sector may be nearing an inflection point,” said Liu Peiqian, chief China economist at NatWest Group Plc. “The industry may be bottoming out in terms of policies, and once that happens, the sector may start to stabilize and gradually improve.”

Tyler Durden

Wed, 10/12/2022 – 21:05

via ZeroHedge News https://ift.tt/TS1Nxbl Tyler Durden