EU NatGas Whipsaws Over ‘Hoax Threat’ At Norwegian Energy Plant

European natural gas futures soared over fears of an incident at a critical Norwegian processing plant. Norway’s grid operator released a statement shortly after the incident hit major media outlets across the EU and the world and said it was nothing more than a ‘hoax.’ Benchmark futures then pared gains.

Bloomberg said Shell Plc confirmed NatGas is flowing through the Norwegian Nyhamna processing facility after local authorities were called to investigate a possible bomb threat at the Ormen Lange field and Nyhamna processing facility earlier on Thursday but found no evidence.

A Shell spokesperson said they were “informed by the police about an unclear situation in the proximity of the Nyhamna gas plant … and as a precaution, the gas plant was evacuated and Shell’s emergency response organization was mobilized.”

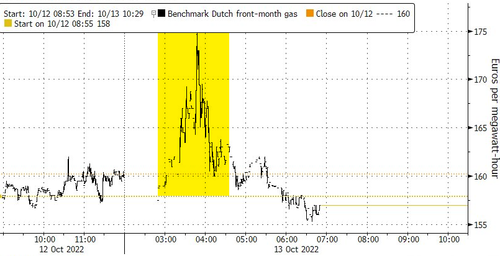

News of the evacuation sent EU NatGas on violent swings, at one point spiking 9% but shortly later, giving up all gains. Still, price action outlines the market’s nervousness about energy infrastructure following the bombing of the Nord Stream pipeline system.

Reuters reported the bomb threat was “made by telephone,” according to Odd Joergen Nilssen, the mayor of Aukra municipality, where the processing facility is located.

Since the Nord Stream attack, the Norwegian Home Guard has been patrolling the plant for fears of sabotage and or possible Russian interference. Many other energy facilities across the EU have increased security.

What’s notable about Nyhamna is that it supplies about 20% of the UK’s demand — any disruption would be catastrophic ahead of winter.

Even though Europe’s NatGas storage facilities are nearly full, the energy-stricken continent faces a cold winter that could draw from storage much quicker than anticipated. Then there’s a risk during peak demand hours that some EU countries might not have enough supplies, which could trigger power blackouts, something Russian energy giant Gazprom warned yesterday.

Tyler Durden

Thu, 10/13/2022 – 10:15

via ZeroHedge News https://ift.tt/Co3nRWI Tyler Durden