Inflation continued burning a hole in Americans’ wallets last month.

Prices rose by an average of 0.4 percent overall, driven primarily by rising costs for housing, food, and medical care. According to the newly released data from the Bureau of Labor Statistics, prices rose by 8.2 percent overall during the last 12 months ending in September. Food prices have climbed by 11.2 percent in the past year, while energy prices are up by a whopping 19.7 percent despite falling by about 2 percent in September.

September’s rising prices occurred despite the ongoing attempts by the Federal Reserve to bring inflation under control with higher interest rates, and it points to ongoing fiscal difficulties for both everyday Americans and the federal government that caused much of this current mess.

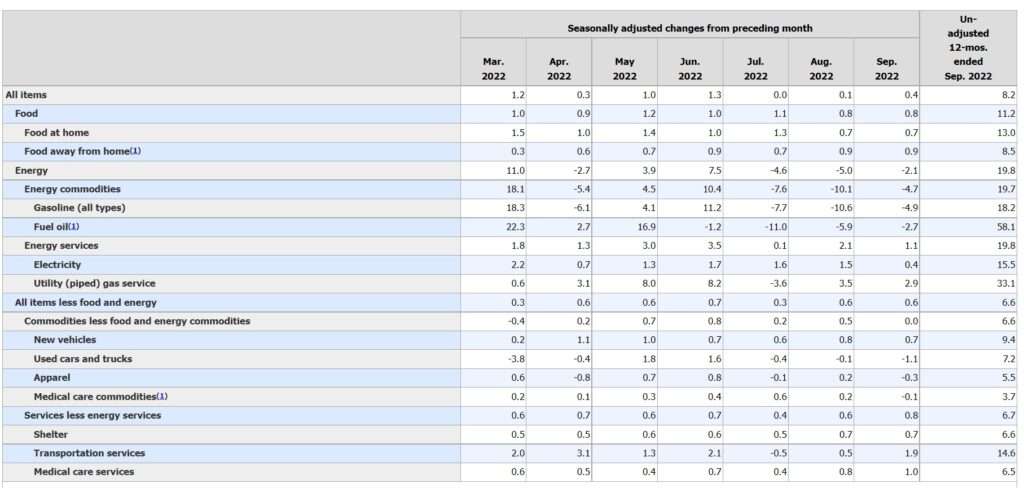

Here are the rest of the ugly details from Thursday’s consumer price index (CPI) report:

Particularly worrying is that so-called core CPI, which filters out more volatile categories like food and energy prices, rose by 0.6 percent last month. In other words, inflation is widespread throughout the economy and no longer contained to the categories that were driving the phenomenon a year ago. Far from being transitory, inflation now seems to be a deeply rooted problem.

The CPI rose +0.4% in September, and is now running at 8.2%, down from 8.3%.

Excluding food and energy, prices rose +0.6% in the month, so core inflation is 6.6%.

Inflation is proving to be more resilient — and more troubling — than many had hoped or forecast.

— Justin Wolfers (@JustinWolfers) October 13, 2022

Rising prices are primarily a concern for Americans who have to actually pay their bills and balance their budgets, of course. But ongoing inflation is increasingly becoming a problem for the federal government as well.

As Reason has reported, rising interest rates needed to combat inflation will rebound onto the federal balance sheet by making the federal debt more expensive. Even when interest rates were at or near historical lows, interest payments on the national debt were on course to become one of the largest segments of the federal budget within the coming decade. Higher interest rates mean the government will have to spend a significantly larger amount of revenue on simply managing the existing debt—a nasty feedback loop that makes the government’s already untenable fiscal situation considerably worse.

The warnings have been coming for years. But no one has been listening. “For well over a decade, the Congressional Budget Office (CBO) has been issuing stark warnings about the nation’s current debt levels and the long-term buildup of debt they portend,” Reason‘s Peter Suderman wrote last week.

But, wait, there’s yet another problem. Social Security hands out annual cost-of-living adjustments, or COLAs, to beneficiaries, and those adjustments are based on the rate of annual inflation each September. This year, that means Social Security benefits will increase by 8.7 percent.

That’s good news for elderly Americans, but it’s only going to accelerate another fiscal crisis. Social Security is already on track to be insolvent by 2034—at which point, unless Congress acts, benefits will be cut across the board.

In one sense, then, persistently rising inflation is an immediate problem for everyone who has to eat, pay rent, and likes having lights and heat in their homes. That’s bad enough, but September’s inflation report is also a harbinger of other major problems to come.

The post Inflation Hits 8.2 Percent After Another Month of Sharply Rising Prices appeared first on Reason.com.

from Latest https://ift.tt/WMFCuUA

via IFTTT