Stocks Erase CPI Losses After ECB Headlines

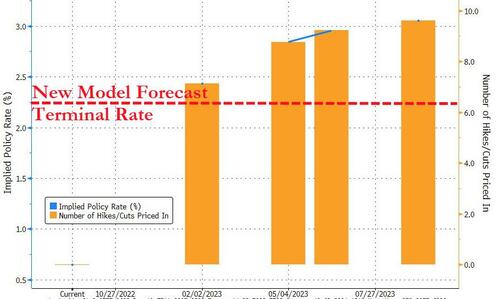

Reuters is reporting that an ECB staff model (presented the model to policymakers at a retreat in Cyprus last week.) puts the target-consistent terminal rate at 2.25%. That is dramatically less than the market is expecting will be required by The ECB to tame inflation...

However, as Reuters reports, policymakers at the gathering gave the model a mixed reception, with many criticising some of its basic assumptions after staff failed to predict the current surge in inflation, the sources said.

Rate-setters agreed this rate would be treated as an input for their internal deliberations but decided they wouldn’t use it as the ECB’s policy guidance or refer to it in official communication, which is led by President Christine Lagarde.

Policymakers’ key objection was that staff models have fared poorly in recent years so there was little confidence in an indicator that was so far below current market pricing, the sources said.

Strawman or not, US equity prices ripped higher on the report, perfectly erasing the losses from the US CPI report…

But as you can seem the markets are now trading lower, likely because of this little snippet buried in the Reuters report: “policymakers gave the new model a mixed reception and fear it could include errors”

Trade accordingly…

Tyler Durden

Thu, 10/13/2022 – 11:31

via ZeroHedge News https://ift.tt/NbxVzB0 Tyler Durden