WTI Extends Gains As Production Slows, Despite Biggest Crude Build In 19 Months

Oil prices extended losses this morning after the hotter-than-expected CPI amid global recession fears and on the heels of yesterday’s OPEC/EIA demand growth outlook cuts and a bigger than expected crude inventory draw reported by API. However, after US cash equity markets opened, crude prices rebounded, erasing all the earlier losses

“We just had this bigger than expected CPI number, which is a big demand destruction number, and we have fallen apart accordingly,” said Robert Yawger, director of the futures division at Mizuho Securities USA in New York.

“If we post anything larger than 7 million in the EIA, you’re probably going to see this thing track lower again.”

While some of this data is likely impacted by Hurricane Ian, it still paints a useful picture of where demand really is…

API

-

Crude +7.054mm (+2.2mm exp)

-

Cushing -750k

-

Gasoline +2.008mm (-2.1mm exp) – biggest build since July

-

Distillates -4.560mm (-2.3mm exp) – biggest draw since March 2022

DOE

-

Crude +9.879mm (+2.2mm exp) – biggest build since March 2021

-

Cushing -309k

-

Gasoline +2.022mm (-2.1mm exp)– biggest build since July 2022

-

Distillates -4.853mm (-2.3mm exp)- biggest draw since March 2022

The official data confirmed API’s report with crude stocks soaring most since March 2021 last week, a distillates draw and gasoline build…

Source: Bloomberg

The gain in US crude stocks at nearly 10m bbl was mainly because of the plunge in exports.

US crude exports have slumped after staying strong for two weeks. The decline of over 1.6m b/d sent outflows to the lowest since August.

Gasoline inventories remain the lowest seasonally since 2014, while on the West Coast, supplies are the lowest in over a decade.

US refineries, which had been operating with over 90% of capacity for months, are now at 89.9%. Rates are the lowest since April with fall maintenance in full swing.

The SPR saw a huge 7.7mm barrel drain last week (3rd largest ever) as the Biden administration grows increasingly desperate… the biggest 3 week drain ever…

Source: Bloomberg

US Crude production dropped to 5 month lows…

Source: Bloomberg

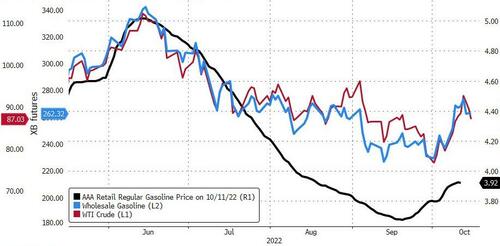

WTI rallied above $87.50 ahead of the official data, briefly dipped after the big build then squeezed higher…

“Oil prices accurately reflect the turbulent trading conditions that are the product of negative macroeconomic and somewhat constructive microeconomic factors,” said Tamas Varga, an analyst at PVM Oil Associates Ltd.

Interestingly Diesel and Jet Fuel crack spreads are exploding higher (wholesale gasoline not so much) as refinery supplies struggle to refill inventories…

And finally, prices at the pump are up for 9 straight days and given where crude and wholesale gasoline prices are, we should expect prices to keep rising ahead of the Midterms…

The only chance for lower prices is continued concerns about future global demand and the bleak economic outlook which will “raise the possibility that supply issues will be less of an issue than demand destruction,” said Michael Hewson, chief market analyst at CMC Markets UK, in a market update.

Tyler Durden

Thu, 10/13/2022 – 11:06

via ZeroHedge News https://ift.tt/YOHEaWP Tyler Durden