Atlanta Fed President Reveals Five Years Of Trading Violations; Claims He “Didn’t Understand” Disclosure Obligations

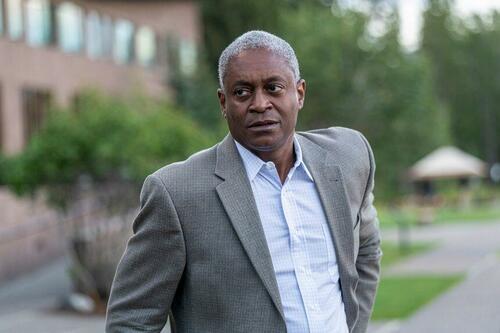

One year after the Fed was rocked by a trading scandal which cost the jobs of three Fed henchmen, including Dallas and Boston Fed presidents, Kaplan and Rosengren, and Fed vice-chair Richard Clarida (who couldn’t wait to be sacked for cause or otherwise just to get back to Pimco) after financial disclosures showed they had been trading extensively in individual stocks in 2020 during a period in which the Fed engaged in extraordinary market interventions as a result of the coronavirus pandemic, moments ago Atlanta Fed president Raphael Bostic joined the club of inglorious Fed traders when he revealed he had improperly disclosed financial transactions for the past five years because he incorrectly interpreted policies governing personal investments.

As the WSJ reports, according to amended disclosures filed Friday, dozens of sales or purchases of mutual funds and other investment vehicles by Bostic hadn’t previously been disclosed. Adding insult to injury, more than 150 of those transactions had settled on dates when they weren’t allowed because they were during blackout periods before and after Fed policy meetings. And the cherry on top: last year Bostic also held more than $50,000 in Treasury securities, exceeding the then-permitted limit on such holdings for Fed officials.

In other words, the first black and openly gay president of the Atlanta Fed was violating pretty much every rule in the book. His excuse? It was “inadvertent.”

Bostic said the lapses were due to his flawed interpretation of central bank policies. He said he had sought to correct his filings and overhaul how he manages his personal accounts “as soon as I became aware that my financial reporting did not meet the expressed or implicit expectations necessary to maintain the public’s trust.”

He added, “At no time did I knowingly authorize or complete a financial transaction based on nonpublic information or with any intent to conceal or sidestep my obligations of transparent and accountable reporting.”

In a statement Friday, Bostic said that he was not aware of the specific trades or timing of the transactions, which were made by a third party manager in accounts where he did not have ability to direct trades. He detailed the transactions in corrected disclosure forms posted to the Atlanta Fed’s website.

“I take very seriously my responsibility to be transparent about my financial transactions and to avoid any actual or perceived conflicts of interest,” Bostic said in the statement adding that he “sincerely regrets” if his actions raise questions (they do). So “seriously” that it took Bostic one year after the Fed’s trading scandal to go over his own disclosures and find that pretty much nothing had been disclosed in them.

The chairwoman of the Atlanta Fed’s board, Elizabeth Smith, said the board had accepted Bostic’s explanation and that the directors were confident Mr. Bostic hadn’t sought to profit from any private policy-setting deliberations.

“We are satisfied with his revised financial disclosures and the changes he has made in managing his investments,” Smith said in a statement released Friday. “The board is also satisfied that President Bostic has established procedures to ensure that future violations do not occur.”

Statement from Federal Reserve Bank of Atlanta Board Chair Elizabeth A. Smith

For immediate release: October 14, 2022

The Federal Reserve Bank of Atlanta’s board of directors has been made aware of inaccuracies in President Raphael Bostic’s forms that disclose his personal financial assets and transactions. Furthermore, we learned of transactions that took place during blackout periods and of holdings that violated guidelines set out by the Federal Open Market Committee, or FOMC.

After reviewing the documents and discussing these issues with President Bostic and the Atlanta Fed’s chief ethics officer, the board acknowledges the violations and accepts President Bostic’s explanation. My board colleagues and I have confidence in President Bostic’s explanation that he did not seek to profit from any FOMC-related knowledge.

The directors appreciate that President Bostic has thoroughly corrected his financial forms, going back to when he first joined the Atlanta Fed. We are satisfied with his revised financial disclosures and the changes he has made in managing his investments. The board is also satisfied that President Bostic has established procedures to ensure that future violations do not occur.

We are also aware that the Office of Inspector General for the Board of Governors of the Federal Reserve System will review this matter. We welcome this review and will cooperate fully to ensure this matter is effectively resolved.

In response to the Fed’s latest trading scandal, Jerome Powell had asked its inspector general to conduct an independent review.

“We look forward to the results of their work and will accept and take appropriate actions based on their findings,” said a Fed spokesperson.

Powell unveiled sweeping personal-investing restrictions on senior officials a year ago to address the stock-trading controversy. Those restrictions took effect earlier this year, and Bostic’s violations were uncovered by Fed ethics officials in Washington as part of a review of officials’ disclosures this year. In other words, contrary to his excuse, it wasn’t a voluntary disclosure but instead Bostic merely got caught.

As the WSJ reports, since becoming the bank’s president in 2017, Bostic placed his financial holdings into accounts managed by a third party that neither he nor his personal investment adviser had the ability to direct. Bostic said he had taken these steps in an effort to avoid conflicts of interest.

But in a seven-page letter disclosing the violations, Bostic said he had recently learned that while he didn’t have the ability to direct individual trades, those trades should have been listed on his disclosures. Moreover, Bostic said the third-party manager had conducted transactions during restricted periods even though such transactions were approved outside of those so-called blackout periods.

Bostic’s disclosures also showed dozens of transactions—none of them in individual stocks—during the most turbulent periods in March and April 2020. Readers can go through these at the following links:

- 2021 Atlanta Fed President Financial Disclosure

- 2020 Atlanta Fed President Financial Disclosure (previously filed 2020 form)

- 2019 Atlanta Fed President Financial Disclosure (previously filed 2019 form)

- 2018 Atlanta Fed President Financial Disclosure (previously filed 2018 form)

- 2017 Atlanta Fed President Financial Disclosure (previously filed 2017 form)

For some context, below is Bostic’s latest financial disclosure (pdf link)

Tyler Durden

Fri, 10/14/2022 – 15:23

via ZeroHedge News https://ift.tt/8cQPF0X Tyler Durden