UMich Inflation Expectations Unexpectedly Jumped In October

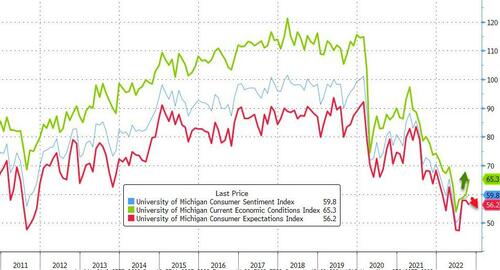

UMich headline sentiment was expected to rise very modestly in preliminary October data and did – beating expectations with a 59.8 print against 58.8 expectations. However, this was driven by a jump in current conditions offsetting a drop in future expectations…

Source: Bloomberg

Continued uncertainty over the future trajectory of prices, economies, and financial markets around the world indicate a bumpy road ahead for consumers.

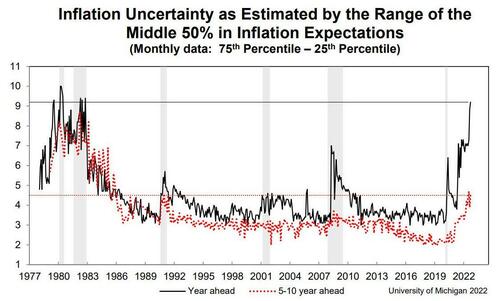

However, what most investors were watching for was inflation expectations which unexpectedly spiked higher…

The median expected year-ahead inflation rate rose to 5.1%, with increases reported across age, income, and education. Last month, long run inflation expectations fell below the narrow 2.9-3.1% range for the first time since July 2021, but since then expectations have returned to that range at 2.9%. After 3 months of expecting minimal increases in gas prices in the year ahead, both short and longer run expectations rebounded in October.

Source: Bloomberg

Do not forget that inflation expectations are likely to remain relatively unstable in the months ahead, as consumer uncertainty over these expectations remained high and is unlikely to wane in the face of continued global pressures on inflation.

Home-buying conditions plunged to nbew cycle lows (40 year lows)…

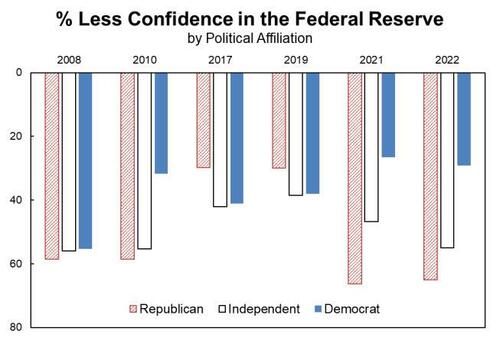

Finally, we note that confidence in The Fed has plunged (especially this year for Independents and Democrats)…

With the usual assumption that a high level of confidence in the Fed would be associated with more favorable prospects for the national economy, consumer views suggest there may be headwinds that may dampen the outlook for the economy.

Tyler Durden

Fri, 10/14/2022 – 10:05

via ZeroHedge News https://ift.tt/5abI8oc Tyler Durden