“Worst.Crisis.Ever.” – Traders Begin Making Big Bets On Massive Volatility Ahead

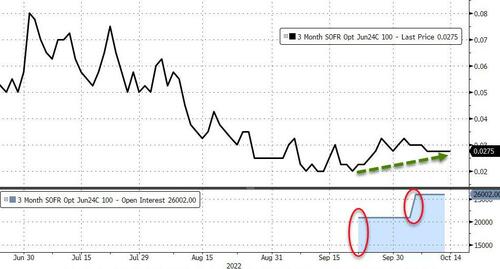

Less than a month ago, we noted a peculiarly ‘scary’ position that one trader had put on, betting on a major crisis occurring in financial markets that prompted The Fed to return all the way back to ZIRP before mid-2024.

Since then that bet size has increased…

Source: Bloomberg

During the last week’s chaotic headlines and market movements, we have seen further bets on a very serious crisis occurring… even sooner.

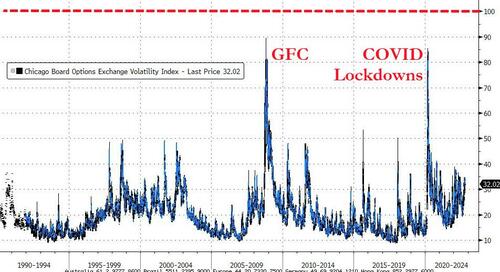

Bloomberg reports that shortly after 1pm on Friday, a trader used options to put on a wager that the VIX could jump to 100 by April, up from its current level of around 32.

The trader appeared to have bought 70,000 call contracts through a series of block trades, spending a total of $4 million.

“Someone buying deep out-of-money VIX calls like the trade we saw today is most likely looking to have a large payoff if volatility increases sharply,” said Michael Beth, director of trading at WallachBeth Capital.

“This means that the trader sees more volatility on the horizon and expects skew to steepen.”

The bet is an extreme one to say the least with VIX being 10-15 vols higher than the crisis peaks of the Great Financial Crisis and the COVID lockdowns…

As one veteran vol trader noted, while “this is not the first extreme OTM vol bet we’ve seen recently… this is betting on markets suffering the worst crisis ever…”

Notably, open interest for VIX calls struck above 100 are sizable and growing (all the way to 150!)…

Interestingly, amid Friday’s equity market plunge, VIX actually fell…

Finally, we wonder, does Janet Yellen still believe there will not be another financial crisis in our lifetimes?

Tyler Durden

Sat, 10/15/2022 – 13:00

via ZeroHedge News https://ift.tt/UGFRsv4 Tyler Durden