Stocks Soar As Delta-Squeeze Arrives Right On Time

Over the weekend, we pointed out that Friday’s bloodbathery was dominated by hedge fund shorting, setting the market up for a major squeeze higher… yet again…

The overall Prime book saw the largest notional net selling in 4 months (-2.1 SDs), driven by short sales outpacing long buys nearly 5 to 1 – this week’s notional short sales ranks in the 94th percentile vs. the past year.

Setting the market up for the negative delta squeeze…

Here comes the delta steamroller https://t.co/j3Ccap1ki9

— zerohedge (@zerohedge) October 16, 2022

And sure enough, US equities are ripping higher this morning, extending pre-market gains following the cash open…

As ‘most shorted’ stocks are getting their faces ripped off…

Bonds are also bid with 10Y Yields back below 4.00%..

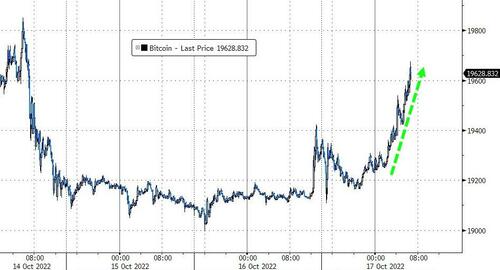

And Bitcoin is also ripping along with big-tech…

All that said, another 2-3% rally will be that and nothing more, and as Michael Hartnett warned, more downside is coming, until the end of the month when a sustained buying spree will be launched by the return of buybacks, which emerge from blackout on October 25.

Furthermore, before you push all-in on this move, we note our warning over the weekend that:

while we may get another over-shorted, oversold rally on Monday and we may get a powerful bear market rally in November that pushes stocks to 4,000 or higher by year end, but the bear market won’t end until the Fed pivots.

The timing of that still remains to be determined, however after the midterm elections when the political blinders drop, we expect that the full – and dire – picture of the US labor market will finally emerge and shock everyone, especially the Fed.

Size your trade accordingly.

Tyler Durden

Mon, 10/17/2022 – 09:51

via ZeroHedge News https://ift.tt/a4LboXJ Tyler Durden