Futures Soar Despite Latest UK Newsflow Rollercoaster Fiasco

It was another overnight emotional and markets rollercoaster session thanks to the constant chaos of newsflow and confusion out of the UK.

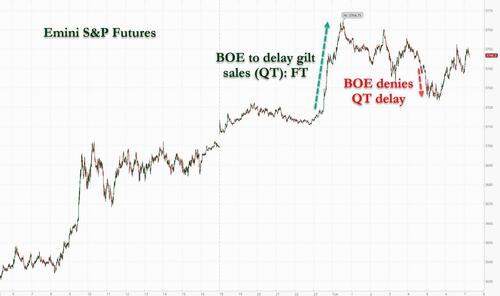

Just around midnight ET, the Financial Times reported that the Bank of England would delay the start of its gilt-sale program (i.e. Q.T.), sending UK gilts, sterling and US equity futures sharply higher. Those gains, however, turned to losses when the central bank denied the report in a statement just around 5am ET, pushing the yield on the UK 10-year bond seven basis points higher to 4.05% while cable dumped 0.5%. That said, the BOE didn’t rule out the prospect of the BOE announcing a delay at a later time. The central bank has already delayed the start of the sales once, during the fallout from the government’s fiscal plan last month

Despite the reversal by the BOE, the huge meltup which we said would be triggered on Monday by Friday’s massive shorting, extended for a second day, encouraged by the reversal of uber-bear Michael Wilson who as we noted yesterday, expects a bear market rally pushing the S&P as high as 4,150, and helping the S&P to close above a key technical level on Monday. Nasdaq 100 futures rose 1.8%, while S&P 500 futures advanced 1.6% at 7:30 a.m. in New York, as tech giants Amazon and Microsoft led major technology and internet stocks higher in premarket trading, while the 10-year Treasury yield holds steady at about 4% and the Bloomberg dollar index was flat.

In premarket trading, bank stocks traded higher as Goldman Sachs becomes the last of the big six US lenders to report earnings this quarter, beating on the top and bottom line (a more detailed report to follow). In corporate news, Credit Suisse is exploring a sale of its US asset-management operations and moving closer to securing financing for other businesses. Amazon and Microsoft lead major US technology and internet stocks higher in premarket trading, set to extend their gains for a second straight session. Nvidia (NVDA US) +2.7%, Amazon (AMZN US) +2.3%, Alphabet (GOOGL US) +2%, Meta (META US) +2%, Apple (AAPL US) +1.7% and Microsoft (MSFT US) +1.7%. Here are some other premarket movers:

- AVEO (AVEO US) shares jump 38% in US premarket trading hours to $14.43 after LG Chem said it will buy the biotech for $15 per share in an all-cash transaction with an implied equity value of $566m on a fully diluted basis.

- Target (TGT US) stock rises 2.7% in US premarket trading after it was upgraded to buy from hold at Jefferies, which says the combination of a subdued valuation and improvements in the supply chain and inventory positioning supports a bullish stance on the retailer.

- FuboTV (FUBO US) shares rise as much as 11% in premarket trading, with analysts saying the firm’s decision to end operations of its Fubo Sportsbook betting unit will help its bottom line.

- Juniper (JNPR US) shares gain as much as 2.6% in US premarket trading after Piper Sandler upgraded the internet infrastructure company to neutral from underweight with the expectation that management can continue to increase product revenue numbers in full-year 2023 by around 10% year-on-year.

- Keep an eye on MongoDB (MDB US) after its shares were raised to neutral at Redburn as the stock is trading 20% below 2020 valuation lows and the brokerage sees no further downside that justifies a sell rating.

- Watch US timber stocks as RBC reshuffles ratings in the sector ahead of the third-quarter earnings season, which analysts say will mark a “sharp return” to normalized pricing, while downgrading Resolute (RFP US) and Western Forest Products (WEF CN) to sector perform from outperform.

“Investors keep pushing stock indices higher following the rebound over the annual lows at the end of last week, and growing risk appetite can now be seen across different asset classes,” said Pierre Veyret, a technical analyst at ActivTrades. As risks including high inflation, slower growth and the energy crisis still remain, “this is still seen as a technical correction,” he added.

Another reason for the continued meltup is because JPMorgan’s inhouse permabull, Marko Kolanovic, who has been long and wrong all year, appears to have thrown in the towel and late on Monday the Croat trimmed the extent of equities overweight in his model portfolio this month, citing “increasing risks around central banks making a hawkish policy error and geopolitics.” As we have said before, the bear market won’t end until Marko turns bearish, so that was another piece of the puzzle falling into place.

Kolanovic says go underweight corporate bonds over equities.

The crash will not end until he turns bearish

— zerohedge (@zerohedge) July 11, 2022

Meanwhile, the Bank of America monthly global fund manager survey “screams macro capitulation, investor capitulation, start of policy capitulation,” opening the way to an equities rally in 2023 the bank’s Chief Investment Strategist, Michael Hartnett wrote in a note on Tuesday. They expect stocks to bottom in the first half of 2023 after the Federal Reserve pivots away from raising interest rates.

“There’s still a strong feeling of a bear market rally about trading over the course of the last week,” said Craig Erlam, senior market analyst at Oanda Europe Ltd. “The economic landscape looks treacherous and we don’t even know if we’re at peak inflation and interest rate pricing yet. Those are substantial headwinds that will make any stock market rebound extremely challenging.”

In Europe, stocks rose for a fourth day, with most industry groups in the green. Risk sentiment was firmly bullish, with cyclical stocks leading the rally, while technology shares also outperformed. Autos, tech and financial services lead gains in Europe as Euro Stoxx 50 rallies 1.4%. FTSE MIB outperforms peers, adding 1.8%. Here are the most notable European movers:

- AZA SS: Avanza shares jump as much as 17%, the most since Oct. 2019, after the Swedish retail trading and savings platform reported what Handelsbanken called a “strong beat” on net interest income.

- THG LN: THG shares surge as much as 12% after SoftBank sold its stake in the British online shopping firm. The sale removes an overhang on the stock and it could help sentiment that existing investor Qatar Investment Authority bought the majority of the stake, according to Bloomberg Intelligence analysts.

- TIT IM: Telecom Italia shares rise as much as 9.6% in Milan trading on speculation reported by Italian newspaper MF regarding potential interest for the company by CVC.

- PUB FP: Publicis shares rise as much as 4.7% after the advertising agency lifted FY organic growth guidance for a second straight quarter.

- GALP PL: Portuguese oil co. Galp falls as much as 6.8% as it says it received a force majeure notice from Nigeria LNG following flooding that caused a “substantial reduction” in the production and supply of LNG and natural gas liquids, according to a regulatory filing.

- N91 LN: Ninety One shares drop as much as 5.3% after the investment manager reported a decline in assets under management during the second quarter.

- ERF FP: Eurofins Scientific shares drop as much as 6.0%, the most since July 28, after the provider of testing services reported third-quarter revenue that fell year-on-year.

- ROG SW: Roche shares slide as much as 1.6% after the Swiss pharmaceutical group slightly missed consensus 3Q expectations on overall sales, but focus remains on its outlook and pipeline, analysts say.

Earlier in the session, Asian equities rebounded, led by advances in tech stocks following a rally on Wall Street, as possible delays in bond sales by the Bank of England bolstered investor sentiment. The MSCI Asia Pacific Index rose as much as 1.5%, buoyed by TSMC, Tencent and Alibaba. All sub-gauges except real estate climbed. The Financial Times reported that the BoE may delay selling billions of pounds of government bonds, easing investor angst after the UK’s botched fiscal plan. The UK central bank denied the report after most markets in the region were closed. Tech stocks listed in Hong Kong climbed after the Nasdaq 100 index had its best day since July. Most benchmarks advanced, with notable gains in Australia, Japan, Hong Kong, and South Korea. Concerns that China is delaying the release of its 3Q GDP report amid the on-going party congress failed to quell the mood. The prospect of the BoE postponing QT “offers the potential for a decline in global rates volatility, a pre-condition for a broader improvement in cross-asset risk sentiment,” Stephen Innes, managing partner at SPI Asset Management, said before the bank’s denial. It’s been almost a year since Bitcoin hit a record. Even after Tuesday’s gain, the key Asian stock benchmark still trades close to its early-2020 low, as China’s virus lockdowns and property crisis weigh on growth. Asian stocks have underperformed their US and European peers this year as the Fed’s rate hikes pressure emerging market currencies, triggering an exodus of foreign funds

Japanese stocks rose, following a rebound in US peers as the S&P 500 was seen pointing toward a technical recovery. Electronics makers were the biggest boost. The Topix rose 1.2% to close at 1,901.44, while the Nikkei advanced 1.4% to 27,156.14. Recruit Holdings Co. contributed the most to the Topix gain, rising 5.1% after announcing a buyback. Out of 2,166 stocks in the index, 1,809 rose and 279 fell, while 78 were unchanged.

Australia stocks rebounded with tech and real estate shares leading; the S&P/ASX 200 index rose 1.7% to close at 6,779.20. The climb tracks a regional rally, buoyed after gains on Wall Street and a report of a possible delay in the Bank of England’s quantitative tightening. In New Zealand, the S&P/NZX 50 index rose 0.6% to 10,847.34.

In rates, Treasuries edged higher in early US trading after paring declines. Losses persist in gilts, where UK curve bear-flattens, with bunds also under pressure amid auctions by Germany, UK and Finland. US yields remain within 2bp of Monday’s closing levels, 10-year yields just under 4% with bunds and gilts trading cheaper by 6bp and 8bp in the sector. Gilt price action has been choppy; Long-end gilts take a breather, 10-year yield about 1bp higher after FT reported that Bank of England is set to delay quantitative tightening until gilt markets calm which the BOE later denied; UK sells 30-year notes later.

In FX, the Bloomberg Dollar Spot Index pared losses to trade marginally lower; yen settles at around the 149 handle while the pound trades lower toward $1.13.

- New Zealand’s dollar led G-10 gains after quarter-on-quarter inflation exceeded forecasts, fueling bets the central bank will need to keep raising interest rates

- The euro moved in a narrow range around $0.950, while the German 10- year yield reversed earlier losses to gain 6bps to 2.32%

- The pound weakened against all of its G-10 peers and fell below $1.13, following in an advance of as much as 0.5% to $1.1410. The long-term outlook for the pound has started to improve. At least, that’s what the options market is saying.

- The yen briefly rallied sharply versus the dollar after dropping to 149.29 per dollar, the lowest level since August 1990. Bank of Japan Governor Haruhiko Kuroda said that while the interest-rate differential with US has been a driving factor for the yen to weaken recently, the currency doesn’t move in parallel with the difference over the longer term

- The yuan stayed near 7.2 per dollar as the central bank kept the currency’s reference rate near 7.1 level in the last few sessions, a move that’s expected to slow the currency’s decline. USD/CNY falls 0.1% to 7.2000. It droped as much as 1.2% in early trade, close to the central bank’s fixing. USD/CNH little changed at 7.2075.

In commodities, oil switched between gains and losses as traders weighed a tight market against concerns over a global economic slowdown. WTI and Brent December contracts are softer on the session and gave up earlier gains as the DXY creeps higher throughout the European morning. Spot gold is flat around the USD 1,650/oz mark in a USD 10/oz range – but still under its 10 and 21 DMAs at 1,673.56/oz and 1,668.63/oz. LME metals are mostly lower amid the recent rise of the Dollar, whilst Rio Tinto forecasted annual iron ore shipments at the lower end of guidance and sees further downside risks to demand as the global economy slows. White House is reportedly planning an oil reserve release announcement this week with a release of another 10mln-15mln bbls in an effort to balance markets and keep prices from climbing, according to Bloomberg.

EU financial services chief McGuiness called on the US to create new crypto rules and said any regulation imposed on the industry would need to be global for it to work, according to FT.

Looking to the day ahead now, and data releases from the US include industrial production and capacity utilisation for September, as well as the NAHB housing market index for October. Central bank speakers include the ECB’s Makhlouf and Schnabel, as well as the Fed’s Bostic and Kashkari. Finally, earnings releases include Goldman Sachs, Netflix, Johnson & Johnson, and Lockheed Martin.

Market Snapshot

- S&P 500 futures up 1.4% to 3,741.00

- MXAP up 1.4% to 138.93

- MXAPJ up 1.6% to 450.98

- Nikkei up 1.4% to 27,156.14

- Topix up 1.2% to 1,901.44

- Hang Seng Index up 1.8% to 16,914.58

- Shanghai Composite down 0.1% to 3,080.96

- Sensex up 1.0% to 58,966.61

- Australia S&P/ASX 200 up 1.7% to 6,779.22

- Kospi up 1.4% to 2,249.95

- STOXX Europe 600 up 1.1% to 402.75

- German 10Y yield up 3% at 2.337%

- Euro up 0.1% to $0.9852

- Brent Futures down 0.6% to $91.05/bbl

- Gold spot up 0.1% to $1,651.42

- U.S. Dollar Index up 0.1% at 112.187

Top Overnight News from Bloomberg

- Just 10% of Britons have a favorable opinion of Liz Truss, a YouGov survey found, piling further woes on the beleaguered prime minister a day after she was forced to row back on the bulk of her economic vision for Britain

- UK trade unions have called on millions of workers to protest against any return to austerity after Britain’s new chancellor of the Exchequer warned that “some areas of spending will need to be cut.”

- There’s scope for a Polish central bank hike by as much as 100bps in November, Monetary Policy Council member Joanna Tyrowicz says in ISB News interview

- French rail, energy and other key workers are striking on Tuesday to demand a bigger share of corporate profits, raising pressure on President Emmanuel Macron to take further steps to ease the impact of surging inflation

- ECB policy maker François Villeroy de Galhau expects the central bank to continue to “go quickly” until its deposit rate reaches 2% at the end of the year, Financial Times reports, citing an interview

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were positive with the region inspired by gains in global counterparts following the UK Chancellor’s reversal of most of the measures of the ‘mini-Budget’ and with a report later suggesting a delay of QT by the BoE. ASX 200 was led by strength in tech and with the top-weighted financials sector also notching firm gains, while commodity-related stocks were somewhat varied with Rio Tinto choppy after a mixed quarterly activity report. Nikkei 225 reclaimed the 27,000 level to the upside, but was off highs with officials continuing to pledge to take action to address excess FX moves. Hang Seng and Shanghai Comp. gained although the mainland lagged amid COVID woes after Nanjing halted certain indoor venues due to rising cases, while the postponement of key Chinese data releases including Q3 GDP has led to some speculation that the data could be disappointing, although it was also suggested that the delay could be so that officials can concentrate on the Chinese Communist Party Congress.

Top Asian News

- China’s Nanjing halted certain indoor venues including bars, KTVs and gyms, while it also halted dine-in services due to an increase in coronavirus cases.

- RBA Minutes from the October 4th Meeting stated the decision to raise rates by only 25bps was finely balanced with the smaller move warranted by the scale of hikes already delivered and lags in policy. RBA added that the uncertain outlook argued for slower hikes for a time but noted further increases in rates are likely over the period ahead and that rates are not especially high, while the board emphasised the importance of keeping inflation expectations anchored and RBA said monthly CPI data confirmed broad-based pick-up in inflation, rents and utilities are expected to increase.

- RBA Deputy Governor Bullock said the board expects to increase interest rates further over the coming months with the pace and timing to be determined by data, while she added that as the board meets more frequently than most peers, it can achieve a similar tightening with smaller individual rate increases.

European equity bourses traded with gains across the board but are off best levels. Sectors are mostly firmer with no overarching theme; Autos & Parts, Financial Services, and Industrial Goods lead the charge whilst Healthcare, Optimised Personal Care, Energy and Basic Resources sit at the bottom of the pile. US equity futures are firmer to a greater magnitude than their European counterparts, with the ES trading on either side of 3,750 whilst the NQ outperforms its peers. Intel’s (INTC) MobilEye IPO is set to be priced between USD 18-20/shr, according to Bloomberg. Renault (RNO FP) and Nissan (7201 JT) are moving towards a “landmark” deal to reshape their alliance, according to Bloomberg; subsequently echoed by the Renault CEO in a Nikkei interview.

Top European News

- BoE is reportedly expected to further delay quantitative tightening until gilt markets calm, according to FT. Subsequently, the BoE labelled this report as “inaccurate”.

- UK PM Truss said she wants to accept responsibility and apologise for the mistakes made, while she added that she will lead the Tories into the next general election and is sticking around because she was elected to deliver for the country. PM Truss also stated the most vulnerable will be protected into next winter regarding household energy bills and that they are looking at exactly how they can do that, according to a BBC interview.

- ECB’s Villeroy said the UK crisis shows the risk of a vicious loop and that the pensions turmoil underscored the need for non-banks to build liquidity buffers, according to FT.

- European Commission to unveil proposal of further emergency energy measures for coming winter (including joint purchasing & alternative benchmark) at 14:30BST/09:30EDT, according to journalist Keating.

FX

- Kiwi elevated as stronger than expected NZ CPI metrics lift RBNZ rate outlooks, NZD/USD probes 0.5700 before pullback

- Sterling underperforming after making stellar gains on Monday as BoE says FT’s QT delay report is inaccurate; Cable sub-1.1300 from just over 1.1400 at one stage

- Loonie lags within a 1.3771-1.3657 range as crude prices sag

- Euro pivots 0.9850 vs Buck as DXY holds around 112.000 and Fib resistance at 0.9858 hampers EUR/USD

- Yen pares some losses from under 149.00 against Dollar amidst some unsubstantiated talk of intervention

- The CBRT’s move to raise the required level of bond holdings for FX deposits means that banks must hold an additional TRY 80-100bln of bonds, via Reuters citing bankers.

- BoJ and FSA are to hold 17th cooperation on financial stability, according to reports.

Fixed Income

- Gilts saw an initial bounce at the open on overnight FT reporting around a potential delay to QT; however, this was modest in nature and has since given way to marked pressure following BoE labelling it as “inaccurate”.

- The overall complex is pressured, with Gilts lagging though Bunds are in close proximity and below 136.00 post poor 7yr-supply and ahead of ECB speak.

- Stateside, UTS have been following their peers directionally though magnitudes are more contained overall pre-data/Fed speak; yield curve mixed, overall.

Commodities

- WTI and Brent December contracts are softer on the session and gave up earlier gains as the DXY creeps higher throughout the European morning.

- Spot gold is flat around the USD 1,650/oz mark in a USD 10/oz range – but still under its 10 and 21 DMAs at 1,673.56/oz and 1,668.63/oz.

- LME metals are mostly lower amid the recent rise of the Dollar, whilst Rio Tinto forecasted annual iron ore shipments at the lower end of guidance and sees further downside risks to demand as the global economy slows.

- White House is reportedly planning an oil reserve release announcement this week with a release of another 10mln-15mln bbls in an effort to balance markets and keep prices from climbing, according to Bloomberg. Note, this would come from part of a previously announced 180mln bbl sale announced earlier in the year

- UAE supports Saudi Foreign Ministry’s statement regarding the OPEC+ decision and fully stands with Saudi Arabia in its efforts to support energy stability and security, according to the state news agency cited by Reuters.

Geopolitics

- US Commerce Department issued a temporary denial order against Ural Airlines for operating in apparent violation of US export controls on Russia, according to Reuters.

- Ukraine President Zelenskiy says there is no space left for negotiations with Russian President Putin, via Reuters.

- Russia’s Kremlin, when asked if Russia’s nuclear umbrella extends to annexed territories, says all the territories are parts of Russia and their security is provided as with all other Russian territories, via Reuters.

- Japanese Chief Cabinet Secretary Matsuno said Japan is to impose additional sanctions against North Korea, according to Reuters.

- Officials revealed that China recruited dozens of former British military pilots to teach Chinese armed forces how to defeat western warplanes and helicopters in a “threat to UK interests”, according to Sky News’s Deborah Haynes.

US Event Calendar

- 09:15: Sept. Capacity Utilization, est. 80.0%, prior 80.0%

- 09:15: Sept. Manufacturing (SIC) Production, est. 0.2%, prior 0.1%

- 09:15: Sept. Industrial Production MoM, est. 0.1%, prior -0.2%

- 10:00: Oct. NAHB Housing Market Index, est. 43, prior 46

- 16:00: Aug. Total Net TIC Flows, prior $153.5b

- 16:00: Aug. Net Foreign Security Purchases, prior $21.4b

Central bank speakers

- 14:00: Fed’s Bostic Takes Part in Workrise Panel Discussion

- 17:30: Fed’s Kashkari Discusses the Economy

DB’s Jim Reid concludes the overnight wrap

We’ve discussed recently how we shouldn’t underestimate just how much the UK’s recent woes have impacted global markets. Correlation doesn’t equal causality, but the UK news has again seemed to heavily influence global markets over the last 24 hours after the UK government officially announced one of the biggest U-turns in political history and ditched the bulk of what remained of their mini-budget. However the risk momentum was also helped by a view that earnings season has starting relatively well versus beaten up expectations. Even overnight the UK is moving global markets again as reports from the FT that the BoE is going to delay QT at around 5am this morning have pushed equities futures over a percent higher with S&P 500 (+1.95%) and NASDAQ 100 (+2.17%) contracts soaring.

This follows a big session yesterday with the S&P 500 (+2.65%) and the STOXX 600 (+1.83%) both posting strong advances that were led by the more cyclical sectors. Tech stocks were one of the big outperformers, with the NASDAQ (+3.43%) and the FANG+ Index (+4.83%) seeing even stronger advances, whilst banks were another outperformer with those in the S&P 500 up +3.48% in their 4th consecutive advance. The moves were also supported by some positive corporate news, with Lufthansa raising their full-year forecasts whilst Bank of America saw trading revenue beat expectations and net interest income rise to a record in Q3, a common theme among banks benefitting from heightened market volatility and rising policy rates. Bank of America joins the other large US banks to report with JPMorgan (+5.94% since releasing earnings), Citi (+1.44% since), Wells Fargo (+3.68%), and Morgan Stanley (-2.75%) all having reported the last few days. That comes as earnings season is moving into full flow, with today’s releases including Netflix, Goldman Sachs and Johnson & Johnson. We’ve had 38 S&P companies report so far, and while major financials have grabbed a lot of the headlines there have been a number of key corporate reporters including consumer staples Walgreens (+3.32% since their earnings), health care provider United Health Group (+2.38% since reporting), food and beverage retailer PepsiCo (+6.24% since reporting), and airline Delta (+6.61%). The breadth of reporters should expand with the major US banks largely now in the rear-view mirror.

Back to the UK and there was an increasing sense of what was coming yesterday, with the first reversal happening two weeks ago as they U-turned on the abolition of the top 45% rate of income tax. Then on Friday we had a second reversal as PM Truss announced that corporation tax would go up after all, in line with the previous government’s plans. But yesterday saw Chancellor Hunt announce that almost everything else would be going as well, including the planned cut in the basic rate of income tax to 19% from April 2023, which will instead be kept at 20% indefinitely.

It’s clear the UK are now desperately trying to claw back their market credibility, as not only have the government reversed course on most of the tax cuts, but they also said they’d revisit the scale of their energy support package as well. Previously, energy prices were set to be capped at £2,500 per year for the average household over the next two years. But the government are now saying that will only go up until April 2023, and after that they’d review what support would be given instead, and were aiming to “design a new approach that will cost the taxpayer significantly less than planned”. Furthermore, the government’s statement implied there was more to come in the fiscal statement on October 31, as it said that government departments “will be asked to find efficiencies within their existing budgets”, and that there’d be “further changes” on fiscal policy “to put the public finances on a sustainable footing”.

UK assets surged on the back of the announcements, with sterling +1.66% higher versus the US dollar after having been as much as +2.38% up, just as yields on 10yr UK gilts tumbled by -35.7bps to 3.96%. In fact, apart from September 28 when the Bank of England began their intervention, that’s the largest daily decline in the 10yr gilt yield since the Conservatives won a surprise victory in the 1992 general election, so we are still experiencing unprecedented volatility. Meanwhile, sterling (+0.31%) is trading higher again this morning ($1.1393) on the FT story that QT is set to be delayed. Back to yesterday and the declines in real yields were even more pronounced than nominals, with the 10yr real yield down by -47.9bps on the day, which again is the largest daily move since the BoE intervention began. That said, even with the recent declines, the spread of UK 10yr yields over German bunds is still wider than it was prior to the mini-budget at +169bps, which points to the fact that investors are still charging a larger premium for holding gilts, even with the recent U-turns.

Sovereign bonds rallied with Gilts in Europe, with yields on 10yr bunds (-7.7bps), OATs (-8.8bps) and BTPs (-13.3bps) all moving lower on the day. Those declines were seen across maturities, and came as we also had a further decline in both US and European natural gas futures that left both at their lowest levels since the summer. In Europe, they were down by a further -13.26% yesterday, which leaves them at a 4-month low of €123 per megawatt-hour, with mild weather supporting storage levels.

Treasury yields initially rallied in lock step with European yields, reaching a rally of -11.1bps shortly after the New York open. Once Europe called it a day, however, yields steadily marched higher to close the day roughly unchanged (-0.6bps) and back above 4%. There wasn’t any specific catalyst of higher 10yr yields, other than perhaps US-based investors are more focused on the Fed and inflation outlook than on UK financial instability. The strength in US equities throughout the day probably also contributed to a stronger growth perception in the US, driving the +4.3bps steepening in 2s10s that we saw today. This morning in Asia, the UK is back influencing Treasuries as 10yr UST yields have gone from flattish to around -4.5bps lower after the FT BoE headlines.

Asian stock markets are also higher with the Nikkei (+1.52%), the Hang Seng (+1.61%), Kospi (+0.99%) stronger still on the FT/BoE headlines. Elsewhere, Chinese shares are lagging with the Shanghai Composite (+0.17%) and the CSI (+0.08%) edging up after declining earlier.

We were meant to get the Q3 GDP release and a slew of other economic data from China overnight, but we found out yesterday that it was being delayed. The unusual move comes as the ruling Communist Party is holding its twice-a-decade event i.e., 20th National Congress. So far, no date for a rescheduled release has been given.

Minutes from the Reserve Bank of Australia’s (RBA) October meeting revealed that the central bank’s surprise decision to ease back to a 25bps hike instead of the 50bps hikes was “finely balanced” as the board members wanted to monitor the impact of its tightening on household spending in an uncertain environment. The minutes also highlighted that further rate hikes are likely required over the period ahead with the pace and timing to be determined by data. Elsewhere, New Zealand’s consumer prices rose +7.2% y/y in the third quarter, much higher than the market expected +6.6% increase, thus cementing the prospect of further aggressive hikes by the Reserve Bank of New Zealand (RBNZ).

In spite of the positive market moves over the last 24 hours, there was further bad news on the DM data side, with the New York Fed’s Empire index showing a third consecutive monthly contraction at -9.1 (vs. -4.3 expected). The prices paid index also ticked up relative to last month, reaching 48.6. Meanwhile in Canada, data from the central bank showed that inflation expectations over 1 and 2 years ahead were continuing to rise, although 5-year ahead expectations moved lower. That came as their business outlook indicator in Q3 fell to 1.69, which is the biggest quarterly decline in that indicator since Q2 2020 as the pandemic’s impact was fully felt.

To the day ahead now, and data releases from the US include industrial production and capacity utilisation for September, as well as the NAHB housing market index for October. Over in Europe, there’s also the German ZEW survey for October. Central bank speakers include the ECB’s Makhlouf and Schnabel, as well as the Fed’s Bostic and Kashkari. Finally, earnings releases include Goldman Sachs, Netflix, Johnson & Johnson, and Lockheed Martin.

Tyler Durden

Tue, 10/18/2022 – 08:00

via ZeroHedge News https://ift.tt/Knar2YL Tyler Durden