Biden Blasts ‘Big Oil’ For “War Profiteering”, Urges Congressional ‘Windfall Tax’

Update (1655ET): President Biden confirmed expectations in his brief address, stating that he is seeking to impose higher taxes on oil firms who do not boost their US production and refining capacity.

“It’s time for these companies to stop war profiteering, meet their responsibilities in this country and give the American people a break and still do very well,” Biden said during a brief speech at the White House.

“If they don’t, they’re going to pay a higher tax on their excess profits and face other restrictions. My team will work with Congress to look at these options that are available to us and others,” Biden added.

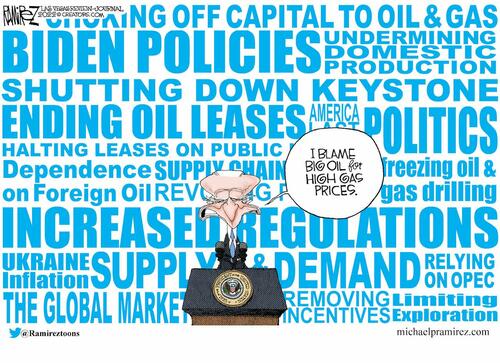

Bloomberg’s Javier Blas comments on the circularity of oil politics…

The circularity of oil politics pic.twitter.com/TvUPdRtElY

— Javier Blas (@JavierBlas) October 31, 2022

Note the final sentence of the 2006 Report on the US Windfall tax policy of the 1980s:

“In the long-run, such a tax is a tax on capital; it reduces the rate of return, thus reducing the supply of capital to the oil industry.”

In other words, a windfall tax failed in the 80s and will just drive prices higher in the long-run.

Additionally, The American Exploration & Production Council said a windfall tax would probably backfire, and the U.S. government should provide permits for pipelines and support U.S. production.

But then again, why would Biden care about the long-run?

* * *

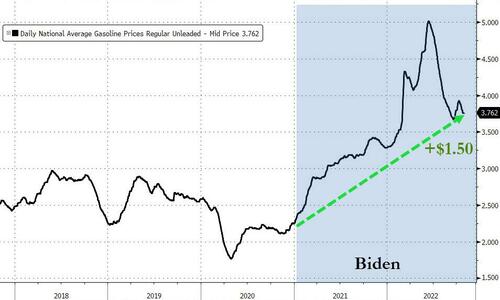

The closer we get to the midterms, the louder the desperate cries of “it wasn’t my fault” come from The White House as practically every indicator signals a dramatic loss of confidence (even among faithful Democrats) in the Biden admin’s policies.

The loudest, simplest, and most palatable for his base is to blame “Big Oil” profiteering (oh and the ‘Putin Price Hike’) for the surge in gas prices since the president was elected.

The week after Chevron and Exxon announced their earnings seems like perfect timing to energize the base again against the fossil fuel industry (while demanding they pump more).

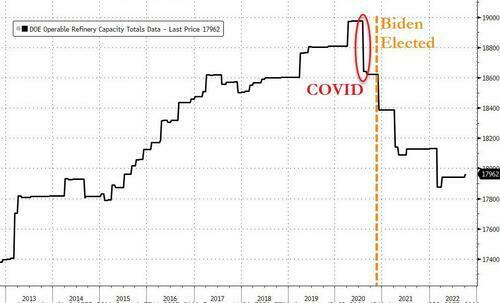

However, as we have noted too many times to remember, the problem is not a lack of crude oil but a lack of refining capacity…

Bear in mind that pump prices are lower than one would expect historically based on crude and wholesale gasoline…

It’s been a theme as prices soared:

-

Biden Blasts “Short-Sighted” OPEC+ Cut, Blames US Energy Firms For Surging Pump Prices

-

Crude Spikes As President Biden Blames OPEC, Big Oil (& Buybacks) For High Gas Prices

-

Biden Sends Threat-Letters To Big Oil: Help Ease “Putin Price Hike” Or Face Our Tools

-

California Accuses Valero Of Oil Price Gouging, Valero’s Response Is Amusing

And we have discussed in detail what a crock of shit that claim is:

-

Chevron CEO Responds To Biden’s Repeated Allegations Of Price-Gouging

-

“Dangerous Nonsense”: Larry Summers Warns Democrats’ Price-Gouging Bill Could Backfire

-

Profits Do Not Cause Inflation (No Matter What Progressives Claim)

And there’s a way to solve it:

And this is not the way…

But we don’t expect any of that anytime soon…

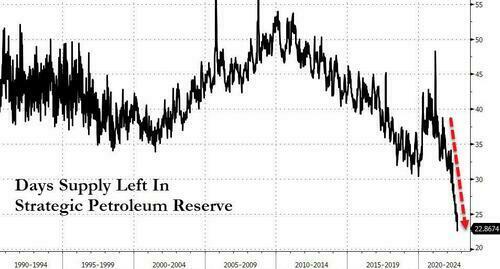

And he’s already drained the Strategic Midterm Reserve to a record low level of days supply…

The Associated Press is reporting that Biden will raise the possibility of imposing a windfall tax (which would be DOA even among his own party). Now where have we seen that before?

The circularity of oil politics pic.twitter.com/TvUPdRtElY

— Javier Blas (@JavierBlas) October 31, 2022

Watch Live below (due to start at 1630ET): President Biden responds to reports over recent days of major oil companies making record-setting profits even as they refuse to help lower prices at the pump for the American people.

Tyler Durden

Mon, 10/31/2022 – 16:58

via ZeroHedge News https://ift.tt/82v3ZkO Tyler Durden