Technical Rally Runs Out Of Gas Despite Dovish Drawl From Fed’s #2

Over the weekend, we said that with earnings season over, with the lower than expected CPI print in the rearview mirror, and with 4 weeks to go until the next FOMC where just a payrolls report (which may well be the first negative print since the wu-flu) looms, risk has collapsed, and as the following chart from Piper Sandler’s Danny Kirsch shows, the 1-week stradle in the SPX has been slashed in half, and now anticipates just over 2.1% in price movement over the next week, the lowest in almost three months.

SPX 1 week straddle down to 2.18%…took out all the event risk and looking forward not much on the near term calendar pic.twitter.com/PDocUm570g

— Danny Kirsch, CFA (@danny_kirsch) November 14, 2022

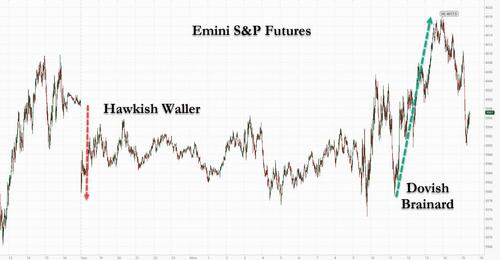

So with fundamentals now largely irrelevant for the next several weeks, what are traders to do? Why listen to Fed speakers, even if they contradict each other as today’s price action demonstrated so amply when first Fed Governor Christopher Waller spooked markets late on Sunday with his hawkish take that policymakers had “a ways to go” before ending interest-rate hikes, before his superior, the Fed’s #2 and vice chair, Lael Brainard, took the mic and whispered soothing words of dovishness, which immediately stopped the selling and sparked a rally that sent the S&P not only above 4,000 but to the highest level in the past two months, before stocks lost steam in the last hour of trading…

… and the Dow Jones pulled back as it was just shy, or less than 2%, from entering a new bull market from the October lows.

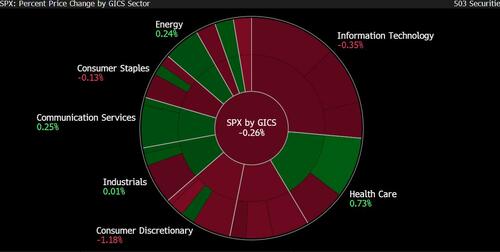

Looking beneath the surface, it was another day where energy outperformed…

… while most other sectors lagged.

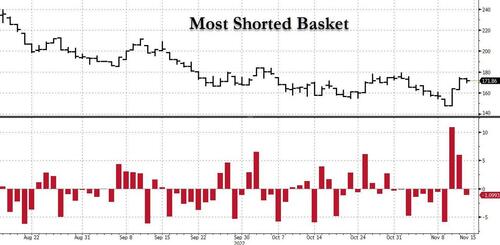

Elsewhere, after a record two-day surge in Goldman’s most shorted basket, today’s the most shorted names dropped…

… with low-momentum stocks suffering a similar fate, and undoing some of their striking gains from last week.

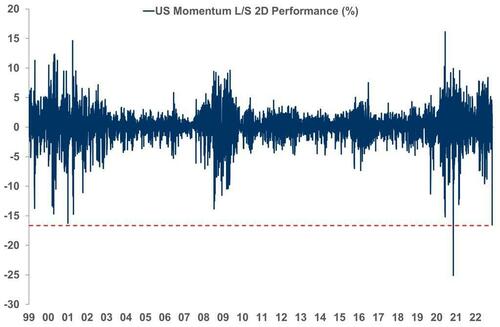

On the other side of the trade, the chart below shows that high-momentum L/S funds suffered their 2nd worst 2-Day drop in the past 20 years according to Morgan Stanley.

Turning to other asset classes, after plunging last week, and being closed on Friday for Veteran’s day, cash Treasuries went nowhere on Monday …

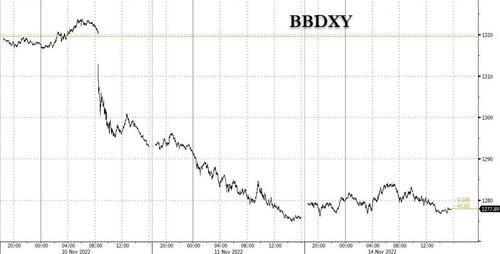

… as did the dollar which was flat after suffering one of the biggest 2-day drops on record last week.

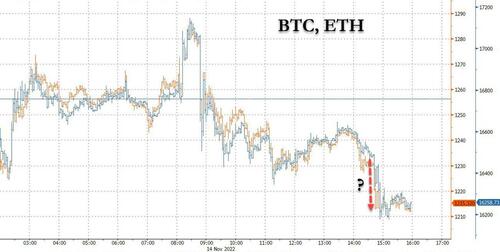

Finally, here is a chart of the one asset class that everyone is looking at and which prompted the last hour selling: namely cryptos, which were hammered to session lows just minutes before stocks were also hit, and while it remains unclear what prompted the selling – rumor of another exchange run, rumor of another blow up, rumor, rumor, rumor – it is unmistakable that any time cryptos sneeze (and plunge) they drag the rest of the financial world with them.

Tyler Durden

Mon, 11/14/2022 – 16:02

via ZeroHedge News https://ift.tt/tj0dirE Tyler Durden