Stocks Cower Ahead Of Powell’s Speech Tomorrow But It Is The Blackout Period Right After That Matters More

In the data-packed week, it is tomorrow’s speech by Fed chair Powell at Brookings titled “Economic Outlook and the Labor Market” (at 1:30pm) that is captivating markets.

As Goldman notes, it is the risk that Powell will once again unleash a market beatdown that is keeping sentiment depressed. As Goldman puts it “keep an eye on Powell speech wed for more verbal Financial Conditions tightening“. The Fed chair will discuss the economy and labor market; echoing the language in the post-meeting statement, FOMC participants argued that the level of the policy rate, the uncertain lags with which monetary policy affects activity, and the incoming data would all be important factors for the future path of monetary policy.

Powell speech comes just days after a more dovish than expected FOMC Minutes helped push stocks above 4,000, however briefly, as gains then vaporized amid the Covid zero drama and with Powell’s own speech looming. On Monday morning, Goldman trader Rich Privorotsky said to “expect the market to trade weak into the event…” and although there is little that he can say to make Fed not be data dependent (NFP and CPI pre Dec FOMC still matter) “he can start to shape the reaction function.”

As Privorotsky concludes, “the message will be hawkish, an attempt to reiterate that even if it looks like inflation is falling this Fed will keep real rates higher for longer to ensure inflation expectations come down to their objective (2%).” To be sure, markets are already frontrunning this with Goldman Prime writing that “flows last week showed selling with investors re-engaging with single stocks shorts “Macro Products were net bought, driven largely by short covering, while Single Stocks were net sold with short sales outpacing long buys (6.4 to 1).“

That’s the bad news: the good news is that as another Goldman trader, Michael Nocerino (both notes available to pro subs) writes, just days after the Powell speech, the Fed Blackout begins (Dec. 3) lasting ten days until the FOMC Dec 14 announcement; and as Nocerino reminds us, “recall last blackout Fed got dovish (FCI was at YTD highs, S&P was 3600-3700, 10yr was 4-4.3%, and there was fear of overtightening & market hopes of a potential pivot soared).” Now, however, the Goldman financial conditions index is back under 100, 10yr rates are at 3.7%, S&P is in a 3950-4000 range and the Fed is doing what they can to not lose ground, and yet Powell’s jawboning will the last of the Fed’s “verbal FCI tightening” while a disappointing payrolls report is set to follow immediately, with another weaker than expected CPI is on deck before the Dec FOMC.

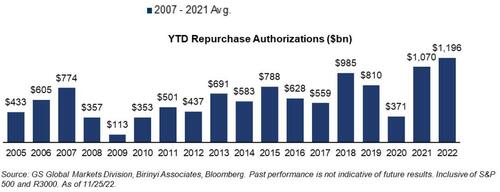

Then there are the the technicals, while buybacks continue to crank at a very healthy clip, or roughly double the average pace at $6BN per day…

BUYBACKS…Volumes finished the week 2.0x vs 2021 FY ADTV. Currently estimate ~98% of S&P to be in their open window. Per our estimates, this is roughly $6B/day in demand

We are still currently in an estimated open window with ~98% of the S&P 500 estimated to be in their open period when they have the ability to enter discretionary repurchase orders. Historically, we typically see November to be a more active month of the year as majority of companies are estimated to be in their open window. We estimate the next blackout window will begin ~12/19…

… it is what CTAs do next that will be critical. As Nocerino explains, “keep an eye on this math this morning…we closed right around the MT threshold of 3969. This should hinder the demand we’ve been seeing. Would also note that they have covered and gone long a decent amount ($153B) so the demand will start to dwindle.” And some more details from his Goldman trading colleague, John Flood:

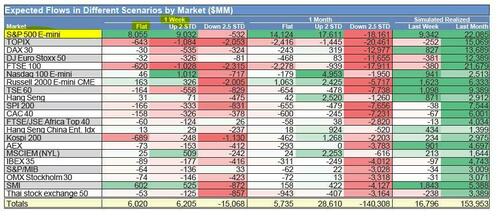

CTAs are currently long $4.1b of S&P. Over the last week we estimate CTAs have purchased $8.2b S&P (+$23b over the last month). This S&P demand has now flipped to supply (an $8b reversal overnight) as CTA medium term momentum pivoted from positive to negative with S&P closing below 3969 (short term momentum trigger is 3879 and long term is 4064). Medium term momentum is the most followed threshold in terms of total CTA AUM.

Yesterday we estimated +$8b of S&P to buy over 1 week in a flat (medium term Mo was positive)…

Versus today we now estimate -$172mm of S&P for sale in a flat tape (Medium term Mo negative south of 3969)…

Translation: much will depend on where the S&P closes today and in the next few days; here again are the key CTA levels:

- short-term 3879

- medium-term 3969 (most important)

- long-term 4064

Oh, and those asking if pensions will spoil the party with another month-end dump, here is the answer: according to Goldman, the November Pension rabalnce has funds sitting on $1BN to Buy, “a non-event.”

In summary, if Powell fails to spark another selloff, and stocks close above 3,969, the blackout period of no more Fed jawboning until Mid-December may be all that is needed to push the S&P into the year-end meltup which both Morgan Stanley and Deutsche Bank now expect as their base case.

All reports mentioned above available to pro subs.

Tyler Durden

Tue, 11/29/2022 – 15:20

via ZeroHedge News https://ift.tt/8F3dp5t Tyler Durden