Goldman’s Supply Chain Congestion Indicator Signals Largest Weekly Decline This Year

The supply chain pressures that drove up US inflationary pressures at the beginning of the Covid-19 pandemic are rapidly waning as global trade comes to a crawl.

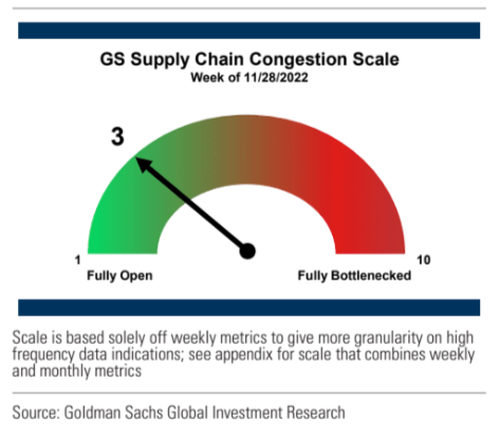

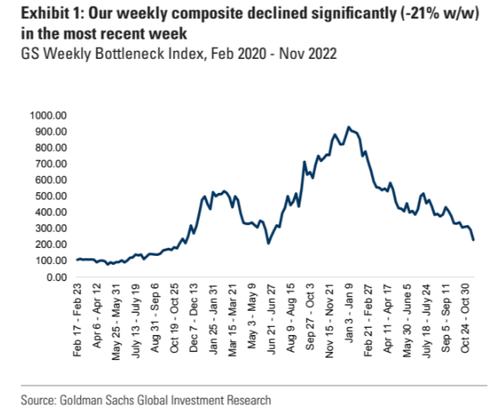

On Monday, Goldman Sachs published its proprietary supply chain tracker that showed “weekly bottleneck scale dropped to ‘3’ from ‘4’ this week as the absolute level of our congestion index moved significantly lower (-21% w/w; Exhibit 1 ); we are now 19% below ‘4’ and 20% above ‘2’ territory.”

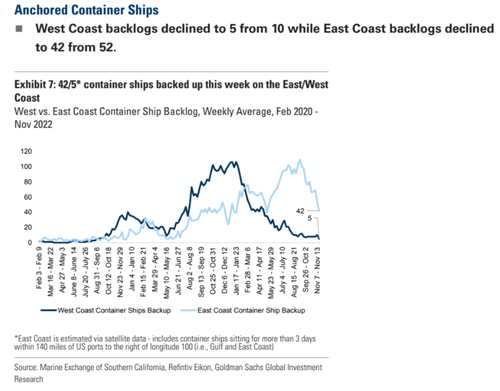

“The number of container ships waiting to dock and unload goods along the West Coast was cut in half (5 ships vs. 10 last week), while East Coast backlogs decreased significantly (42 ships vs. 52 last week); the combined backlog decline was ~24% w/w, or the single largest week of relief seen for all of 2022,” Goldman analyst Jordan Alliger wrote in a note.

Economic storm clouds are gathering worldwide as some of the largest shipping companies warn about sliding global trade. US shipper FedEx and Danish shipping giant A.P. Moller-Maersk A/S have been vocal about emerging signs of a worldwide slowdown. FedEx has parked planes while Maersk has canceled sails.

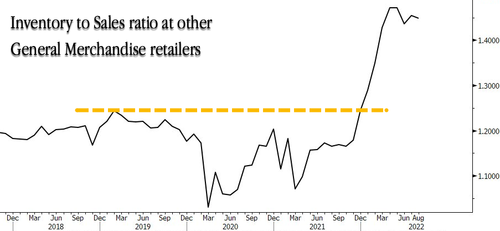

In May, we outlined that a reversal of the “shortage of everything” bullwhip effect was nearing, as skyrocketing inventories (the result of Covid-era overordering due to snarled supply chains) was about to hit a faltering economy, and prices of goods would decline as companies would be forced to liquidate excess inventories into a recession (see “Bullwhip Effect Ends With A Bang: Why Prices Are About To Fall Off A Cliff” from May 23). We reminded readers about this a few times over the summer (“Bullwhip-Effect Reversal Is The Major Downside Growth Risk” and “Container Rates Slump As “Bullwhip Effect” Enters Terminal Phase“).

Companies across the board are bloated with inventories. This can be shown in the inventory-to-sales ratio, reaching multi-decade highs — forcing importers to reduce shipments from overseas suppliers.

Now US importers have dialed back on shipments from Asia, sending container rates crashing down.

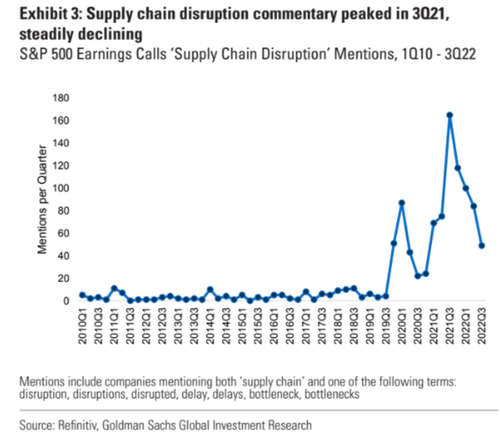

Goldman’s Alliger pointed out in the latest earnings season that supply chain disruption mentions on calls between management teams and analysts have been plunging all year.

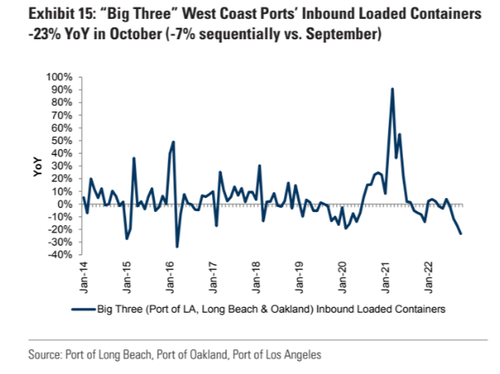

As for the three largest West Coast ports, including Ports of Los Angeles, Long Beach, and Oakland, inbound loaded containers on a yearly basis in October are dropping to levels not seen in years.

“Total inbound containers for the Ports of LA, Long Beach, and Oakland -23% YoY in October vs. -17% YoY in September. Note that the -7% MoM decline in October fell well short of the +0.8% MoM average over the last five years, indicating slower-than-seasonal West Coast import container growth,” Alliger wrote.

Supply-related issues are diminishing rapidly and could soon be at levels that would provide the Federal Reserve with a view that it’s winning the war on inflation as the most aggressive interest rate hikes in four decades crushes the demand side of the economy.

Notice how transport prices for producers topped out just before the consumer price index.

Freight markets have been a reliable leading economic indicator and may only suggest trouble ahead for the global economy. As well as possibly confirming the peak inflation narrative.

Tyler Durden

Tue, 11/29/2022 – 17:45

via ZeroHedge News https://ift.tt/IiWUJuy Tyler Durden