US equity futures started off the new month with a bang, set to surge after Monday’s less than spooky declines, as investors awaited Wednesday’s Fed decision (where JPM sees one outcome pushing stocks 10% higher… and another sending them crashing 8%), while sentiment got a big boost from speculation that Chinese policymakers are making preparations to gradually exit the stringent Covid Zero policy.

At 7:30am, contracts on the S&P 500 rose 1.0% while those on the Nasdaq 100 gained 1.1% on the first day of November, a month that has seen the underlying benchmarks end in the green on average for the past three decades. Dow Jones futures climbed 0.6% after the underlying gauge wrapped up its best month since 1976. Treasuries were poised for their biggest jump in a week as 10Y yields dropped to 3.94%, alongside real rates and the dollar as hawkish Fed hike wagers are trimmed ahead of this week’s policy outcome; the yen, euro and cable surged.

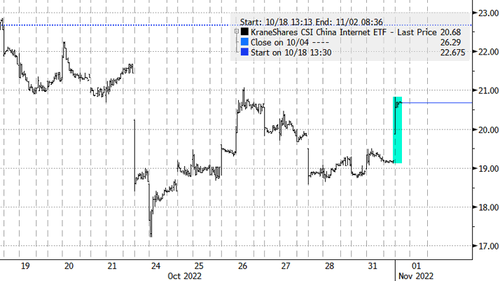

Chinese stocks listed in the US surged in New York premarket trading, their gains fueled by speculation that Beijing is preparing to phase out Covid Zero policies, even as the country’s Foreign Ministry said it was unaware of such a plan. The KraneShares CSI China Internet Fund, an exchange-traded fund holding more than 40 Chinese stocks, soared 7.7%. Also in the premarket, Tesla shares rose as much as 2.1% following a Reuters report that the EV maker plans to start mass production of its Cybertruck at the end of 2023. Here are other notable premarket movers:

- Abiomed shares soared 51% in US premarket trading to $379.55 after Johnson & Johnson agreed to buy all its outstanding shares for an upfront payment of $380 per share in cash plus a CVR consideration of up to $35 if certain clinical and commercial milestones are achieved

- GameStop shares rise as much as 5.6% in US premarket trading, with a meme-stock revival set to extend into a second day as other stocks popular with retail traders also rally. The video-game retailer also launched an NFT marketplace. Among other meme stocks AMC Entertainment (AMC US) +1.4%, Bed Bath & Beyond (BBBY US) +3.5%, Lucid (LCID US) +2.1%

- Carvana shares jump as much as 15% in US premarket trading after JPMorgan upgraded the online used-car platform to neutral from underweight, with analysts saying that risks appear to be “better understood” and liquidity is “manageable.”

- Macau casino stocks rise in US premarket trading amid speculation that China is planning to gradually exit its Covid Zero policies, even as the country’s Foreign Ministry said it was unaware of any government committee that’s assessing ways to carry out the plan. Melco Resorts (MLCO US) +7.5%, Las Vegas Sands (LVS US) +4.1%, Wynn Resorts (WYNN US) +3.3% and MGM Resorts (MGM US) +2.3%

- Stryker delivered a strong top-line that bodes well for the medtech group’s outlook, but questions remain on when that will translate into a stronger earnings performance, analysts say. Stryker shares fell 5% in postmarket trading after the update.

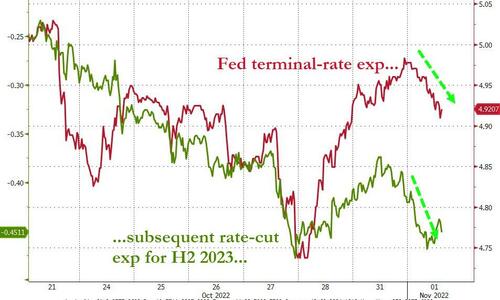

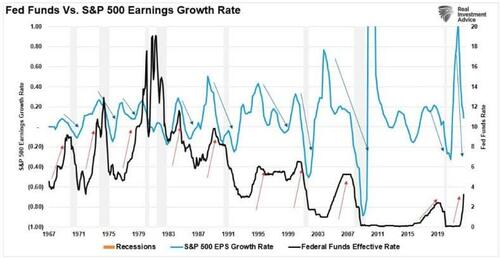

All eyes will be on the Fed on Wednesday, when it’s widely expected to raise rates by 75 basis points for a fourth time but the question is how Powell will guide for December and his views on the terminal rate. His comments will also be key in understanding the trajectory of tightening in the US, where the policy is already having an impact on company earnings.

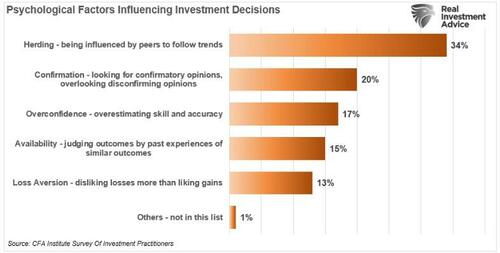

“What is important is the path Chair Powell lays out for next year. The Fed probably doesn’t want the market to start pricing in rate cuts, and this is what the market tends to do,” said Stephen Innes, managing partner at SPI Asset Management. “It’s an open invitation to buy stocks in case we do get a Fed pivot or inflation starts abating and we get a huge asymmetrical move to the top side.”

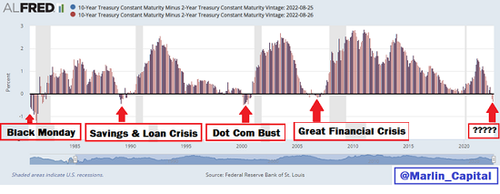

Strategists are expecting the US central bank to end tightening in the near term. Indicators including the inversion of the yield curve between 10-year and three-month Treasuries “all support a Fed pivot sooner rather than later,” according to Morgan Stanley’s Michael Wilson. Also, JPMorgan’s Marko Kolanovic is seeing signs boosting optimism that the global tightening cycle could end by early 2023, which of course is also market consensus.

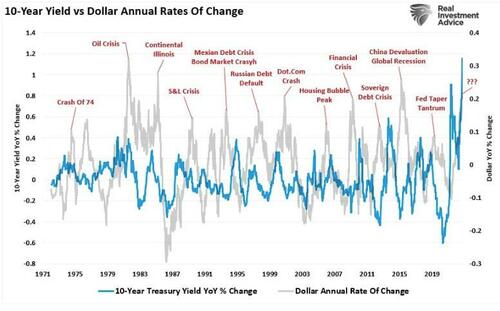

“If the Fed does give us some indication that there is light at the end of the tunnel, we are very close if not already past peak dollar,” Mark Matthews, head of Asia research at Julius Baer said on Bloomberg TV. “Then all the currencies which have declined like the euro will rebound.”

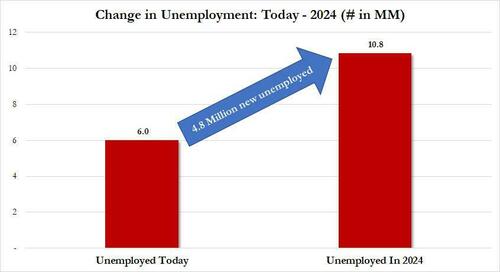

Meanwhile, economists surveyed by Bloomberg said Fed officials will maintain their resolutely hawkish stance this week, laying the groundwork for interest rates reaching 5% by March 2023, moves that seem likely to lead to a US and global recession. Nomura Holdings Inc. quantitative strategist Yoshitaka Suda said derivatives cues imply the pace of the ongoing rebound in the S&P 500 benchmark is likely to dwindle after the Fed’s decision. The comparatively low volatility ahead of the meeting shows that the options market is “increasingly optimistic” about the event, he said. A shift in options hedging by traders could also weigh on the market, he added.

European equity benchmarks rose over 1% as bond yields retreated lower. CAC 40 outperfoms while the DAX lags peers a bit. Mining shares led gains as most base metals trade in the green. European luxury stocks jumped, tracking an earlier rally in Chinese markets on speculation that the country’s policymakers are looking at gradually unwinding its stringent Covid Zero policy. LVMH rose as much as 3.9%. Shares in tech investor Naspers and its unit Prosus also surged, following Tencent higher as Chinese tech stocks rose after unverified social media posts circulated online that a committee was being formed to assess scenarios on how to exit Covid Zero. A Chinese Foreign Ministry spokesman said he’s unaware of a committee. Here are the biggest European movers:

- Oil advanced and BP Plc climbed after announcing a further $2.5 billion buyback. Here are Europe’s biggest movers:

- Ocado Group surged as much as 40% in a brisk short covering rally sparked by news the UK online grocer has entered a partnership to develop Lotte’s online business in South Korea.

- Shares of European online retailers and food delivery firms rally on Tuesday after heavy selling this year, as yields on 10-year US Treasuries and German bunds slide. Delivery Hero rises as much as 15%.

- Scor shares gain as much as 6.3% as Mediobanca upgraded the reinsurer to outperform in a reshuffling of its sector preferences.

- ALKB- Abello fell as much as 7% after Danske Bank analyst Thomas Bowers cut the recommendation to hold from buy.

- Fresenius Medical Care falls as much as 5.5% after Warburg downgraded the stock to sell from hold, citing increased uncertainties regarding the supply chain and macro factors despite 3Q figures slightly above estimates.

- Rentokil shares drop as much as 4.5% after the company posted 3Q growth in line with expectations. Morgan Stanley noted that the firm’s maintained outlook implies more subdued progress on margins in 2H.

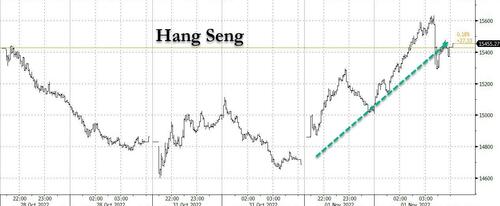

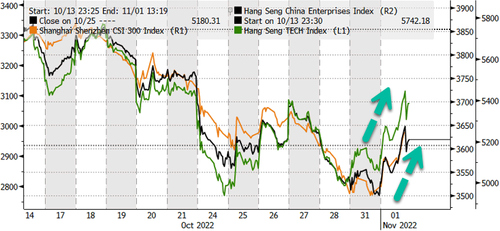

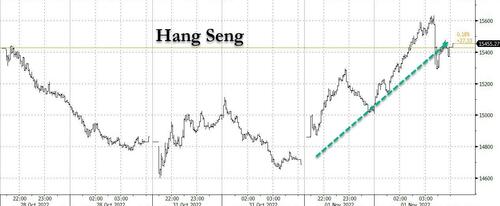

Asian stocks advanced ahead of a key US Federal Reserve rate decision, as Chinese shares staged a strong rebound on speculation of a potential reopening. The MSCI Asia Pacific Index jumped as much as 2.4%, the most in more than two weeks, as Chinese and Hong Kong gauges roared back from multi-year lows on speculation that policymakers are making preparations to gradually exit the stringent Covid Zero policy. The Hang Seng Index climbed more than 5%, with internet giants Meituan and Tencent Holdings the biggest contributors to the advance.

Unverified social media posts circulated online on Tuesday showed a committee was being formed to assess scenarios on how to exit Covid Zero. A Covid-induced economic slowdown in China has been one of the biggest overhangs for the region’s markets. “Obviously some people are betting big on China’s reopening,” said Willer Chen, an analyst at Forsyth Barr Asia. “At this level, it’s probably better to trade every rumor than ridiculing its authenticity.” Meanwhile, the Federal Reserve looks set to raise interest rates by 75 basis points on Wednesday amid its most-aggressive tightening campaign in four decades. Investors will be watching for any signs that hikes may slow in the future. Asian equities fell 2% in October, capping a third-straight monthly decline, amid headwinds including China’s slowdown and global monetary tightening. The MSCI Asian benchmark is hovering near the lowest level since April 2020.

Japanese stocks rose as the yen’s weakness was seen providing earnings benefits for the nation’s exporters. The Topix rose 0.5% to close at 1,938.50, while the Nikkei advanced 0.3% to 27,678.92. Keyence Corp. contributed the most to the Topix gain, increasing 3.4%. Out of 2,166 stocks in the index, 1,011 rose and 1,044 fell, while 111 were unchanged. “Japanese stocks are holding firm as the market sees a positive impact of the yen’s depreciation reflected in the recent earnings,” said Tetsuo Seshimo, portfolio manager at Saison Asset Management

Australian government bond yields reversed earlier gains and the nation’s stocks rallied to a seven-week high after the central bank raised interest rates by a quarter point as expected and signaled further tightening to come as it combats escalating inflation. Australia’s S&P/ASX 200 index rose 1.7% to close at 6,976.90, the highest since Sept. 13, Mining and bank shares boosted the benchmark most, with all 11 sectors advancing. In New Zealand, the S&P/NZX 50 index fell 0.2% to 11,316.64

India’s key stocks posted its 11th advance in thirteen sessions, inching closer to record levels on robust earnings and resumption of foreign flows. The S&P BSE Sensex rose 0.6% to close at 61,121.35 in Mumbai, its highest since Jan. 17. The NSE Nifty 50 Index advanced 0.7%. The gauges rose more than 5% each in October and are trading close to their peak levels seen a year ago. All but one of the 19 sector sub-gauges compiled by BSE Ltd. advanced, led by power companies and utilities. Software exporter Infosys Ltd. provided the biggest boost to the Sensex, which is now close to trading at 14-day RSI of 70, a signal to some traders that the security is overbought. Foreigners bought $186 million of Indian equities in the month through Oct. 28 after net withdrawals of $1.6 billion in September. Corporate earnings for the September quarter have been mostly impressive. Of 32 Nifty companies which have so far reported, 21 have either met or exceeded average analyst estimates, while nine have missed. Agrochemicals maker UPL Ltd.’s quarterly numbers trailed the estimates on Tuesday, while three Nifty companies beat the consensus.

In rates bunds, Treasuries and gilts all rallied across the curve. US yields are richer by 6bp to 10bp across the curve with gains led by intermediates, tightening the 2s5s30s fly by 4.5bp on the day; 10-year yields near lows of the day around 3.95%, outperforming bunds and gilts by 1.5bp and 3bp in the sector. The advance began during Asia session after RBA raised rates 25bp and lowered GDP forecasts. Gilts rally added support, with the UK government focusing on raising taxes to restore stability to public finances. In swaps market, Fed-dated OIS rates ease lower ahead of Wednesday’s policy decision.

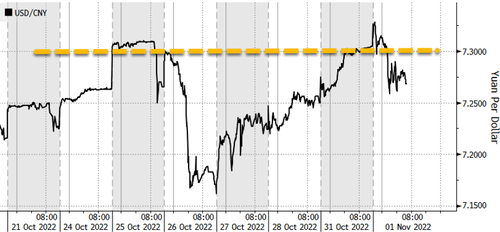

In FX, Bloomberg Dollar Spot index falls 0.6%, snapping three days of gains as traders positioned for the Federal Reserve to potentially turn less hawkish at this week’s policy meeting. DKK and EUR were the weakest performers in G-10 FX, NZD and NOK outperform. The Fed is expected to raise rates by 75 basis points this week and some analysts are beginning to believe that the most aggressive interest-rate hiking cycle in decades by global central banks is nearing an end “Markets may be attempting to front-run the Fed on bets they may not give an outsized rate hike at the meeting this week, which is buoying other currencies against the dollar,” said Mingze Wu, a foreign-exchange trader at StoneX Group in Singapore. The Australian dollar gained against the greenback after the RBA hiked rates by 25bps. “While the market may interpret this as the central bank potentially signaling a pause in rate hikes, we think this would be wrong as the RBA is simply reinforcing its gradual approach of raising rates by 25bp rate hikes at its next few meetings,” says David Forrester, FX strategist at Credit Agricole CIB.

In commodities, Crude benchmarks are firmer intraday but off best levels, deriving support in tandem with broader risk sentiment on the China COVID rumours and associated USD pullback. WTI Dec and Brent Jan futures are around USD 87.00/bbl (85.92-88.24 range) and USD 93.50/bbl (92.33-94.74) respectively. WTI trades within Monday’s range, adding 1.7% to trade near $88-handle. Brent rises 1.6% to top $94. Spot gold is bolstered by the USD’s retreat and has surpassed the 10-DMA but met resistance thereafter around USD 1650/oz amid the constructive risk tone. Base metals are firmer across the board on the China reports, with LME copper briefly extending past USD 7.6k/T for instance.

Bitcoin is firmer but in contained ranges above the USD 20k mark, while more pronounced upside is seen in the likes of ETH and Dogecoin.

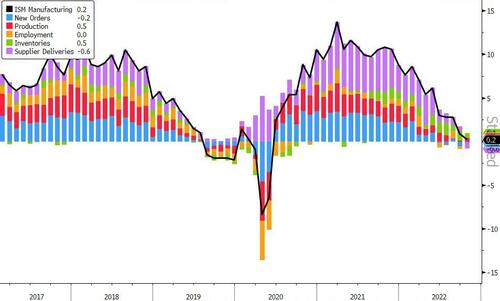

Looking to the day ahead, data releases from the US include the ISM manufacturing reading for October and the JOLTS job openings for September. Otherwise, there’s the October manufacturing PMIs from around the world. Earnings releases include Eli Lilly, Pfizer and Uber. Finally in the political sphere, general elections will be taking place in Denmark and Israel.

Market Snapshot

- S&P 500 futures up 0.8% to 3,915.25

- MXAP up 2.1% to 139.01

- MXAPJ up 2.5% to 444.55

- Nikkei up 0.3% to 27,678.92

- Topix up 0.5% to 1,938.50

- Hang Seng Index up 5.2% to 15,455.27

- Shanghai Composite up 2.6% to 2,969.20

- Sensex up 0.5% to 61,024.40

- Australia S&P/ASX 200 up 1.7% to 6,976.86

- Kospi up 1.8% to 2,335.22

- STOXX Europe 600 up 1.3% to 417.58

- German 10Y yield down 3.3% to 2.07%

- Euro up 0.5% to $0.9926

- Brent Futures down 0.8% to $94.10/bbl

- Gold spot up 0.9% to $1,648.12

- U.S. Dollar Index down 0.54% to 110.93

Top Overnight News from Bloomberg

- Crispin Odey has closed his flagship hedge fund and two others to new clients, hoping to keep assets at a manageable level following a record year.

- Chinese stocks roared back from a rout and the yuan strengthened as speculation mounted that policymakers are making preparations to gradually exit the stringent Covid Zero policy that’s been the biggest bugbear for investors.

- UK house prices fell the most since the start of the pandemic in October as political and market turmoil sent shock waves through the property market.

- Any bargain hunters hoping to snap up Credit Suisse Group AG now that the lender’s revamp has pushed its stock down yet again may find themselves getting short shrift in Zurich.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher as the region shrugged off the losses on Wall St and with Chinese Caixin PMI data not as bad as feared, although some cautiousness remained ahead of the looming risk events. ASX 200 finished positive with all sectors in the green after the RBA rate decision whereby it stuck to a 25bps rate increase instead of reverting to a more aggressive pace. Nikkei 225 eked modest gains amid a slew of earnings releases which were the catalyst for the biggest movers. Hang Seng and Shanghai Comp were both positive with notable outperformance in Hong Kong amid a tech-led surge and bargain buying after its brief retreat beneath the 15,000 level, while Caixin Manufacturing PMI data printed better than forecast despite remaining at a contraction.

Top Asian News

- Bloomberg suggests that the gains in Chinese stocks are due to an unverified social media post that circulated online overnight that a committee was being formed to assess scenarios on how to exit COVID Zero; subsequently, China’s Foreign Ministry says they are not aware of the situation.

- Zhengzhou in C.China’s Henan said on Tue that the city will lift the temporary control for COVID-19 low-risk regions and gradually resume normal life “after over 10-day fight against the virus”, according to Global Times.

- RBA hiked the Cash Rate Target by 25bps to 2.85%, as expected. RBA said the board remains resolute in determination to return inflation to the target and expects to increase interest rates further over the period ahead, as well as reiterated that the size and timing of future interest rate increases will continue to be determined by the incoming data and the Board’s assessment of the outlook for inflation and the labour market. RBA also noted that the central forecast for GDP growth has been revised down a little with growth of around 3% expected this year and 1.5% in 2023 and 2024, while inflation is now forecast to peak at around 8% later this year and the central forecast is for CPI inflation to be around 4.75% over 2023 and a little above 3% over 2024.

- RBA Governor Lowe says the board has judged it appropriate to raise rates at a lower magnitude, will return to larger rate hikes if deemed necessary, will hold rate if the situation requires it.

- Hong Kong Exchange is to to cut trading tariff on cash market to boost market efficiency, effective 1st Jan 2023.

European bourses are firmer across the board with commodity stocks leading the way on the overnight China COVID rumours, Euro Stoxx 50 +1.40%. Sectors are all in the green and show clear outperformance in Basic Resources while some of the more defensively inclined sectors lag, but remain positive overall. Stateside, futures are similarly supported though magnitudes a touch more contained ES +0.8%; NQ outperforms as global yields pullback post-RBA with key data and more Central Bank action looming.

Top European News

- ECB President Lagarde said they have not reached the destination on rates yet and reiterated that the ECB is committed to doing whatever it takes to get inflation back to the 2% target, while she added that inflation is too high throughout the eurozone and the possibility of a recession has increased.

- Europe is set for mild weather in November, via Bloomberg citing forecasters.

- Sunak, Hunt Say ‘Inevitable’ All Britons Will Pay More Tax

- Credit Suisse Top Wealth Executive Sommerhalder Leaving Firm

- Ex-Deutsche Trader Asks Top Court to Quash Spoofing Conviction

- Sasol Convertible Bond Books Are Covered, Terms Show

- Ocado Deal With South Korea’s Lotte Shopping Boosts Shares

FX

- USD pressured as risk rebounds and yields retreat, with new month and pre-FOMC positioning also potentially impacting; DXY sub-111.00 to a 110.80 low.

- USD/JPY slumps amid fresh remarks from Finance Minister Suzuki, approaching a test of the 147.00 mark vs earlier 148.80 best.

- Antipodeans benefit from the USD but NZD outpaces its AUD peer following the RBA sticking with a 25bp hike and Governor Lowe thereafter keeping their options open.

- Both EUR and GBP benefitting from the USD’s dip with Cable reclaiming 1.15 after an upward revision to Manufacturing PMI while EUR/USD remains just shy of hefty OpEx at 0.9950.

- Petro-FX benefits from benchmark pricing with Norwegian data adding impetus for the Scandi’s while the CAD awaits its own PMI release.

Fixed Income

- Both core and periphery benchmarks are bid amid a broad pullback in yields post-RBA and as participants await upcoming Central Bank announcements and key data readings.

- Gilts are the current outperformer and have topped 103.00 amid the latest reporting around the upcoming Autumn statement.

- Specifically for the complex, today sees the commencement of the BoE’s QT with the first operation focused on the short-end.

- Both Bunds and USTs are similarly supported in tandem with a busy afternoon and week-ahead docket stateside, USTs peaking at 111.15 thus far.

- UK DMO reschedules the 0.35% 2025 Gilt to November 23rd (prev. November 16th).

Commodities

- Crude benchmarks are firmer intraday but off best levels, deriving support in tandem with broader risk sentiment on the China COVID rumours and associated USD pullback.

- Specifically, WTI Dec and Brent Jan futures are around USD 87.00/bbl (85.92-88.24 range) and USD 93.50/bbl (92.33-94.74) respectively.

- Russia Deputy PM Novak says Russia and Iran discussed an oil swap and gas supply, according to TASS.

- Iranian Oil Minister says “our relations with Russia are closer than ever, and the level of cooperation will increase day by day”, according to Al Jazeera.

- Libya’s NOC chief says oil output at 1.2mln BPD (vs 1.163mln BPD reported in September due to power issues).

- Spot gold is bolstered by the USD’s retreat and has surpassed the 10-DMA but met resistance thereafter around USD 1650/oz amid the constructive risk tone.

- Base metals are firmer across the board on the China reports, with LME copper briefly extending past USD 7.6k/T for instance.

US Event Calendar

- 09:45: Oct. S&P Global US Manufacturing PM, est. 49.9, prior 49.9

- 10:00: Sept. JOLTs Job Openings, est. 9.75m, prior 10.1m

- 10:00: Oct. ISM Manufacturing, est. 50.0, prior 50.9

- Oct. ISM Employment, prior 48.7

- Oct. ISM New Orders, prior 47.1

- Oct. ISM Prices Paid, est. 53.0, prior 51.7

- 10:00: Sept. Construction Spending MoM, est. -0.6%, prior -0.7%

DB’s Jim Reid concludes the overnight wrap

Morning again from NY. I’ve had to fly back for an important event after only landing back to London from NY on Friday. I had a load of emails and work to do on the plane but was told that their Wi-Fi wasn’t working. I hadn’t downloaded any films or research so after briefly working out what on earth I could do for 7 hours without any entertainment or work, I plumped for starting to write a surprise Xmas song for my family on the recording software on my iPad (note: with headphones). I now have two verses, a chorus, drums, some sleigh bells, Xmas strings and some heavy sampled guitar riffs. It’s either quite good or awful. I’m not sure which yet. I’ll aim to give it to them on December 1st. If you’re unlucky I’ll offer up a link to it then. You can see my short surprise Halloween song on my Bloomberg header page. It’s not for the faint hearted.

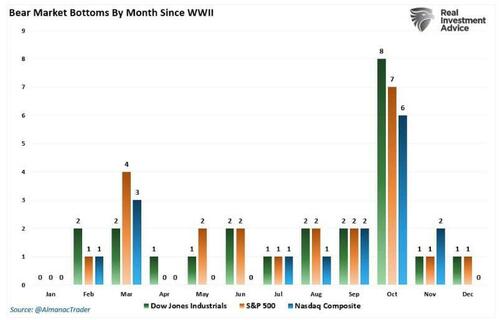

December is now only a month away as today welcomes in November. Since it’s the start of the month, Henry will be shortly releasing our usual performance review. October proved to be a much better month for financial assets after the disastrous performance over Q3, aided by hopes of a pivot from central banks, a stabilisation in Europe’s energy situation, as well as an end to the UK market turmoil. But we shouldn’t get ahead of ourselves, as the S&P 500’s +8.1% gain over the month in total return terms means it’s only partially recovered from its -9.2% loss in September, let alone its -23.9% loss over the first nine months of the year as a whole. There’s also some other interesting milestones, with gold having lost ground for a 7th consecutive month for the first time since 1869. The full report will be in your inboxes shortly.

When it comes to the last 24 hours in markets, investors have been in something of a holding pattern ahead of the Fed’s decision tomorrow, but previous hopes about an imminent central bank pivot have continued to fade. The latest catalyst was another upside inflation surprise from the Euro Area, albeit one flagged from some of the regional reports on Friday. Once again, the inflation report was bad news from whichever angle you wanted to look at it, with the headline CPI reading for October rising to +10.7% according to the flash reading, which was not only above the +10.3% expected (which may have been a bit stale after Friday), but also easily the highest inflation since the formation of the single currency. So that’s further bad news for the ECB, and points away from some of the more dovish signals they sent at last week’s press conference.

Even as headline inflation hit a new record, what’s concerning for policymakers is that the details suggest it’s increasingly impossible to just pin this on the energy shock, even if that has been the single biggest driver. In fact, CPI excluding energy hit a record +6.9%, and overall core CPI also hit a record +5.0%. In addition, the rises have been broad-based across the 19 countries that make up the single currency, and October marked the first month yet that inflation has been above 7% in every single Euro Area country at once. We did hear from a couple of the more dovish members of the ECB’s Governing Council yesterday, including Italy’s Visco, who warned that a worse-than-expected deterioration in the economic outlook “shouldn’t be underestimated”, and said that there were “no clear signs” that inflation expectations were becoming unanchored.

That backdrop prompted a decent selloff across European sovereign bonds, with yields on 10yr bunds (+4.1bps), OATs (+6.3bps) and BTPs (+12.7bps) all moving higher on the day. That came as inflation breakevens in France hit their highest level since May, with the 10yr breakeven up +1.1bps on the day to 2.79%.

Those moves higher in inflation expectations were given further support by the latest moves in European natural gas prices, which continued to tick higher from their recent lows last week, gaining another +9.90% yesterday to hit €123 per megawatt-hour. That pattern was echoed more broadly, with UK natural gas futures up +22.04% after the Met Office released their latest 3-month weather outlook for the UK. Although the forecast said that their base case (60%) was that the coming season would be around average in terms of temperature, there was a larger chance than usual that it would be a cold season (25%), and a smaller than usual chance of a mild season (15%).

Over in the US, there was a similar unwinding in the pivot trade yesterday as investors looked forward to the Fed’s decision tomorrow. For instance, the peak terminal rate priced in for the May 2023 meeting rose by +7.1bps yesterday to 4.96%, which is the highest it’s been since the WSJ’s Nick Timiraos released his article on October 21 discussing the potential for a slower pace of rate hikes from December. And in turn, expectations of a more aggressive pace of rate hikes meant that Treasuries lost ground too yesterday. 10yr yields were nearly 10bps higher intraday, before rallying hard late on in what looked like month-end driven buying flows to finish the day just +3.6bps higher at 4.05%. Speaking of Timiraos though, a reminder that as we mentioned in yesterday’s edition, he wrote a further article on Sunday pointing out that cash-rich consumers with larger savings buffers could mean that interest rates need to move higher than anticipated given spending is less sensitive. So if you value him as an indicator of the Fed’s thinking, that certainly pointed in a more hawkish direction as well.

With the pivot trade unwinding, equities put in a weaker performance and the S&P 500 (-0.75%) moved off from its six-week high that it reached on Friday. It was a broad-based decline, but the more cyclical sectors and interest-sensitive tech stocks suffered in particular, with the FANG+ index (-1.81%) nearly reaching its recent low from mid-October. Over in Europe the main indices put in a somewhat better performance, with the STOXX 600 up +0.35%, but that in part reflected the fact that they hadn’t been open during the late US rally on Friday.

Overnight in Asia however, the major equity indices have put in a much stronger performance, with the Hang Seng (+3.43%) leading the way, followed by the CSI 300 (+2.00%), the KOSPI (+1.42%), the Shanghai Comp (+1.22%), and the Nikkei (+0.15%). That’s come amidst sizeable advances for tech stocks, with the Hang Seng tech index up by an even larger +4.71%. In the meantime, Australian equities have also rallied following the RBA’s decision to raise their cash rate target by 25bps to 2.85%, in line with expectations. Their statement said that the Board “expects to increase interest rates further over the period ahead.” They also upgraded their inflation forecasts relative to last month, now saying they expected CPI inflation to be around 4.75% over 2023, having previously said they saw it “a little above” 4%. Looking forward, US equity futures are pointing higher as well, with those on the S&P 500 up +0.43%.

In terms of yesterday’s other data, Euro Area GDP grew a bit faster than expected in Q3, with the preliminary flash estimate showing growth of +0.2% (vs. +0.1% expected). Otherwise, German retail sales unexpectedly grew by +0.9% in September (vs. -0.5% expected), and UK mortgage approvals fell by less than expected in September to 66.8k (vs. 63.7k expected).

To the day ahead now, and data releases from the US include the ISM manufacturing reading for October and the JOLTS job openings for September. Otherwise, there’s the October manufacturing PMIs from around the world. Earnings releases include Eli Lilly, Pfizer and Uber. Finally in the political sphere, general elections will be taking place in Denmark and Israel.