Fear Gauge Suggests US Labor Market May Break Soon

Authored by Ven Ram, Bloomberg cross-asset strategist,

Treasury yields are signaling mounting concern that the US labor market is close to breaking. That may spur investors to seek comfort in duration.

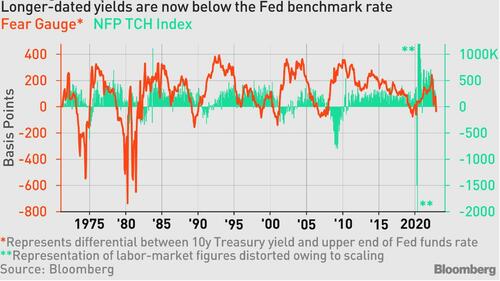

Yields on 10- and 30-year Treasuries slumped below the lower end of the Federal Reserve’s benchmark rate this month for the first time in the current economic cycle. That occurrence — a dipstick of fear in the market — has traditionally presaged a shrinking labor market in data going back more than five decades.

The Fear Gauge suggests that the Fed won’t be successful in engineering a soft landing of the economy as it seeks to align demand in line with supply.

US employers increased their payrolls by 200,000 in November, continuing an unbroken stretch of expansion since 2020, according to the median forecast of economists before data due later this week.

The negative spread illustrates how investors are already making a beeline for duration, keeping long-dated Treasuries bid. That suggests the Bloomberg Treasury Index may recoup some of the record losses it has suffered this year.

Specifically, 10-year Treasury yields, currently around 3.70%, will find it hard to push emphatically above 4.34% — the highest level since the global financial crisis that we saw as recently as last month — unless the Fed’s terminal rate is way higher than current market expectations of circa 5%.

The outlook for long-dated Treasuries may present a stark contrast with that for the front end.

Two-year Treasury yields are bound to face upward pressure as the Fed continues to raise rates toward the terminal rate.

The Fed will find itself caught between a rock and a hard place should the labor market crumble while inflation stays well above its target.

Indeed, given how tight the labor market has been in recent months even though the economy has lost considerable momentum, there is a possibility that it may yet defy historical antecedents, imposing a limitation on the analysis.

In turn, that could mean the Fed may be able to persist longer with its tightening, sending long-dated yields higher yet again, though at this stage of the economic narrative that seems to be a tail risk rather than the base case.

All told, Treasury 10-year yields have surged about 220 basis points so far in 2022, headed for their worst year on record in Bloomberg data going back five decades. Should the Fed’s quest for a soft landing prove elusive, they may get some respite in the months to come.

Tyler Durden

Thu, 12/01/2022 – 07:20

via ZeroHedge News https://ift.tt/BTi6wla Tyler Durden