Stocks Defend 200DMA As VIX Tumbles Below 20, Yields Plunge Sending Gold Soaring

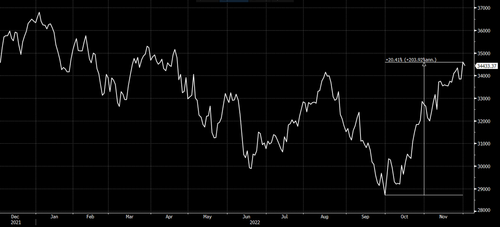

One day after Jerome Powell’s dovish speech sparked a stock explosion which helped the S&P close November up more than 5%, and with October’s 8% return stocks have sotmed higher after tumbling into a deep bear market in September (just as JPM permabull Marko Kolanovic turned bearish) to return more than 13% in the past two days…

… not to mention push the Dow Jones into a new bull market…

… on Thursday stocks were effectively unchanged with the S&P hugging the flatline after some early excitement.

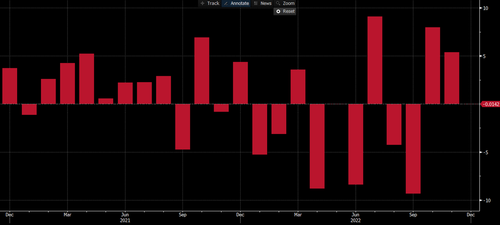

Spoos initially extended gains this morning after mixed data that included cooler-than-expected month-over-month PCE figures. Personal income beat, though spending was in line with estimates. However, futures slid about 30 minutes into the US cash session when manufacturing surveys indicated first contractionary ISM print since May 2020…

… spoos drifted lower to close just around the flatline…

… but much more importantly, futs never break back below the oh-so-critical 200DMA which as regular readers will recall, proved to be an insurmountable resistance during the August bear market rally. Well, not so much this time, and the S&P closed comfortably above the all-important moving average even if it still has to convincingly break above the downward trendline.

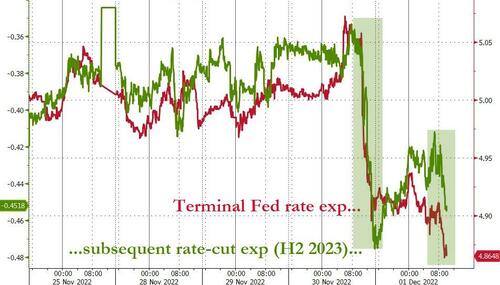

Peeking below the surface we find that the key catalyst behind today’s move was the continued sharp drop in TSY yields, which saw the 10Y plunge as low as 3.50%…

… as every part of the curve was dragged lower…

… courtesy of a furious dovish repricing in fed funds which saw the terminal rate (red) continue to drop while bets on rate-cuts in H2 2023 (green) continued to rise.

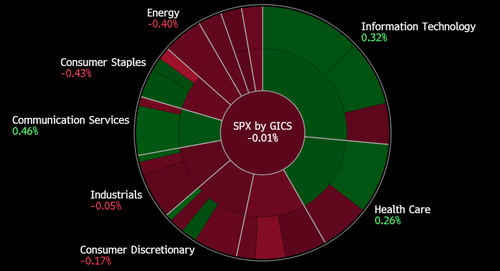

The plunge in yields boosted tech and hammered banks…

… and financial institutions, especially Blackstone, whose 69 Billion Real Estate fund hits redemption limits.

But not even that was enough to spook markets which now appear to be preparing for a ful-blown year-end rally and the VIX finally tumbled back under 20 for the first time since the August meltup.

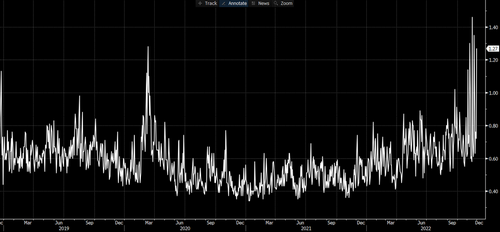

There is another reason why VIX is plunging: the put to call ratio made another near-record high this week and all those puts are now being furiously unwound and monetized for what little value they have.

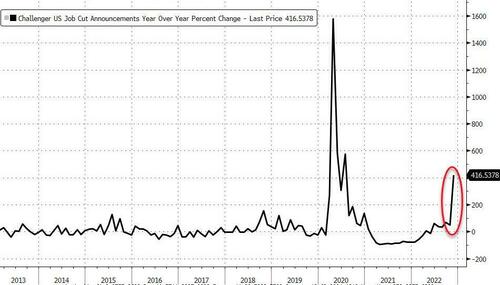

There is another reason why we may be facing a huge meltup: the latest Job Cuts data soared, suggesting NFP could be disastrous tomorrow…

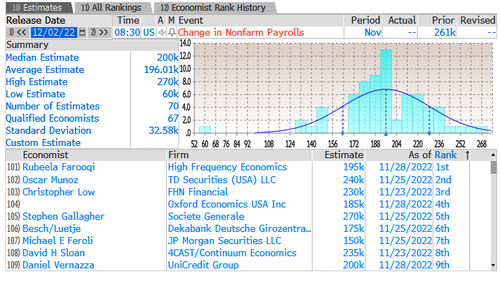

…. which of course would force the Fed to be even more dovish, and send stocks even higher. Incidentally, consensus expectations for tomorrow’s NFP are for around 196k. Our prediction: much, much lower.

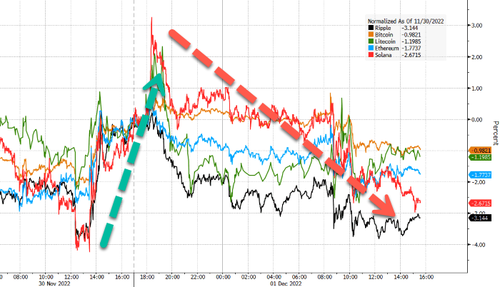

Finally, with the market now aggressively repricing the Fed’s tightening intentions and betting on much more easing in 2022, with bitcoin and crypto nursing huge wounds and playing defense…

… as Bitcoin remains stuck between $16K and $17K since the FTX fraud shock….

… the big winner today was gold and silver, with the yellow metal soaring above $1800, the highest level since August.

Tyler Durden

Thu, 12/01/2022 – 16:09

via ZeroHedge News https://ift.tt/0CKPMDh Tyler Durden