22 Changes In 2022: Crypto Year In Review

We’ve done our best to put together 22 points that we think tell the story of this year in crypto.

Everything shown is as of December 26th or December 27th.

Without further ado, Thanefield Capital’s 22 Changes in 2022.

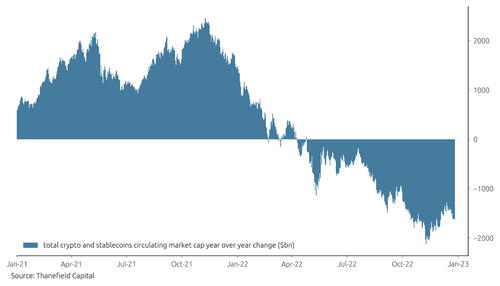

1. Total crypto and stablecoins market cap

2021: +$162mn per hour

2022: -$164m per hour

Almost exactly, 2022 undid every dollar crypto and stablecoins added in 2021. Year over year market cap destruction first flashed in Q1 and was tagging $2tn by November. We’d love to see a more standardized measurement of total crypto value (addressing problems like FDV and liquidity) gain popularity, but this is the headline number.

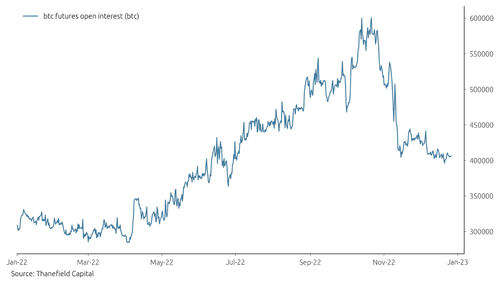

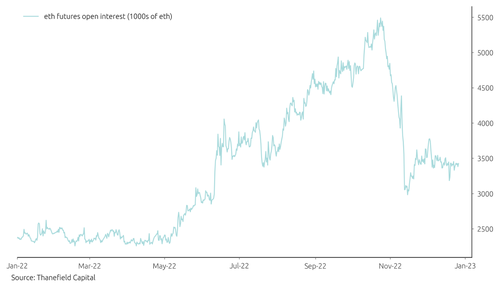

2. Bitcoin and Ethereum futures open interest

Futures open interest for the two biggest cryptos went up only in coin terms, doubled, and then blew up with the FTX crash. Both charts will still close the year out significantly higher than at the start. Both charts are of course lower when measured in dollars.

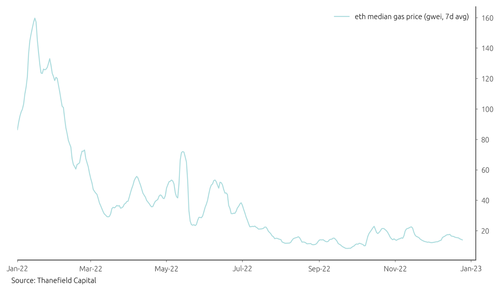

3. Ethereum gas

The cost/demand to transact on Ethereum dropped around 80%.

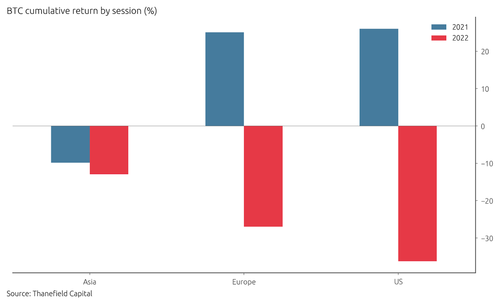

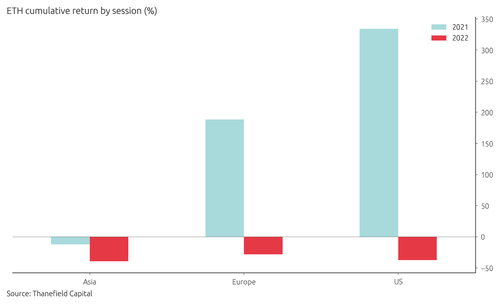

4. Session performance

For the second year in a row, crypto tended to go down during Asia market hours. It was the worst time of day for Ethereum but the best for Bitcoin. All three sessions had negative absolute performance.

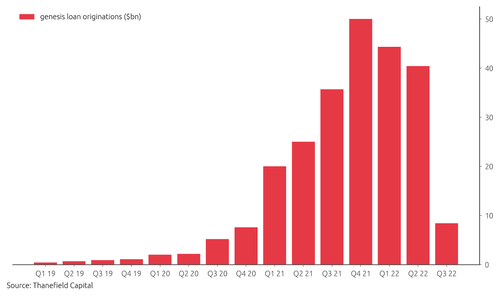

5. Crypto lending

OTC leverage imploded after 3AC went down – with market leader Genesis originating $8.4bn in loans this Q3 vs. $50bn in the last quarter of 2021. The more recent Q4 numbers are likely to be even lower.

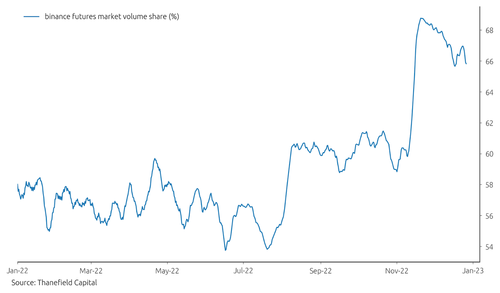

6. Binance dominance

Binance pushed their total futures market share to almost 70%.

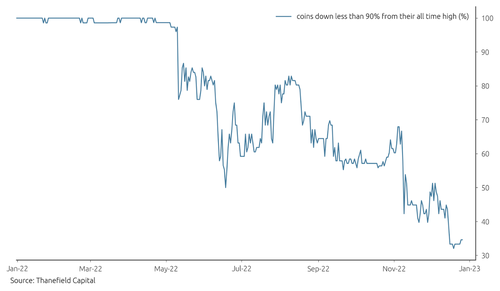

7. Altcoin drawdowns

This year sent a whopping 2/3rds of the names in our Binance spot universe (~80 coins) down more than 90% from their all time high.

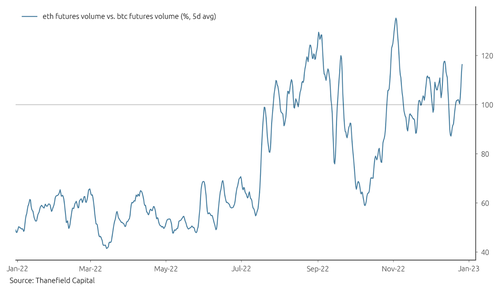

8. Ethereum volume share

Starting this year at just half the size, it is now a toss up whether Ethereum futures will trade more volume than Bitcoin on any given day. This came and went with the merge trade but surged again in Q4 and appears to be sticking around.

9. SBF

The face of crypto was charged with conspiracy to defraud the United States.

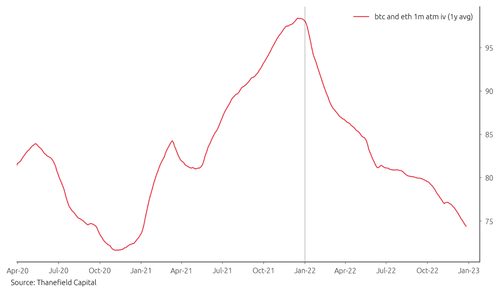

10. Implied volatility

The average implied volatility for 1 month Bitcoin and Ethereum options averaged just under 100 in 2021, and looks set to close this year under 75. The adjustment lower has accelerated in recent weeks.

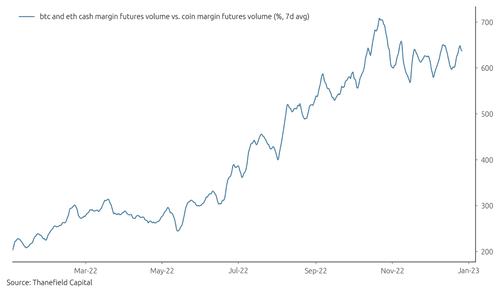

11. Futures margin

2022 solidified the crypto futures transfer to cash margin from coin margin – taking the ratio from 200% to 700%.

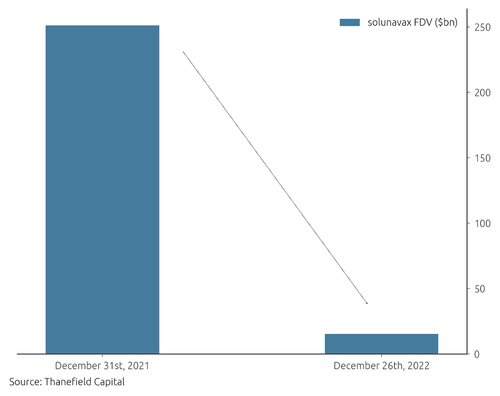

12. Solunavax

Solana, Luna, and Avax wiped out roughly $236bn in FDV. This number was on par with 2019’s total crypto market cap.

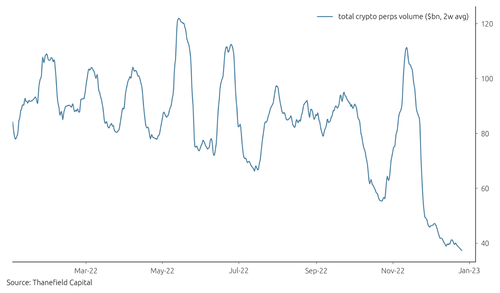

13. Perps volume

Total perpetual futures volume opened the year averaging around $90bn a day and will end the year crashing under $40bn a day.

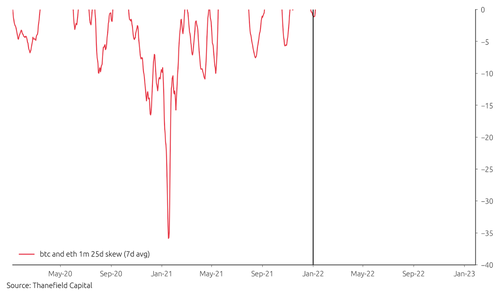

14. Put love

Downside is the new upside – crypto options stopped trading with a negative skew this year. Chart is cropped at zero for visual purposes.

15. Heroes

Half of the top 10 crypto funds going into this year are now either bankrupt, missing in action, or both.

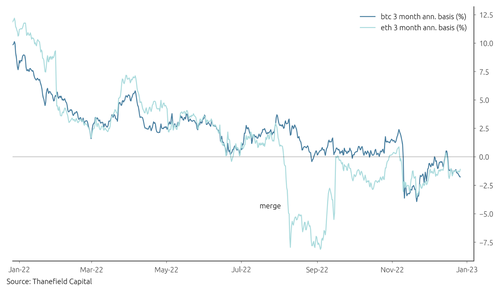

16. Carry

What was left of the once >40% annualized basis trade in Bitcoin and Ethereum was squashed to zero and then some, and has stayed there.

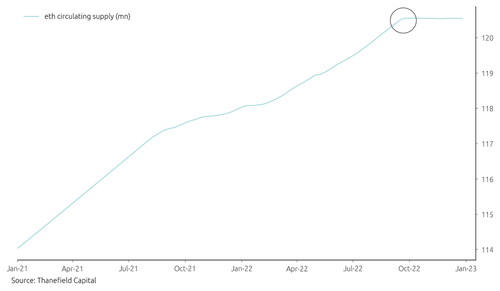

17. Ethereum supply

The merge gave crypto’s second largest asset a wildly different emissions schedule, moving Ethereum further into direct competition with Bitcoin.

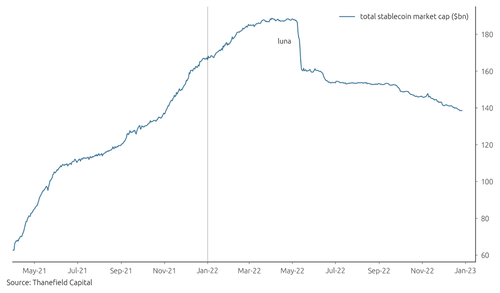

18. Stablecoins

For the first time in their history, stablecoins saw a decrease in circulation this year. It’s a slow turning chart and it’s only going one way right now.

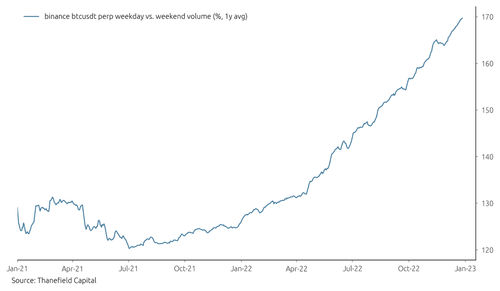

19. Weekends

Crypto markets were further integrated into a M-F lifestyle, with Bitcoin averaging almost 70% more volume on weekdays than weekends now, up from a roughly 30% difference at the start of the year. The kicker is that this took the form of less volume on weekends, not more volume on weekdays.

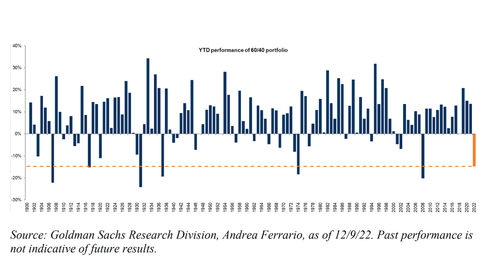

20. The bigger picture

Macro left us on our own this year with one of the worst performances for a US 60/40 portfolio in history.

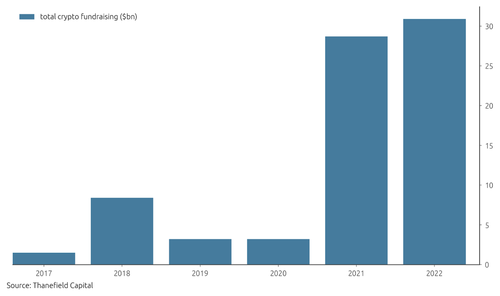

21. Fundraising

Here’s the chart that sticks out like a sore thumb. This year’s total crypto fundraising topping the 2021 total goes to show just how extreme activity here remained well into H1. Post-FTX, everything is different but the data will take some time to come in.

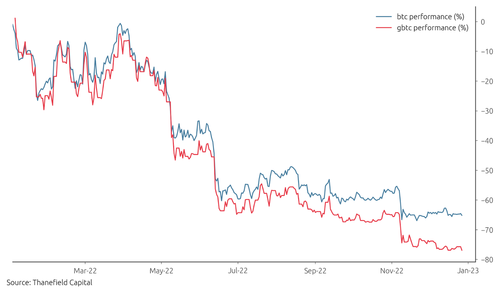

22. GBTC

GBTC made the transition from a troubled product to a failed, parasitic product as the NAV discount blew out to more than half. The discount widening played a large part in the downfall of 3AC.

See you next year!

Tyler Durden

Fri, 12/30/2022 – 15:20

via ZeroHedge News https://ift.tt/N4RgC8b Tyler Durden