Futures Slide On Final Trading Day Of 2022

US equity-index futures slumped on Friday, tracking European stocks lower, after Wall Street’s best session of the month and denting hopes that Santa Claus would make a late appearance on the last trading day of the year and ease the pain for investors as global stock markets are about to close the books on their worst annual performance since the global financial crisis in 2008.

Similarly to European bourses, US tech led the decline – after leading yesterday’s gain – with contracts on the Nasdaq 100 down 0.7% at 5:26 a.m. in New York. The tech-heavy index enjoyed a 2.6% jump during the previous session, thanks in large part to a sharp bounce-back in Tesla shares. The Nasdaq has lost a third of value this year as tech stocks emerged as some of the most vulnerable to rising rates. Optimism spurred by weaker than expected continuing job claims data signaling some easing in tight US labor markets faded overnight, taking contracts on the S&P 500 about 0.5% lower, and appears to be headed for that infamous JPM Collar strike of 3835.

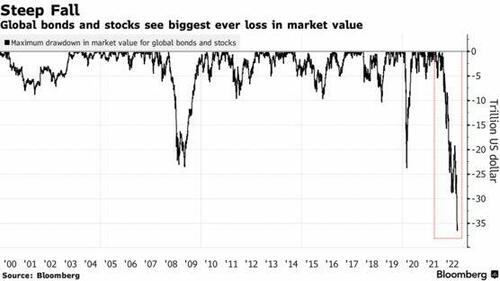

Add bonds and you get a $36 trillion loss in market value, the largest ever.

The dollar extended declines against major peers, with the Bloomberg Dollar Spot Index heading for its lowest level since June. Treasury yields inched higher and the yen rallied even as the Bank of Japan unveiled an unprecedented third day of unscheduled bond purchases.

In premarket trading, travel and leisure stocks are under pressure as a surge in Covid-19 cases in China has prompted authorities to consider flight and travel restrctions. Technology shares are also under the spotlight after a volatile week, notably for Apple Inc. and Tesla. Here are some other notable premarket movers:

- China Securities Regulatory Commission will ask Futu Holdings and UP Fintech Holding to correct illegal acts in cross-border securities business, according to a statement from the regulator. Futu shares fall 25% in premarket trading.

- Sesen Bio rises 27% in US premarket trading after the company said it will increase a previously announced one-time special dividend following its merger with Carisma Therapeutics, to around $0.34 per share from as much as $0.12 per share.

With low visibility on the Federal Reserve’s monetary policy path, the surge in Covid cases in China or the war in Ukraine, strategists are being cautious in calling the direction of travel for the next few weeks.

“On equities, I expect a choppy first few weeks of the year, while central banks keep their hawkish tone, but then a more positive second quarter and onwards as inflation declines,” said Rajeev De Mello, a global macro portfolio manager at GAMA Asset Management.

The market’s uncertain direction sapped hopes for a rally to close out 2022, a year when inflation reasserted itself to wipe a fifth in value from global stocks, the worst run since the financial crisis. Bonds lost 16% of value, the biggest decline since at least 1990 for one leading measure, as central banks raced to slow rising consumer prices by hiking interest rates around the world.

European stocks dropped 0.7%, and was trading at session lows, as technology and telecommunications shares led a broad-based decline in the Stoxx Europe 600 index, which is heading for its worst year since 2018. The gauge held a decline even after data showed Spanish inflation slowed for a fifth straight month in December as energy costs continue to decline in the euro zone’s fourth-largest economy.

Earlier in the session, Asian stocks headed higher on their last session for 2022 as shares in China advanced on mobility figures that showed economic activity rebounded in several of the nation’s cities where infections have likely peaked. The MSCI Asia Pacific Index climbed as much as 0.8%, the most in a week, with most markets in the region gaining. US data allayed fears of a supercharged jobs market that would support a more aggressive policy path. Bourses in South Korea and the Philippines were closed Friday. Despite the gain, Asian stocks are down almost 20% this year in their worst slump since the 2008 financial crisis. Vietnam and South Korea were the region’s worst performers in 2022, with both losing at least a quarter of their value. India and Indonesia were among the world’s top gainers. The annual loss for Asia is in line with the drop in global and US equities.

While investors remain concerned about the supply-chain impact from China’s Covid infection surge ahead of its Lunar New Year holiday in January, the reopening of the nation’s economy has helped support sentiment. Expect Asia’s “discount to intrinsic value to narrow across the region in 2023 due to an improvement in sentiment on the back of China’s reopening and US rate hike expectations plateauing,” said Sukumar Rajah, director of portfolio management at Franklin Templeton Emerging Markets Equity.

Emerging-market stocks were set for the first weekly advance in three as the benchmark index remained on track for a decline of more than 20% in 2022.

In FX, the Bloomberg Dollar Spot Index fell as much as 0.3%; the pound underperformed, losing ground against the greenback which dropped to the lowest level since June. The yen rose against all G-10 currencies even after the BOJ announced unscheduled bond purchases for the third day. USD/JPY fell more than 1% to 131.55 after dropping 1.1% on Thursday. The combination of additional fixed-rate and fixed amount purchases announced Friday have boosted BOJ’s buying this month to about 17 trillion yen, a monthly record, according to data compiled by Bloomberg

“Our view is that the BOJ’s yield curve control policy is on borrowed time and the central bank will have to eventually let go of the policy — this is one key factor why we see USD/JPY heading toward 120 per dollar in 2023,” said Rodrigo Catril, senior FX strategist at National Australia Bank Ltd. in Sydney. “JPY flow implications are also likely supporting the yen with Japan domestic yields starting to look more appealing for Japanese insurance companies as well as any offshore investor with FX hedged positions”

In rates, treasuries were under pressure as the last US trading session of the year gets under way, with yields higher by 2bp-3bp across the curve, inside weekly ranges. 10-year TSY yields were higher by 2.4bp at 3.84%, near the highest level since mid-November and above 50-DMA level; German 10-year is up ~7bp on the day; Bunds and most other euro-zone bond markets underperformed after bearish Spanish inflation data. Treasuries may draw support into month-end index pricing at 1pm New York time. Sifma recommended a 2pm close for cash bonds. Global market focus remains on the impact of China’s unwind of Covid restrictions, with the nation facing as many as 25,000 deaths a day later in January, according to estimates.

In commodities, oil rose after a three-day run of declines on worries about a rise in crude stockpiles and concerns that rising Covid-19 infections in China would slow demand in one of the world’s top oil importers.

The only economic datapoint on the last trading day of the year is the Chicago PMI which is expected to bounce modestly to 40.0 from 37.2.

Market Snapshot

- S&P 500 futures down 0.5% to 3,853.75

- STOXX Europe 600 down 0.5% to 428.18

- MXAP up 0.5% to 155.91

- MXAPJ up 0.3% to 506.39

- Nikkei little changed at 26,094.50

- Topix down 0.2% to 1,891.71

- Hang Seng Index up 0.2% to 19,781.41

- Shanghai Composite up 0.5% to 3,089.26

- Sensex down 0.6% to 60,775.99

- Australia S&P/ASX 200 up 0.3% to 7,038.69

- Kospi down 1.9% to 2,236.40

- German 10Y yield little changed at 2.52%

- Euro little changed at $1.0660

- Brent Futures up 0.1% to $83.55/bbl

- Brent Futures up 0.1% to $83.55/bbl

- Gold spot up 0.1% to $1,816.85

- U.S. Dollar Index little changed at 103.88

Top Overnight News from Bloomberg

- The Bank of Japan announced an unprecedented third day of unscheduled bond purchases as it fights back against speculation it is about to end its super-accommodative monetary policy

- European and US equity futures edged lower and Asian shares were mixed on the final trading day of a brutal year in financial markets that has dragged stocks and bonds to their worst annual run in more than a decade.

- China will extend the trading hours for the onshore yuan as the government pushes ahead with plans to internationalize the currency

- No novel Covid-19 variants have emerged in China, according to a global consortium that’s tracking coronavirus mutations

- China appointed its ambassador to the US, Qin Gang, as the new foreign minister, as the Asian nation shows signs of moving back to a lower-key diplomatic strategy after a growing backlash against its confrontational style

US Event Calendar

- 09:45: Dec. MNI Chicago PMI, est. 40.0, prior 37.2

Tyler Durden

Fri, 12/30/2022 – 08:02

via ZeroHedge News https://ift.tt/aC6Kle2 Tyler Durden