Oil Should Lure Bulls Back in 2023

By Grant Smith and Mark Cudmore, Bloomberg markets live reports and strategists

Oil prices may have surrendered the bulk of this year’s gains, but the conditions are right to lure back bulls in the new year.

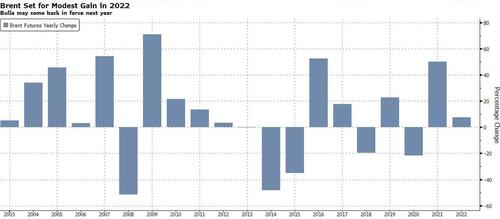

Brent crude futures are set to end 2022 with a modest increase of 7% — a mere fraction of the $60-a-barrel gain they had racked up in the spring, when alarm over the war in Ukraine was at its peak. Faltering fuel demand, fears over a US recession and China’s Covid resurgence have all helped to dissolve the rally.

Nonetheless, there are plenty of reasons why oil is poised for a renewed surge next year.

On the demand side, the coldest part of winter has yet to bite and should stoke the need for heating fuels in the first months of 2023. Later in the year, China’s re-opening may have gathered strength, bringing more cars onto the road and planes in the air. Hedge fund star Pierre Andurand estimates that demand growth could double mainstream expectations next year, soaring by 4%.

As for supplies, Russian exports may have defied the skeptics throughout last year but that’s because sanctions are only now going into full force. Insurers are shunning their traditional trade in Russian cargoes, a portent of the supply drop to come. The 15% plunge in Russian output long-predicted by the International Energy Agency may finally be on the way.

Meanwhile oil’s forward curves testify to the underlying market strength, with Brent spreads largely showing a premium — known as backwardation — that signifies supply tightness. If all else fails, Saudi Arabia and its OPEC+ allies have demonstrated they’re willing to defend the market by slashing oil production, even if it means enduring political outcry.

It’s this combination of demand surprises and supply shortfalls that may well send Brent — ending the year close to $83 a barrel — back towards triple digits in 2023.

Tyler Durden

Fri, 12/30/2022 – 14:00

via ZeroHedge News https://ift.tt/SbYIgLV Tyler Durden