Dealmaking Freeze Hits London Offices After Truss’ ‘Mini-Budget’ Sparked Turmoil

Last autumn, former Prime Minister Liz Truss’ disastrous mini-budget sparked financial turmoil across UK markets. The Bank of England was forced to intervene with a massive bond-buying scheme to halt pension fund deleveraging. One market that was exceptionally roiled by the chaos was the UK commercial property market.

Truss’s then-chancellor, Kwasi Kwarteng, caused financial turbulence and fears of a 2008-style financial crisis by unveiling the mini-budget, also known as “The Growth Plan,” which was designed to boost economic growth through tax cuts that were funded by fiscal stimulus. This caused dysfunction in the UK gilt market and led to pensions unloading everything from stocks, bonds, collateralized-loan obligations, and even office buildings. That quickly cooled investments in London office buildings in the fourth quarter.

Real estate information provider CoStar Group Inc. revealed £400 million ($488 million) of offices in the UK were bought and sold in the fourth quarter, an 88% plunge from the prior quarter.

Bloomberg noted, “the dealmaking freeze — worse than the decline during the financial crisis or Covid-19 lockdowns — came as former Prime Minister Liz Truss’s proposals for unfunded tax cuts spooked markets.”

CoStar’s data shows the two-decade quarterly average for offices bought and sold is around £3.5 billion ($4.2 billion). So the last quarter’s figure reflects the turmoil sparked by Truss. Also, buyers are on the sidelines as they wait for price adjustments due to higher borrowing costs and the rising risk of recession.

At the time of the turmoil last fall, pensions were unloading positions in the UK’s largest property funds, causing these funds to gate redemptions to avoid asset “firesales.”

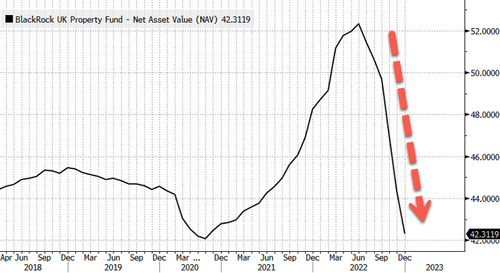

And the turmoil is unlikely to be over. US fund manager BlackRock recently suspended redemption requests from investors in its £3.5 billion ($4.2 billion) UK property fund.

The net asset value of the BlackRock UK Property Fund has been on a rollercoaster ride in the last few quarters and roundtripped Covid lows.

It seems like a combination of Truss’ disastrous mini-budget sparking financial chaos late last year and increasing economic uncertainty have led to freezing the UK office property market.

Tyler Durden

Tue, 01/17/2023 – 04:15

via ZeroHedge News https://ift.tt/nzZLW6t Tyler Durden