Bed Bath & Beyond Craters After Confirming It Received Default Notice From JPMorgan

The insatiable BBBY dip-buyers just got some news of the very worst kind.

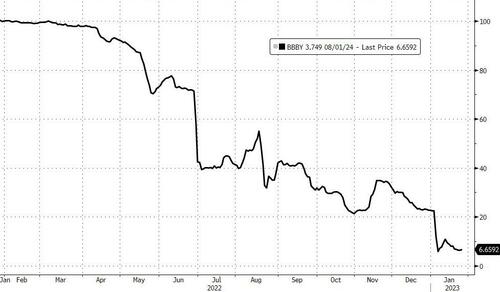

After the stock enjoyed one of its typically idiotic short squeezes earlier this month which pushed the worthless shares from $1.27 to $6 in a few days courtesy of panicking shorts despite constant warnings that an equity value-vaporizing bankruptcy was imminent, moments ago the company filed a 10-Q in which it confirmed that a bankruptcy is now officially in play after the company received a notice of default from JPMorgan on its credit facility.

According to the filing, “on or around January 13, 2023, certain events of default were triggered under the Company’s Credit Facilities as a result of the Company’s failure to prepay an overadvance and satisfy a financial covenant, among other things.” As a result of the event of default, on January 25, 2023, the administrative agent under the Amended Credit Agreement (JPMorgan) notified the Company that full and immediate repayment of the full facility is due, to wit:

The Company’s net cash used in operating activities was $307.6 million and $890.0 million for the three and nine months ended November 26, 2022. Cash, cash equivalents and restricted cash were $225.7 million as of November 26, 2022. On or around January 13, 2023, certain events of default were triggered under the Company’s Credit Facilities (as defined below) as a result of the Company’s failure to prepay an overadvance and satisfy a financial covenant, among other things. As a result of the continuance of such events of default, on January 25, 2023, the administrative agent under the Amended Credit Agreement notified the Company that (i) the principal amount of all outstanding loans under the Credit Facilities, together with accrued interest thereon, the FILO Applicable Premium (as defined in the Amended Credit Agreement) and all fees (including, for the avoidance of doubt, any break funding payments) and other obligations of the Company accrued under the Amended Credit Agreement, are due and payable immediately, (ii) the Company is required, effective immediately, to cash collateralize letter of credit obligations under the Credit Facilities, and (iii) effective as of January 25, 2023, all outstanding loans and obligations under the Credit Facilities shall bear interest at an additional default rate of 2% per annum. As a result of these events of default, the Company classified its outstanding borrowings under its asset-based revolving credit facility (the “ABL Facility) and its FILO Facility as current in the consolidated balance sheet as of November 26, 2022. The Company’s outstanding borrowings under its ABL Facility and FILO Facility were $550.0 million and $375.0 million, respectively, as of November 26, 2022. In addition, the Company had $186.2 million in letters of credit outstanding under its ABL Facility as of November 26, 2022. The Company also had $1.030 billion in senior notes (excluding deferred financing costs) outstanding as of November 26, 2022. For information regarding the Company’s borrowings, see Note 12.

Unfortunately, there is a problem: BBBY doesn’t have the money JPM is asking for, so it will most likely have to file for bankruptcy instead.

At this time, the Company does not have sufficient resources to repay the amounts under the Credit Facilities and this will lead the Company to consider all strategic alternatives, including restructuring its debt under the U.S. Bankruptcy Code. The Company is undertaking a number of actions in order to improve its financial position and stabilize its results of operations including but not limited to, cost cutting, lowering capital expenditures, and reducing its store footprint including related distribution centers. In addition, the Company will continue to seek reductions in rental obligations with landlords in its determination of the appropriate footprint, seek additional debt or equity capital, reduce or delay the Company’s business activities and strategic initiatives, or sell assets. These measures may not be successful.

They won’t be.

The stock, which as noted above was idiotically trading north of $3 (having mercifully cut its most recent short squeeze gains in half), tumbled and was halted for trading twice before some pathological dip buyers couldn’t resist and started bidding it up again.

Of course, for the stock to be trading here suggests there is still some equity “tip” value in the enterprise when even the bonds are trading a 6 cents on the dollar or pure liquidation value. In fact at this rate the bonds will be trading below where the stock is.

In any event, in light of the imminent bankruptcy filing, we found a tweet from 2014 which is perfectly appropriate for the insanity that US capital markets have become.

BBBY Net Income in past decade: $7.1 billion;

BBBY stock buybacks in past decade: $6.6 billion— zerohedge (@zerohedge) July 7, 2014

As for all those who pathologically are still buying every dip int he stock, please stop.

Tyler Durden

Thu, 01/26/2023 – 15:21

via ZeroHedge News https://ift.tt/Yp45Q2Z Tyler Durden