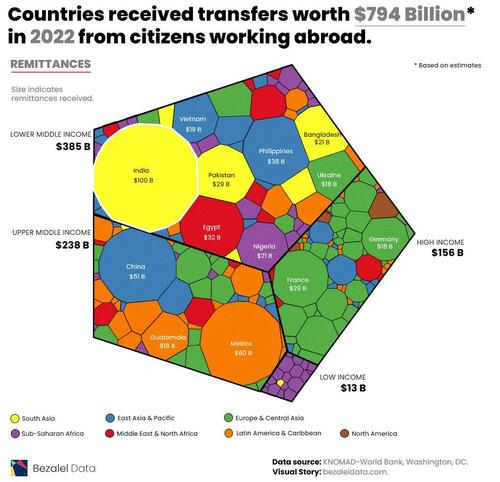

Visualizing Remittance Flows & GDP Impact By Country

The COVID-19 pandemic slowed down the flow of global immigration by 27%.

And, as Visual Capitalist’s Richie Lionell details below, alongside it, travel restrictions, job losses, and mounting health concerns meant that many migrant workers couldn’t send money in the form of remittances back to families in their home countries.

This flow of remittances received by countries dropped by 1.5% to $711 billion globally in 2020. But over the next two years, things quickly turned back around.

As visa approvals restarted and international borders opened, so did international migration and global remittance flows.

In 2021, total global remittances were estimated at $781 billion and have further risen to $794 billion in 2022.

In these images, Richie Lionell uses the World Bank’s KNOMAD data to visualize this increasing flow of money across international borders in 176 countries.

Why Do Remittances Matter?

Remittances contribute to the economy of nations worldwide, especially low and middle-income countries (LMICs).

They have been shown to help alleviate poverty, improve nutrition, and even increase school enrollment rates in these nations. Research has also found that these inflows of income can help recipient households become resilient, especially in the face of disasters.

At the same time, it’s worth noting that these transfers aren’t a silver bullet for recipient nations. In fact, some research shows that overreliance on remittances can cause a vicious cycle that doesn’t translate to consistent economic growth over time.

Countries Receiving the Highest Remittances

For the past 15 years, India has consistently topped the chart of the largest remittance beneficiaries.

With an estimated $100 billion in remittances received, India is said to have reached an all-time high in 2022.

This increasing flow of remittances can be partially attributed to migrant Indians switching to high-skilled jobs in high-income countries—including the U.S., the UK, and Singapore—from low-skilled and low-paying jobs in Gulf countries.

| Rank | Remittance Inflows by Country | 2022 (USD) |

|---|---|---|

| 1 | India |

$100,000M |

| 2 | Mexico | $60,300M |

| 3 | China | $51,000M |

| 4 | Philippines | $38,000M |

| 5 | Egypt, Arab Rep. | $32,337M |

| 6 | Pakistan | $29,000M |

| 7 | France | $28,520M |

| 8 | Bangladesh | $21,000M |

| 9 | Nigeria | $20,945M |

| 10 | Vietnam | $19,000M |

| 11 | Ukraine | $18,421M |

| 12 | Guatemala | $18,112M |

| 13 | Germany | $18,000M |

| 14 | Belgium | $13,500M |

| 15 | Uzbekistan | $13,500M |

| 16 | Morocco | $11,401M |

| 17 | Romania | $11,064M |

| 18 | Dominican Republic | $9,920M |

| 19 | Indonesia | $9,700M |

| 20 | Thailand | $9,500M |

| 21 | Colombia | $9,133M |

| 22 | Italy | $9,000M |

| 23 | Nepal | $8,500M |

| 24 | Spain | $8,500M |

| 25 | Honduras | $8,284M |

| 26 | Poland | $8,000M |

| 27 | Korea, Rep. | $7,877M |

| 28 | El Salvador | $7,620M |

| 29 | Lebanon | $6,841M |

| 30 | Israel | $6,143M |

| 31 | United States | $6,097M |

| 32 | Russian Federation | $6,000M |

| 33 | Serbia | $5,400M |

| 34 | Brazil | $5,045M |

| 35 | Japan | $5,000M |

| 36 | Portugal | $4,694M |

| 37 | Ghana | $4,664M |

| 38 | Jordan | $4,646M |

| 39 | Czech Republic | $4,539M |

| 40 | Haiti | $4,532M |

| 41 | Ecuador | $4,468M |

| 42 | Georgia | $4,100M |

| 43 | Kenya | $4,091M |

| 44 | Croatia | $3,701M |

| 45 | Peru | $3,699M |

| 46 | Sri Lanka | $3,600M |

| 47 | West Bank and Gaza | $3,495M |

| 48 | Jamaica | $3,419M |

| 49 | Armenia | $3,350M |

| 50 | Tajikistan | $3,200M |

| 51 | Nicaragua | $3,126M |

| 52 | Kyrgyz Republic | $3,050M |

| 53 | Senegal | $2,711M |

| 54 | Austria | $2,700M |

| 55 | Switzerland | $2,631M |

| 56 | Sweden | $2,565M |

| 57 | United Kingdom | $2,501M |

| 58 | Hungary | $2,404M |

| 59 | Bosnia and Herzegovina | $2,400M |

| 60 | Slovak Republic | $2,300M |

| 61 | Moldova | $2,170M |

| 62 | Azerbaijan | $2,150M |

| 63 | Tunisia | $2,085M |

| 64 | Zimbabwe | $2,047M |

| 65 | Luxembourg | $2,000M |

| 66 | Netherlands | $2,000M |

| 67 | Myanmar | $1,900M |

| 68 | Algeria | $1,829M |

| 69 | Albania | $1,800M |

| 70 | Somalia | $1735M |

| 71 | Congo, Dem. Rep. | $1,664M |

| 72 | Malaysia | $1,620M |

| 73 | Kosovo | $1,600M |

| 74 | Denmark | $1,517M |

| 75 | Latvia | $1,500M |

| 76 | Bolivia | $1,403M |

| 77 | Belarus | $1,350M |

| 78 | Cambodia | $1,250M |

| 79 | Bermuda | $1,200M |

| 80 | South Sudan | $1,187M |

| 81 | Uganda | $1,131M |

| 82 | Mali | $1,094M |

| 83 | South Africa | $1,019M |

| 84 | Sudan | $1,013M |

| 85 | Argentina | $966M |

| 86 | Montenegro | $920M |

| 87 | Finland | $880M |

| 88 | Bulgaria | $850M |

| 89 | Slovenia | $800M |

| 90 | Australia | $737M |

| 91 | Madagascar | $718M |

| 92 | Turkey | $710M |

| 93 | Canada | $700M |

| 94 | Lithuania | $700M |

| 95 | Togo | $668M |

| 96 | Greece | $665M |

| 97 | Costa Rica | $654M |

| 98 | Estonia | $626M |

| 99 | Qatar | $624M |

| 100 | Iraq | $624M |

| 101 | Gambia, The | $615M |

| 102 | Tanzania | $609M |

| 103 | Norway | $600M |

| 104 | Panama | $596M |

| 105 | Burkina Faso | $589M |

| 106 | Hong Kong SAR, China | $571M |

| 107 | Paraguay | $554M |

| 108 | Mozambique | $545M |

| 109 | Niger | $534M |

| 110 | Cyprus | $527M |

| 111 | Lesotho | $527M |

| 112 | Mongolia | $500M |

| 113 | Rwanda | $469M |

| 114 | Fiji | $450M |

| 115 | North Macedonia | $450M |

| 116 | Guyana | $400M |

| 117 | Cabo Verde | $375M |

| 118 | Kazakhstan | $370M |

| 119 | Cameroon | $365M |

| 120 | Cote d’Ivoire | $360M |

| 121 | Liberia | $351M |

| 122 | Afghanistan | $350M |

| 123 | Ethiopia | $327M |

| 124 | Samoa | $280M |

| 125 | Mauritius | $279M |

| 126 | Saudi Arabia | $273M |

| 127 | Malta | $271M |

| 128 | Malawi | $267M |

| 129 | Zambia | $260M |

| 130 | Tonga | $250M |

| 131 | Comoros | $250M |

| 132 | Ireland | $249M |

| 133 | Suriname | $221M |

| 134 | Benin | $209M |

| 135 | Lao PDR | $200M |

| 136 | Timor-Leste | $185M |

| 137 | Sierra Leone | $179M |

| 138 | Guinea-Bissau | $178M |

| 139 | Trinidad and Tobago | $172M |

| 140 | Mauritania | $168M |

| 141 | Iceland | $164M |

| 142 | Eswatini | $148M |

| 143 | Belize | $142M |

| 144 | Curacao | $131M |

| 145 | Uruguay | $127M |

| 146 | Chile | $78M |

| 147 | Vanuatu | $75M |

| 148 | St. Vincent and the Grenadines | $70M |

| 149 | Grenada | $69M |

| 150 | Botswana | $56M |

| 151 | St. Lucia | $55M |

| 152 | Bhutan | $55M |

| 153 | Djibouti | $55M |

| 154 | Dominica | $52M |

| 155 | Burundi | $50M |

| 156 | Aruba | $44M |

| 157 | Namibia | $44M |

| 158 | Guinea | $41M |

| 159 | Solomon Islands | $40M |

| 160 | Oman | $39M |

| 161 | Antigua and Barbuda | $35M |

| 162 | St. Kitts and Nevis | $33M |

| 163 | Marshall Islands | $30M |

| 164 | Kuwait | $27M |

| 165 | New Zealand | $25M |

| 166 | Macao SAR, China | $17M |

| 167 | Angola | $16M |

| 168 | Kiribati | $15M |

| 169 | Cayman Islands | $14M |

| 170 | Sao Tome and Principe | $10M |

| 171 | Seychelles | $9M |

| 172 | Maldives | $5M |

| 173 | Gabon | $4M |

| 174 | Palau | $2M |

| 175 | Papua New Guinea | $2M |

| 176 | Turkmenistan | $1M |

| Total | World | $794,059M |

Mexico and China round out the top three remittance-receiving nations, with estimated inbound transfers of $60 billion and $51 billion respectively in 2022.

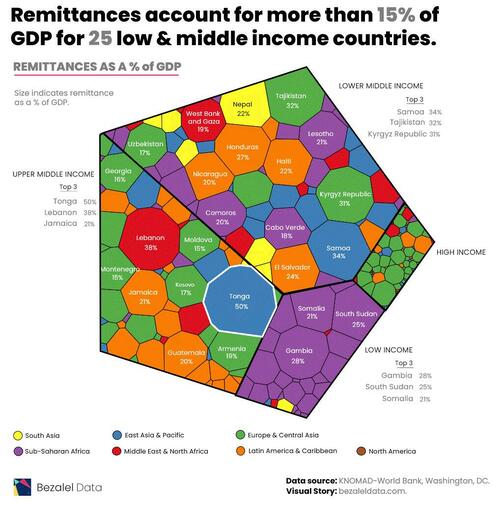

Impact on National GDP

While India tops the list of countries benefitting from remittances, its $100 billion received amounts to only 2.9% of its 2022 GDP.

Meanwhile, low and middle-income countries around the world heavily rely on this source of income to boost their economies in a more substantive way. In 2022, for example, remittances accounted for over 15% of the GDP of 25 countries.

| Rank | Remittance Inflows by Country | % of GDP (2022) |

|---|---|---|

| 1 | Tonga | 49.9% |

| 2 | Lebanon | 37.8% |

| 3 | Samoa | 33.7% |

| 4 | Tajikistan | 32.0% |

| 5 | Kyrgyz Republic | 31.2% |

| 6 | Gambia, The | 28.3% |

| 7 | Honduras | 27.1% |

| 8 | South Sudan | 24.8% |

| 9 | El Salvador | 23.8% |

| 10 | Haiti | 22.4% |

| 11 | Nepal | 21.7% |

| 12 | Jamaica | 21.2% |

| 13 | Lesotho | 21.0% |

| 14 | Somalia | 20.6% |

| 15 | Comoros | 20.1% |

| 16 | Nicaragua | 19.9% |

| 17 | Guatemala | 19.8% |

| 18 | Armenia | 18.9% |

| 19 | West Bank and Gaza | 18.5% |

| 20 | Cabo Verde | 18.2% |

| 21 | Kosovo | 17.3% |

| 22 | Uzbekistan | 17.0% |

| 23 | Georgia | 16.2% |

| 24 | Moldova | 15.4% |

| 25 | Montenegro | 15.0% |

| 26 | Ukraine | 13.8% |

| 27 | Marshall Islands | 11.0% |

| 28 | Guinea-Bissau | 10.9% |

| 29 | Bosnia and Herzegovina | 10.1% |

| 30 | Albania | 9.8% |

| 31 | Senegal | 9.8% |

| 32 | Jordan | 9.6% |

| 33 | Philippines | 9.4% |

| 34 | Fiji | 9.2% |

| 35 | Liberia | 9.0% |

| 36 | Dominican Republic | 8.8% |

| 37 | Dominica | 8.6% |

| 38 | Serbia | 8.6% |

| 39 | Togo | 7.9% |

| 40 | Morocco | 7.9% |

| 41 | Pakistan | 7.7% |

| 42 | Vanuatu | 7.6% |

| 43 | Timor-Leste | 7.5% |

| 44 | Suriname | 7.3% |

| 45 | St. Vincent and the Grenadines | 7.3% |

| 46 | Kiribati | 7.2% |

| 47 | Egypt, Arab Rep. | 6.8% |

| 48 | Ghana | 6.1% |

| 49 | Mali | 5.9% |

| 50 | Grenada | 5.8% |

| 51 | Zimbabwe | 5.3% |

| 52 | Croatia | 5.3% |

| 53 | Belize | 5.3% |

| 54 | Sri Lanka | 4.8% |

| 55 | Madagascar | 4.7% |

| 56 | Vietnam | 4.5% |

| 57 | Bangladesh | 4.5% |

| 58 | Tunisia | 4.5% |

| 59 | Cambodia | 4.4% |

| 60 | Sierra Leone | 4.3% |

| 61 | Mexico | 4.2% |

| 62 | Nigeria | 4.1% |

| 63 | Rwanda | 3.8% |

| 64 | Ecuador | 3.8% |

| 65 | Latvia | 3.6% |

| 66 | Romania | 3.6% |

| 67 | Niger | 3.6% |

| 68 | Kenya | 3.5% |

| 69 | Bolivia | 3.2% |

| 70 | Burkina Faso | 3.2% |

| 71 | Myanmar | 3.1% |

| 72 | North Macedonia | 3.1% |

| 73 | Mongolia | 3.1% |

| 74 | Eswatini | 3.1% |

| 75 | Azerbaijan | 3.0% |

| 76 | Mozambique | 3.0% |

| 77 | St. Kitts and Nevis | 2.9% |

| 78 | India | 2.8% |

| 79 | St. Lucia | 2.7% |

| 80 | Guyana | 2.6% |

| 81 | Colombia | 2.6% |

| 82 | Congo, Dem. Rep. | 2.6% |

| 83 | Solomon Islands | 2.4% |

| 84 | Luxembourg | 2.4% |

| 85 | Mauritius | 2.4% |

| 86 | Sudan | 2.3% |

| 87 | Uganda | 2.3% |

| 88 | Malawi | 2.3% |

| 89 | Belgium | 2.2% |

| 90 | Sao Tome and Principe | 2.0% |

| 91 | Afghanistan | 2.0% |

| 92 | Slovak Republic | 2.0% |

| 93 | Antigua and Barbuda | 2.0% |

| 94 | Bhutan | 2.0% |

| 95 | Cyprus | 1.9% |

| 96 | Portugal | 1.8% |

| 97 | Thailand | 1.7% |

| 98 | Belarus | 1.6% |

| 99 | Mauritania | 1.6% |

| 100 | Estonia | 1.6% |

| 101 | Malta | 1.5% |

| 102 | Peru | 1.5% |

| 103 | Czech Republic | 1.5% |

| 104 | Djibouti | 1.4% |

| 105 | Burundi | 1.3% |

| 106 | Paraguay | 1.3% |

| 107 | Hungary | 1.3% |

| 108 | Slovenia | 1.2% |

| 109 | Aruba | 1.2% |

| 110 | Lao PDR | 1.2% |

| 111 | Benin | 1.1% |

| 112 | Israel | 1.1% |

| 113 | Poland | 1.1% |

| 114 | Lithuania | 1.0% |

| 115 | France | 1.0% |

| 116 | Bulgaria | 0.9% |

| 117 | Algeria | 0.9% |

| 118 | Zambia | 0.9% |

| 119 | Costa Rica | 0.9% |

| 120 | Palau | 0.8% |

| 121 | Panama | 0.8% |

| 122 | Cameroon | 0.8% |

| 123 | Tanzania | 0.7% |

| 124 | Indonesia | 0.7% |

| 125 | Spain | 0.6% |

| 126 | Iceland | 0.5% |

| 127 | Trinidad and Tobago | 0.5% |

| 128 | Austria | 0.5% |

| 129 | Cote d’Ivoire | 0.5% |

| 130 | Seychelles | 0.4% |

| 131 | Korea, Rep. | 0.4% |

| 132 | Italy | 0.4% |

| 133 | Germany | 0.4% |

| 134 | Sweden | 0.4% |

| 135 | Denmark | 0.3% |

| 136 | Malaysia | 0.3% |

| 137 | Namibia | 0.3% |

| 138 | Switzerland | 0.3% |

| 139 | Finland | 0.3% |

| 140 | Botswana | 0.3% |

| 141 | Greece | 0.2% |

| 142 | Ethiopia | 0.2% |

| 143 | Qatar | 0.2% |

| 144 | Russian Federation | 0.2% |

| 145 | Brazil | 0.2% |

| 146 | China | 0.2% |

| 147 | South Africa | 0.2% |

| 148 | Iraq | 0.2% |

| 149 | Guinea | 0.2% |

| 150 | Netherlands | 0.2% |

| 151 | Uruguay | 0.1% |

| 152 | Kazakhstan | 0.1% |

| 153 | Hong Kong SAR, China | 0.1% |

| 154 | Argentina | 0.1% |

| 155 | Norway | 0.1% |

| 156 | Japan | 0.1% |

| 157 | Maldives | 0.08% |

| 158 | Turkey | 0.08% |

| 159 | United Kingdom | 0.07% |

| 160 | Macao SAR, China | 0.07% |

| 161 | Ireland | 0.05% |

| 162 | Australia | 0.04% |

| 163 | Oman | 0.04% |

| 164 | Saudi Arabia | 0.03% |

| 165 | Chile | 0.02% |

| 166 | United States | 0.02% |

| 167 | Gabon | 0.02% |

| 168 | Kuwait | 0.01% |

| 169 | Angola | 0.01% |

| 170 | New Zealand | 0.01% |

| 171 | Papua New Guinea | 0.01% |

| 172 | Turkmenistan | 0.001% |

Known primarily as a tourist destination, the Polynesian country of Tonga banks on remittance inflows to support its economy. In 2022, the country’s incoming remittance flows were equal to almost 50% of its GDP.

Next on this list is Lebanon. The country received $6.8 billion in remittances in 2022, estimated to equal almost 38% of its GDP and making it a key support to the nation’s shrinking economy.

Tyler Durden

Fri, 01/27/2023 – 23:25

via ZeroHedge News https://ift.tt/xhOIt4v Tyler Durden