The Cost Of Living Has Become Extremely Oppressive And 57% Of Americans Cannot Afford A $1,000 Emergency Expense

Authored by Michael Snyder via The Economic Collapse blog,

I don’t have to tell you that your money doesn’t go as far as it once did. You see it every time that you go shopping. Our leaders flooded the system with money and pursued highly inflationary policies for years, and now we are all paying the price.

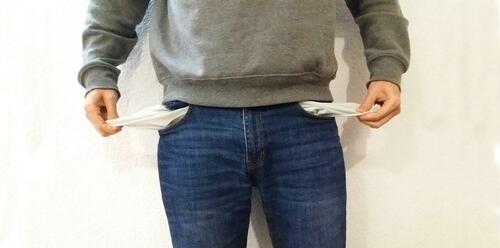

The cost of living has been rising much faster than our incomes have, and this is systematically destroying the middle class. Survey after survey has shown that a solid majority of the population is living paycheck to paycheck, and at this point most U.S. consumers are tapped out. In fact, one brand new survey just discovered that 57 percent of Americans cannot even afford to pay a $1,000 emergency expense…

According to Bankrate’s Annual Emergency Fund Report, 68% of people are worried they wouldn’t be able to cover their living expenses for just one month if they lost their primary source of income. And when push comes to shove, the majority (57%) of U.S. adults are currently unable to afford a $1,000 emergency expense.

When broken down by generation, Gen Zers (85%) and Millennials (79%) are more likely to be worried about covering an emergency expense.

These numbers are quite ominous, because they clearly demonstrate that we are completely and utterly unprepared for any sort of a major economic downturn.

And thanks to the rapidly rising cost of living, we are losing even more ground with each passing month.

Another survey that was recently released found that “earnings are falling behind the cost of living” for 72 percent of middle income families…

Nearly three-quarters, or 72%, of middle-income families say their earnings are falling behind the cost of living, up from 68% a year ago, according to a separate report by Primerica based on a survey of households with incomes between $30,000 and $100,000. A similar share, 74%, said they are unable to save for their future, up from 66% a year ago.

We haven’t experienced anything like this in the United States in decades.

When I walked into a Walmart store the other day, I was shocked by how high the prices are now.

Isn’t Walmart supposed to be the place with “low prices every day”?

Well, the prices were certainly not “low” when I walked through the store.

And I was stunned to learn that McDonald’s is now selling one hash brown for three dollars.

McDonald’s charging $3 for 1 (one) hash brown is actually insane pic.twitter.com/qZwZrPTrTV

— cabral (@comradeaux) January 18, 2023

Are you kidding me?

I am sure that many of you can remember a time when they were 50 cents.

Sadly, those days are not coming back.

Food prices are going to continue to go up, and the CEO of Unilever recently admitted that his company has actually “been accelerating the rate of price increases that we’ve had to put into the market”…

“For the last 18 months we’ve seen extraordinary input cost pressure … it runs across petrochemical derived products, agricultural derived products, energy, transport, logistics,” he said.

“It’s been feeding through for quite some time now and we’ve been accelerating the rate of price increases that we’ve had to put into the market,” he added.

That doesn’t sound good at all.

And he also ominously warned that “there’s more inflationary pressure coming”…

Unilever’s view, he said, was that “we know for sure there’s more inflationary pressure coming through in our input costs.”

As food prices continue to rise, these big companies are going to look for ways to reduce input costs.

One way that they are going to do that is by starting to put crushed bugs in our food.

I know that this may sound really bizarre to you, but this is already happening in Europe…

As of yesterday, a food additive made out of powdered crickets began appearing in foods from pizza, to pasta to cereals across the European Union.

Yes, really.

Defatted house crickets are on the menu for Europeans across the continent, without the vast majority of them knowing it is now in their food.

So you might want to start reading labels a lot more carefully from now on.

Of course it isn’t just the cost of food that has become extremely oppressive.

Just about everything has gotten more expensive, and this has broken the remaining strength of the U.S. consumer.

If you doubt this, just consider some of the latest economic numbers that we have seen.

-U.S. retail sales fell once again last month…

US retail sales continued their fall in December, dropping by 1.1% as inflation remained high, the Commerce Department reported Wednesday.

That’s the largest monthly decline since December 2021, and practically every category (except for building materials, groceries and sporting goods) saw sales drop from the prior month.

-Sales of existing homes have now fallen for 11 months in a row…

U.S. existing home sales slowed for the 11th consecutive month in December as higher mortgage rates, surging inflation and steep home prices sapped consumer demand from the housing market.

-More Americans than ever before are being forced to pay at least 30 percent of their incomes on rent…

The average US household is now considered ‘rent-burdened’ as a record-high number of people are spending more than 30 percent of their income on rent.

According to Moody’s Analytics’ latest affordability report, the national average rent-to-income (RTI) ratio reached 30 percent for the first time since the company began tracking the data more than 20 years ago.

U.S. consumers are being stretched financially like never before, and many are turning to debt to help them maintain their current lifestyles.

As a result, the savings rate has plunged to a historic low, credit card debt has surged to a record high, and the average rate of interest on credit card balances has also risen to a record high. As Zero Hedge has aptly noted, this is “nothing short of catastrophic”…

The combination of record high credit card debt and record high credit card interest is nothing short of catastrophic for both the US economy, and the strapped consumer who has no choice but to keep buying on credit while hoping next month’s bill will somehow not come. Unfortunately, it will and at some point in the very near future, this will also translate into massive loan losses for US consumer banks; that’s when Powell will finally panic.

For a long time, we have been warned that the very foolish economic policies that our leaders were implementing would have deeply tragic consequences.

And now it is starting to happen right in front of our eyes.

Sadly, the truth is that this is just the beginning.

The entire system is cracking and crumbling all around us, and there is much more pain ahead.

* * *

It is finally here! Michael’s new book entitled “End Times” is now available in paperback and for the Kindle on Amazon.

Tyler Durden

Sun, 01/29/2023 – 11:30

via ZeroHedge News https://ift.tt/3qPVtlB Tyler Durden