Demographically Sobering Thoughts On US Employment In The Next Five Years

Authored by Mike Shedlock via MishTalk.com,

Assuming no recession, will employment rise or fall this year?

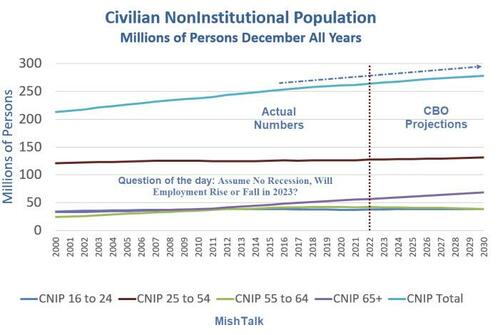

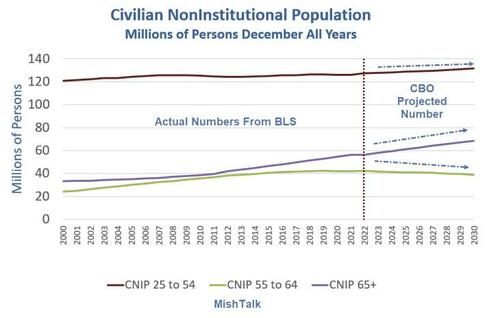

Civilian Noninstitutional Population from BLS, projections by the CBO, chart by Mish

Civilian Noninstitutional Population (CNIP) Definition

Persons 16 years of age and older residing in the 50 states and the District of Columbia, who are not inmates of institutions (e.g., penal and mental facilities, homes for the aged), and who are not on active duty in the Armed Forces.

CNIP Chart Notes

-

Actual numbers from the BLS for years 2000 through 2022

-

December all years

-

Total is the sum of parts which induces small but irrelevant rounding errors

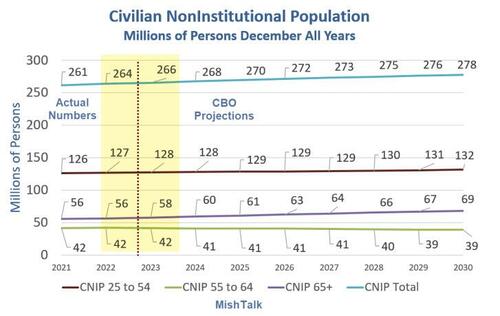

CNIP Projection Detail 2021-2030

Civilian Noninstitutional Population from BLS, projections by the CBO, chart by Mish

CNIP 2023 Projected Change From 2022

-

Total: +2 Million

-

Core 25-54 Age Group: +1 Million

-

55-64 Age Group: No Change

-

Age 65+: +2 Million

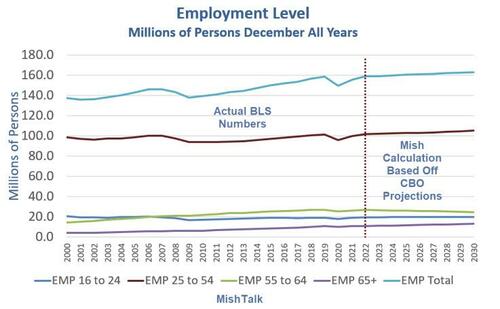

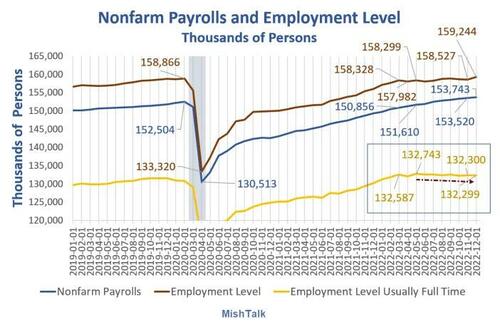

Employment Level 2000-2030 December All Years as of 2022

Employment levels from the BLS through 2022, 2023-2030 Mish projections

Employment Level Chart Notes

-

I made projections by taking the percentage of people working in each age group in December 2022 and assumed that percentage would be relatively stable going forward.

-

Example: In 2022, for age group 25-54, there were 101.8 million people employed. The percentage of people employed in age group 25-54 was 101.8 (Employed) / 127.32 (CNIP) = 80.0 percent. For projections, I assumed that number will hold for all subsequent years.

-

These percentages likely will not hold if there is an employment decline due to recession.

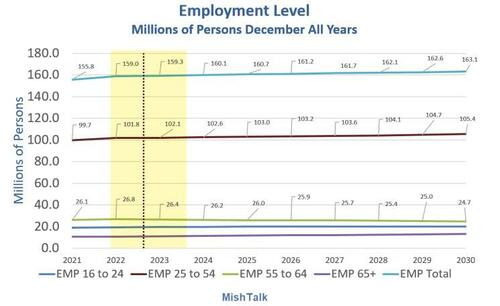

Employment Level and Projections 2021-2030

Employment levels from the BLS through 2022, 2023-2030 Mish projections

Employment Level and Projections Assumptions

-

No decline in employment due to recession

-

The BLS employment levels as of December 2022 are accurate

-

The BLS CNIP projections are accurate

-

The percentage of people working will be relatively constant

Based on those assumptions, I project a mere rise in total employment for the year of about 300,000.

Looking further ahead the total employment gain from 2022 to 2030 is a mere 4.1 million in 8 years.

Does this make any sense? Yes, it does. Let’s start with a look at participation rates.

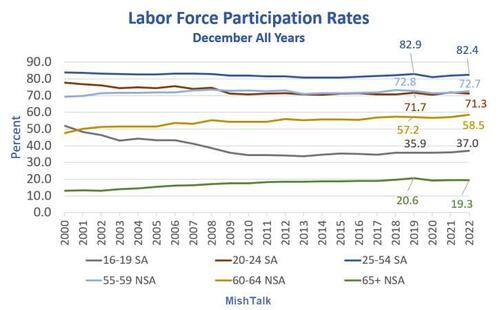

Labor Force Participation Rates, December All Years 2022

Labor force participation rates 2000-2022 from BLS

Participation Rate Chart Notes

-

The Labor Force Participation Rate is the calculated as the labor force divided by the working-age population.

-

The Labor force is the number of people working or actively looking for work. Unemployed persons are in the labor force.

-

Participation rates have generally been declining except for age group 60-64 and 65+ (the latter declining since 2019).

-

In December 2019, the LFPR was 82.9% and is 82.4% as of December 2022.

Note that in my example above, I used an employment ratio of 80.0 percent.

The unemployment rate for age group 25-54 in December of 2022 was 2.9%. Subtracting 2.9 from 82.4 yields 79.5 nearly spot on to the slightly higher number that I used.

To understand why employment is so stagnant, let’s hone in on the demographic reason.

Civilian Noninstitutional Population 2000-2030 Detail

Civilian Noninstitutional Population from BLS, projections by the CBO, chart by Mish

Civilian Noninstitutional Population Detail Notes

-

The number of people age 65+ is rising rapidly

-

The number of people age 55-64 is in decline

The above chart fully explains my stagnant employment projections.

Key Participation Rates

-

Age 55-59: 72.7

-

Age 60-64: 58.5

-

Age 65+: 19.3

People are rapidly shifting from high participation rates to much lower ones.

For 2023, the CBO estimates a 2023 increase in the age 65+ population of 2 million and that 2 million accounts for the total rise in population.

Final Thoughts

There is a big difference between participation rates of 55-59 (72.7) and 60-64 (58.5). Unfortunately the CBO did not provide that breakdown.

Similarly, there is a big difference between participation rates of 16-19 (37.0) and 20-24 (71.3). Again the CBO did not provide that breakdown.

My employment projections through 2030 are more likely to be off in one direction or another due to those missing numbers than any of the other assumptions.

Again, the baseline assumption is no employment losses due to a recession!

Finally, by 2030, the CBO projects the 16+ population will grow by 14 million while I project employment based off demographic trends will only rise by 4.1 million.

Importantly, of the 14 million population increase, 13 million of it will be in age group 65+.

Think about that for a second including strains on Medicare and Social Security.

Understanding the Current Discrepancy Between Jobs and Employment

Payroll and employment data from the BLS, chart by Mish

Payrolls vs Employment Since March 2022

-

Nonfarm Payrolls: +2,887,000

-

Employment Level: +916,000

-

Full Time Employment: -288,000

Full time employment is down 288,000 since March and down by 444,000 since May!

For discussion, please see December Jobs: Employment Rises by 717,000 All of Them Part Time

Also note that The BLS Reports Employment in the Second Quarter Fell By 287 Thousand

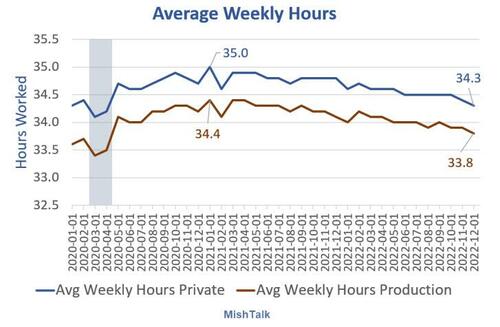

In addition the average number of hours worked is declining.

Average Work Week Has Peaked

Data from BLS, chart by Mish

For discussion, please see Average Work Week Has Peaked and Total Aggregate Hours Is Rolling Over

Demographics explain the alleged “noise” in falling full time employment while job growth allegedly growing by leaps and bounds.

Job growth, if real (which I doubt), consists of people taking second part time jobs to make ends meet.

Given my charts assume no recession (or no significant layoffs in recession), what happens if there is one?

* * *

Tyler Durden

Mon, 01/30/2023 – 12:35

via ZeroHedge News https://ift.tt/n5f2QUD Tyler Durden