“HODLers Held The Line” – Bitcoin Tops $24k As “Capitulation Has Clearly Unfolded”

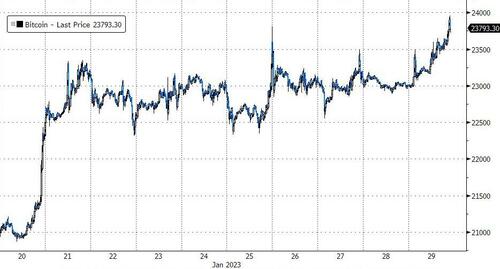

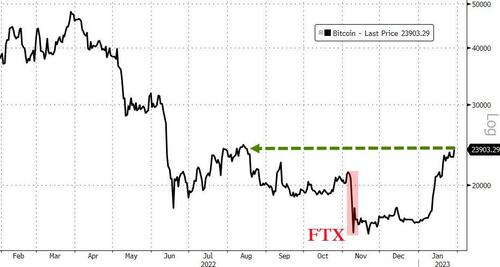

Bitcoin is up 55% from its November cycle lows, trading up near $24,000…

…its highest since mid-August, erasing all the FUD from FTX…

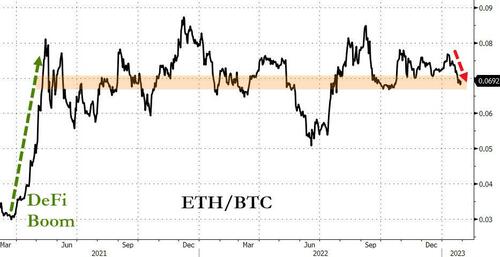

Ethereum is also soaring but has notably underperformed Bitcoin in the last few weeks, with the ratio of ETH to BTC now back to significant support levels…

Bitcoin bulls have everything to play for as the weekly and monthly closes decide what could be Bitcoin’s best January in ten years.

As CoinTelegraph reports, as of Jan. 27, resistance was stacked at $23,200, $24,500 and $25,000, with the latter nonetheless still on traders’ radar as a potential next target.

“$25,000 target in sight,” a confident Crypto Tony told Twitter followers in comments on the day.

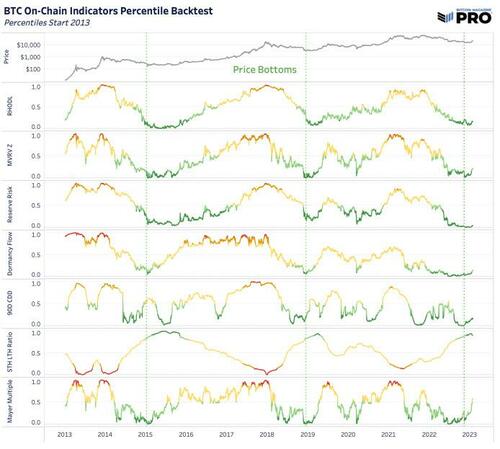

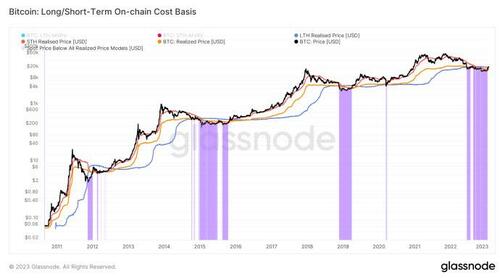

Additionally, Dylan LeClair writes at Bitcoin Magazine that across bitcoin’s short history, many on-chain cyclical indicators are currently pointing to what looks to be a classic bottom in bitcoin price. Market extremes — potential tops and bottoms — are where these indicators have proven to be the most useful.

On-chain indicators overlaid with previous bitcoin price bottoms.

However, these indicators need to be considered alongside many other macroeconomic factors and readers should consider the possibility that this could be another bear market rally — as we still sit below the 200-week moving average price of around $24,600. That being said, if price can sustain above $20,000 in the short-term, the bullish metrics paint a compelling sign for more long-term accumulation here.

A major tail risk is a possible market-wide selloff in risk assets that are currently pricing a “soft landing” style scenario along with the potentially incorrect expectations of a Federal Reserve policy pivot in the second half of this year. Many economic indicators and data still point to the likelihood that we’re in the midst of a bear market similar to 2000-2002 or 2007-2008 and the worst has yet to unfold. This secular bear market is what’s different about this bitcoin cycle compared to any other in the past and what makes it that much harder to use historical bitcoin cycles after 2012 as perfect analogues for today.

All that being said, from a bitcoin-native perspective, the story is clear: Capitulation has clearly unfolded, and HODLers held the line.

Given the transparent nature of bitcoin ownership, we can view various cohorts of bitcoin holders with extreme clarity. In this case, we are viewing the realized price for the average bitcoin holder as well as the same metric for both long-term holders (LTH) and short-term holders (STH).

The realized price, STH realized price and LTH realized price can give us an understanding of where various cohorts of the market are in profit or underwater.

A look at realized price for short- and long-term holders.

On a monthly basis, realized losses have flipped to realized profits for the first time since last April.

The #Bitcoin market has stopped bleeding.

Realized P/L ratio (30d MA), a ratio between all coins moved at a profit and a loss (at the price last moved on chain), has flipped positive. pic.twitter.com/lm9EIX5EBr

— Dylan LeClair 🟠 (@DylanLeClair_) January 26, 2023

Capitulation and loss taking has flipped to profit realization across the network, which is a very healthy sign of thorough capitulation.

There is a strong case to be made that given the current elasticity of bitcoin’s supply — as evidenced by the historically small number of short-term holders or rather the large number of long-term holders — it will be challenging to shake out current market participants. Especially considering the gauntlet endured over the previous 12 months.

Statistically, long-term bitcoin holders are usually unfazed in the face of bitcoin price volatility. The data shows a healthy amount of accumulation throughout 2022, despite a massive risk-off event in both the bitcoin and legacy market.

While liquidity dynamics in legacy markets should be noted, the supply-side dynamics for bitcoin look to be as strong as ever. All it will take for a significant price appreciation will be a small influx of newfound demand.

Tyler Durden

Sun, 01/29/2023 – 15:30

via ZeroHedge News https://ift.tt/a95gNUn Tyler Durden