Cardboard Box Demand Plunging At Rates Unseen Since The Great Recession

By Rachel Premack of FreightWaves,

Demand and output for cardboard boxes and other packaging material fell sharply in the fourth quarter of 2022, according to data released by the American Forest & Paper Association and Fibre Box Association on Friday.

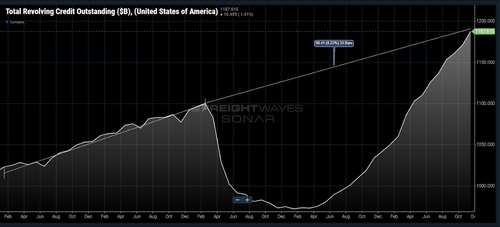

It’s the latest indicator that consumer demand is eroding following the pandemic. Dwindling savings, inflation, rising interest rates and fears of a recession may all be swaying consumers to spend less.

Such pressures would show up in the humble box industry, which serves as an excellent barometer for the larger economy. Practically everything we consume and use spends some time in a box, ranging from online orders to food sent to grocery stores.

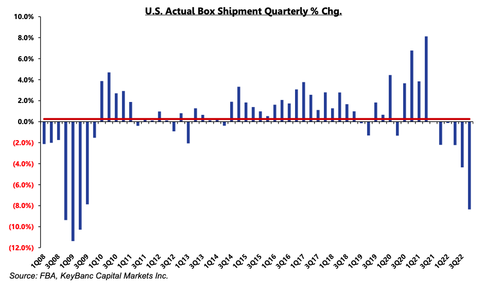

U.S. box shipments fell by 8.4% in the fourth quarter, according to the Fibre Box Association. KeyBanc’s Adam Josephson, who leads the bank’s analysis of the packaging industry, wrote in a Sunday note that this was “the most severe quarterly decline since the Great Financial Crisis (2Q09).”

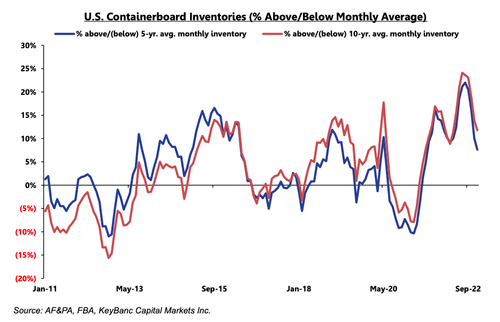

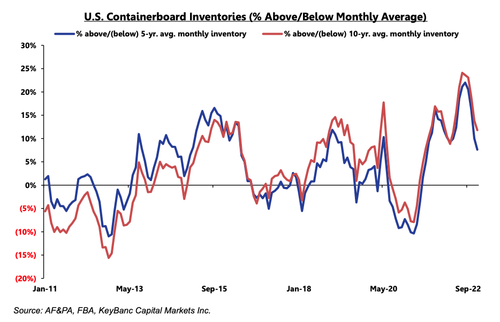

U.S. box operating rates fell to 80.9%, the Fibre Box Association said, which was also a low last seen in the first quarter of 2009. This means nearly 20% of the U.S. capacity to produce boxes was stagnant last quarter. Supply of containerboard, which is used to make corrugated boxes, stood at 4.3 weeks, according to the American Forest & Paper Association. That’s down from last quarter, but still historically high.

The American Forest & Paper Association reported that another type of packaging material called boxboard had its lowest operating rate in its five-year record during 2022’s final quarter. Boxboard is typically thinner than cardboard and lacks air pockets.

Box bloodbath? Cardboard crisis?

Box demand normally sees modest upticks of 1% to 2% each year. But government stimulus and the shift from service to goods demand through 2020 and 2021 shocked box demand into some of its fastest growth in history. Prices rose as much as 55% through this time, Josephson said.

A hangover after a yearslong cardboard carnival would be in order — and this one looks nasty.

To Josephson, the end of 2022 in the packaging world had “echoes of the Great Financial Crisis everywhere one looks,” he wrote in the Sunday note. What’s more, significant capacity — that is, more facilities that produce packaging materials — is set to enter the market through the next several years. It’s a tricky time for more packaging production to open up, given the shaky outlook for demand and falling consumer spending.

“Inflationary pressures on the consumers have also added to the problem by reducing the consumers’ discretionary spending capabilities,” said Thomas Hassfurther, executive vice president of corrugated products at WestRock, in a Thursday call to investors. WestRock is the No. 2 largest packaging company in the U.S.

“In addition, consumer behavior changed very quickly as we exited the extreme COVID period, resulting in more of a preference towards travel, entertainment and experience versus that of tangible goods,” Hassfurther said. “Containerboard and box demand continues to be negatively impacted from the deterioration in U.S. and global economic conditions, rising interest rates and a cooler housing market.”

However, WestRock executives maintained that demand in 2023 still appeared “healthy” compared to pre-COVID times. On the Thursday call, they forecast shipments to be 6% higher in first-quarter 2023 compared to the same period in 2019, on a per-day basis.

What goes up must come down … and down …

Many of the industries that saw wild demand during the pandemic are now crashing, like container shipping, used cars and home building.

A downturn after a wild upswing isn’t particularly shocking. What’s troublesome is that executives grew or made plans to grow in response to this unprecedented demand. An increase in supply will further drive down already-plummeting prices.

In the cardboard world, for example, more than 2 million tons per year of additional containerboard output is coming to the North American market. Ocean carriers expect to add a record-breaking number of new container ships through the next two years. And nearly 60 real estate firms, most of which expanded payrolls during the pandemic, have already had to lay off more than 13,000 workers through 2022 and 2023, according to Insider.

It’s not all doom and gloom. Outbound requests for truckload services were slightly up in late January 2023, compared to the same period in 2019 and 2020. That’s a chipper indicator for goods demand. The Fed’s offensive on inflation has appeared to slow the rate of price increases without halting an unusually strong job market. Payrolls across the U.S. remain historically strong, with an unemployment rate of just 3.5%.

Tyler Durden

Tue, 01/31/2023 – 17:40

via ZeroHedge News https://ift.tt/tjmNvbk Tyler Durden