Tesla Price Cuts Signal Growing Margin Malaise

By Jan-Patrick Barnert and Sagarika Jaisinghani, Bloomberg Markets Live reporters and strategists

Tesla Inc.’s move to slash prices across the US and major European markets has triggered similar cuts across the electric-vehicle sector — with Ford Motor Co. being the latest to follow suit today [ZH: as we said would happen]

If other automakers and dealers match Tesla price cuts, core CPI could drop by more than 1% M/M

— zerohedge (@zerohedge) January 13, 2023

But the new trend goes well beyond the EV industry, and could quickly become the next big earnings headwind.

Companies that until now have defended their profitability from surging cost inflation by charging more are finding that they have less power to do so as price growth starts to cool. Indeed, many are now starting to lower prices at a time when expenses remain inflated, putting their profit margins under strain.

The list of firms showing signs of earnings stress is growing. Ford and Chinese electric-vehicle maker Xpeng Inc. have both followed Tesla’s lead on price, while apparel makers Lululemon Athletica Inc. and Hennes & Mauritz AB served notice of the impact on margins as they marked down goods to help manage bulging inventory just as expenses are soaring.

Elsewhere, video-games makers including Ubisoft Entertainment SA are offering discounts to counter weak consumer demand, an issue that’s also a thorn in the side of appliance maker Electrolux AB.

“Falling inflation is going to be a significant headwind for profit margins given the sequencing of costs falling later than end price,” said Michael Wilson, a strategist at Morgan Stanley who was top-ranked in last year’s Institutional Investor survey. Investors should be careful what they wish for as peaking inflation is “very negative for profitability.”

The growing pressure on profit margins presents a potential hurdle to the equities rally of the last four months. While investors have been fretting over rising interest rates, peak inflation and a possible recession, they’ve at least been able to count on robust company earnings as a reason to stay invested. Now that leg of support appears to be crumbling.

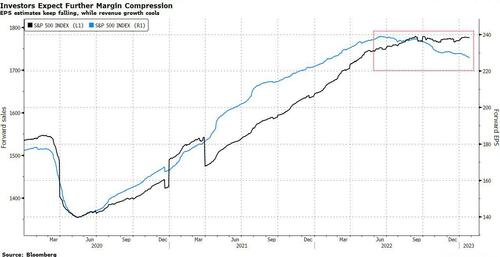

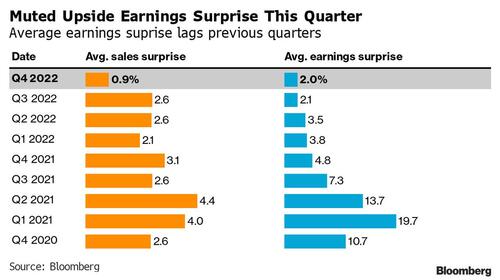

According to data compiled by Bloomberg, earnings per share estimates for the S&P 500 have fallen since peaking in June 2022, while revenue projections have flatlined. With about 125 index members having reported so far this results season, sales are beating estimates by the smallest percentage since data going back to the fourth quarter of 2020, the data show.

For JPMorgan Chase & Co. macro strategists led by Dubravko Lakos-Bujas, 2023 corporate guidance “should be less optimistic relative to current estimates.” Lower pricing power, demand destruction, wage pressures and higher interest expenses stand to push margins lower, they say.

Kasper Elmgreen, Amundi SA’s head of equities, warns that “profit margins have to come down,” pointing to a reversal in once helpful factors such as tax, interest rates and inflation.

“The resilience last year was about consumers that had strong savings,” Elmgreen said. “Now you’re starting to get worried and confidence indicators are collapsing. Real incomes are under pressure. And that’s going to manifest itself in consumption.”

Chinese electric vehicle maker Xpeng has pushed back its profit goal until 2025, after having previously aimed to break even by late 2023 or early 2024.

The technology sector faces a particularly tough time. Companies from Amazon.com Inc. to Alphabet Inc.’s Google have recently laid off staff after years of growth. The sector announced 97,171 job cuts in 2022, up 649% compared with the previous year, according to consulting firm Challenger, Gray & Christmas Inc.

Reducing costs can only go so far before companies start hitting their own margins, said Karim Chedid, head of investment strategy for iShares EMEA at BlackRock Inc.

“The drivers of company profits last year are not going to be repeated this year,” Chedid said. “And they’re going to find it difficult to defend margins again.”

Tyler Durden

Tue, 01/31/2023 – 13:45

via ZeroHedge News https://ift.tt/3ubzyYo Tyler Durden