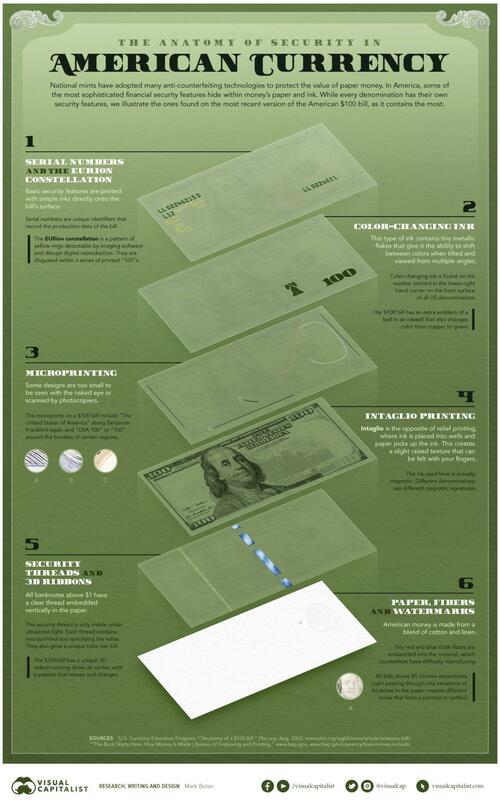

These Are The Security Features Of American Money

In 1739, Benjamin Franklin sought to tackle the issue of counterfeit money in America, using a printing press and leaves to create unique raised patterns on the colonial notes.

Almost 300 years later, Benjamin Franklin is the face of the U.S. $100 bill, and it is protected by a myriad of security features including secret images, special ink, hidden watermarks, and magnetic signatures, among others.

In this infographic below, Visual Capitalist’s Avery Koop and Mark Belan have broken down the $100 bill to showcase the anatomy of American currency.

The Makeup of American Money

There are 6 key features that identify real bills and protect the falsification of American money.

① Serial Numbers & EURion Constellation

The most basic form of security on an $100 bill is the serial number. Every bill has a unique number to record data on its production and keep track of how many individual bills are in circulation.

The EURion constellation is star-like grouping of yellow rings near the serial number. It is only detectable by imaging software.

② Color Changing Ink

This ink changes color at different angles thanks to small metallic flakes within the ink itself. The $100 bill, like all other paper bills in the U.S., has its value denoted in color changing ink on the bottom right-hand corner; unlike other bills, it also features a liberty bell image using the ink.

③ Microprinting

Microprinting allows for verifiable images that cannot be scanned by photocopiers or seen by the naked eye. The $100 bill has phrases like “USA 100” written invisibly in multiple places.

④ Intaglio Printing

Rather than regular ink pressed onto the paper, intaglio printing uses magnetic ink and every different bill value has a unique magnetic signature.

⑤ Security Threads & 3D Ribbons

The security thread is a clear, embedded, vertical thread running through the bill. It can only be seen under UV light, contains microprinted text specifying the bill’s value, and on each different bill value it glows a unique color.

Additionally, 3D ribbons are placed in the center of $100 bills with a pattern that slightly changes as it moves.

⑥ Paper, Fibers, & Watermarks

Because American money is made of cotton and linen, blue and red cloth fibers are woven into the material as another identifying feature. Finally, watermarks are found on most bills and can only be detected by light passing through the bill.

The Relevance of Cash

Here’s a look at the total number of each paper bill that is physically in circulation in the U.S.:

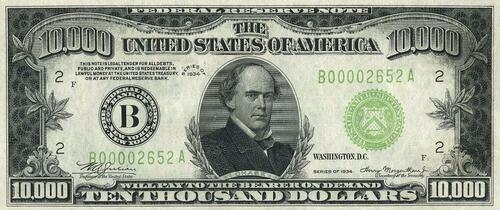

Interestingly, a number of $500-$10,000 dollar bills are in someone’s pockets. And while they are not issued anymore, the Fed still recognizes the originals of these bills that were legally put into circulation in the past.

A $10,000 Federal Reserve Note (1934)

Additionally, there is fake money passing hands in the U.S. economy. Being the most widely-accepted currency in the world, it’s no wonder many try to falsely replicate American money. According to the U.S. Department of Treasury, there are approximately $70 million in counterfeit bills currently circulating in the country.

Finally, a natural question arises: how many people still use cash anyways?

Well, a study from Pew Research Center found that it while it is a dwindling share of the population, around 58% of people still use cash for some to all of their weekly purchases, down from 70% in 2018 and 75% in 2015.

Tyler Durden

Sun, 01/01/2023 – 17:15

via ZeroHedge News https://ift.tt/iXO4I5b Tyler Durden