Something’s Gotta Give…

Authored by Jesse Felder via TheFelderReport.com,

We’re at a fascinating juncture here in the markets.

Stocks have sold off hard for a little over a year now but have rallied once again in the short run. The result is that the S&P 500 Index has formed a fairly tight coil or pennant pattern over the past several months. And, as my friend Peter Atwater points out, this coil is merely a visual representation of a fierce battle going on in the markets.

Tight market coils always remind me of a tug-of-war.

Enormous energy is expended while the rope remains stationary until one side or the other exhausts. Then the rope moves violently to one side or the other.

— Peter Atwater (@Peter_Atwater) June 9, 2021

This tug-of-war between bulls and bears is centered on the trends in inflation, monetary policy and the economy. The recent rally in stocks has been driven by the idea that inflation will rapidly come down back to the Fed’s 2% target, without an economic recession as catalyst, allowing the Fed to end and even reverse its rate hike campaign later this year. As to inflation, CPI swaps are now pricing in a rapid decline in inflation over the course of this year.

‘Market-based gauges of inflation expecta-tions project the annual pace of rising prices will tumble in the months ahead roughly as fast as during the recession that followed the 2008 financial crisis.’ https://t.co/ibHpeApYDx

— Jesse Felder (@jessefelder) January 23, 2023

The stock market clearly sees this as good news. However, as the article above notes, a decline in inflation that rapid has only ever happened during steep economic recessions like that seen in the wake of the Great Financial Crisis just over a decade ago. Still, the market appears to be content to ignore the possibility of recession and discount strong earnings gains this year and next.

‘Are earnings estimates for 2023 and 2024 too optimistic?’ https://t.co/LpRp8ksHg7 via @SoberLook pic.twitter.com/T9x09ewX3c

— Jesse Felder (@jessefelder) January 13, 2023

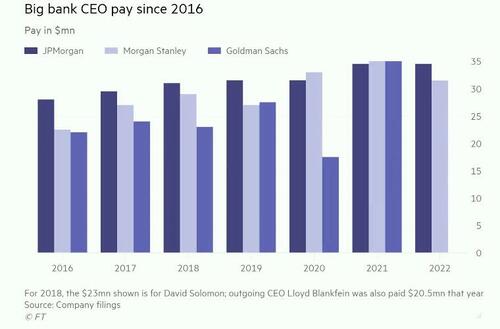

But if earnings are going to soar in a way that would preclude recession, then it would likely mean that inflation won’t come down back to 2%, as my friend Julian Brigden suggests. Markups have been a significant factor in both the strength of earnings and inflation over the past couple of years. And if inflation remains elevated, then the Fed may find itself coming under a great deal of pressure to keep interest rates elevated longer than the market expects if not raise them even higher than they have already indicated.

I’ve been saying for a while US corporations are the new enemy when it comes to fight #inflation. They simply have too much pricing power. Now the Fed appears to agree! https://t.co/7ynR9aPXQ8 https://t.co/Q7Egquue3o

— Julian Brigden (@JulianMI2) January 12, 2023

Of course, if the Fed is forced to raise interest rates even higher, the currently elevated probability of recession will grow even greater. A number of indicators, such as the Conference Board’s Leading Economic Index, suggest recession is not only likely but may have already begun. This perhaps helps to explain why many markets are so sanguine regarding inflation and also why they expect the Fed to be cutting rates later this year, rather than hiking.

Leading Economic Index from @Conferenceboard fell again in December, -7.4% y/y vs. -6.1% in prior month … decline increasingly consistent with prior recessions pic.twitter.com/eO9tcYIBgY

— Liz Ann Sonders (@LizAnnSonders) January 23, 2023

And if the Fed is going to cut rates later this year, against its most recent guidance which suggests rates will remain elevated for a prolonged period of time, they would likely only do so in reaction to overwhelming evidence that recession has begun and inflation pressures will continue to wane as a result. Of course, this may not be the positive catalyst stock market bulls might hope for; just the opposite.

‘Amidst the bursting of three of the great US bubbles (1929, 2000, 2007), the fundamentals had so much negative momentum that the largest part of the market decline occurred after the first rate cut.’ https://t.co/8MZyb0TweF pic.twitter.com/lk0lvoF321

— Jesse Felder (@jessefelder) January 24, 2023

So either we avoid recession and earnings will show strong gains, forcing the Fed to get even more hawkish than markets currently expect (bringing on recession at a later time) or inflation will come down in reaction to a steep recession that will allow the Fed to cut interest rates once again. Neither scenario sounds particularly bullish for the stock market, especially given the fact that valuations remain at historically extreme levels.

‘With interest rates now well above zero, the primary causes and conditions of the recent speculative bubble are no longer in place. The persistence of rich valuations here are, in my view, largely the result of psychological anchoring.’ https://t.co/StThAHLqkM by @hussmanjp pic.twitter.com/j4NLDZlcrt

— Jesse Felder (@jessefelder) January 23, 2023

But I guess we’ll have to see whether bulls or the bears exhaust first.

Tyler Durden

Fri, 01/27/2023 – 14:24

via ZeroHedge News https://ift.tt/Hn46pYO Tyler Durden